In the last few trading sessions, the stock market sent a clear signal — copper-related stocks started moving up together.

This was not limited to just one company. Mining firms, diversified metal companies, and even copper-consuming businesses showed buying interest.

Such a move usually indicates a sector-driven rally, not a stock-specific event.

So the key questions are:

- Why did the copper sector suddenly gain momentum?

- Is this rally sustainable?

- Which companies are benefiting the most?

Let’s break it down in simple language, backed by data and fundamentals.

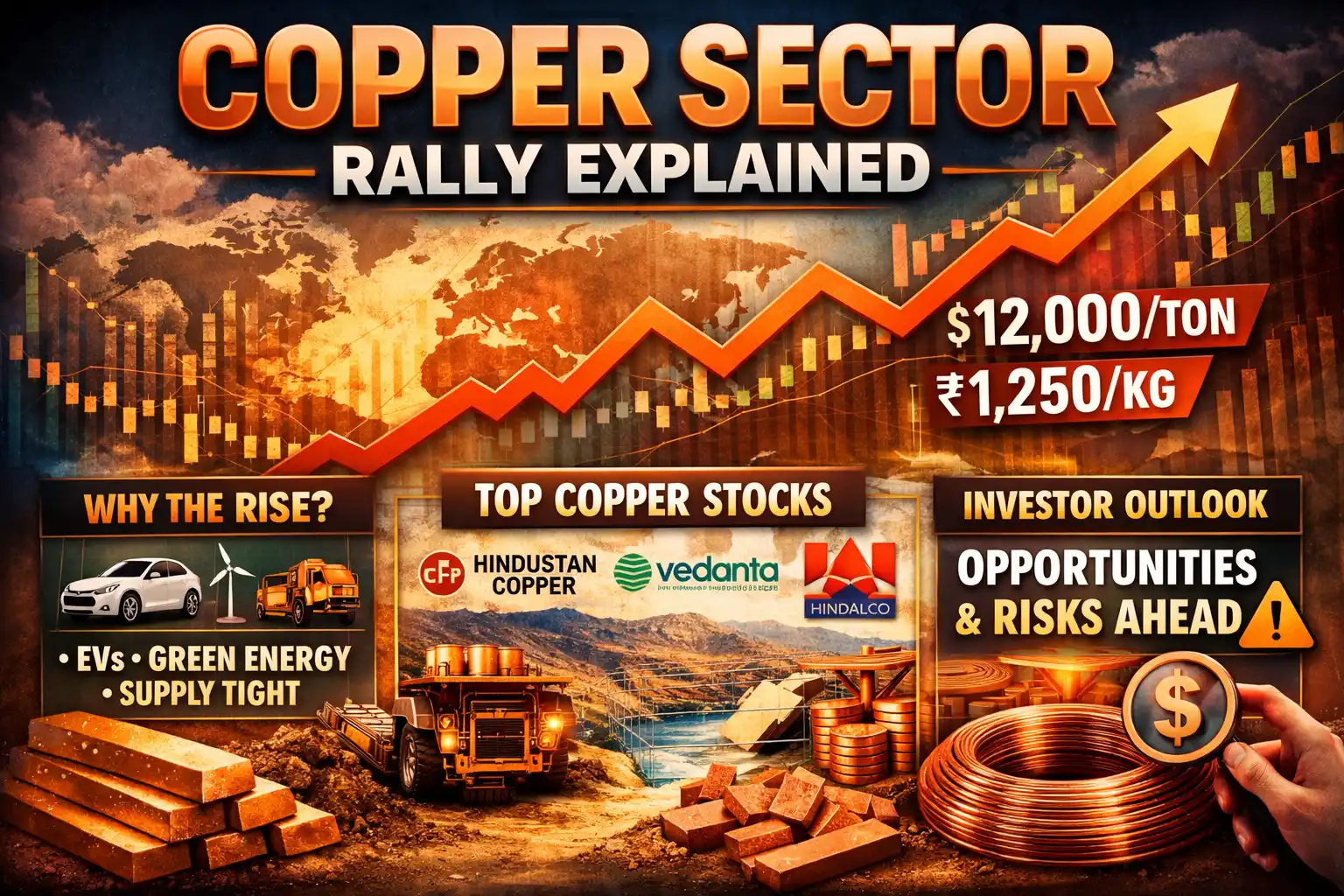

Copper Price Data: The Proof Behind the Rally

Any rally in copper stocks starts with copper prices themselves.

🌍 Global Copper Price Trend

- Average copper price in 2024: $8,000–$9,000 per tonne

- In 2025:

- Prices crossed $10,500 per tonne

- At times moved close to $12,000 per tonne, a multi-year high

➡ This indicates a 25–30% rise in global copper prices.

🇮🇳 Indian Market (MCX Copper)

- MCX copper prices moved into the range of ₹1,200–₹1,260 per kg

- A strong year-on-year increase

📌 Rising copper prices directly improve:

- Revenue

- Margins

- Future earnings expectations of copper-related companies

This is the foundation of the current rally.

Why Is the Copper Sector Rising?

1️⃣ Global Supply Constraints

- Production issues in major copper-producing countries like Chile and Peru

- Delays in new mining projects due to:

- High costs

- Environmental approvals

- Long gestation periods

➡ Lower supply + strong demand = higher prices

2️⃣ Electric Vehicles & Green Energy Boom

Copper is no longer just an industrial metal — it is a strategic metal for the future economy.

Major demand drivers:

- Electric vehicles (EVs)

- Solar and wind power projects

- Power transmission lines

- Charging infrastructure

- Data centers

📌 An electric vehicle uses 3–4 times more copper than a traditional vehicle.

3️⃣ Infrastructure Push in India and China

- China’s manufacturing activity is stabilizing

- India is aggressively investing in:

- Power transmission

- Renewable energy

- Railways

- Urban infrastructure

➡ Infrastructure growth = long-term copper demand

Key Companies Linked to the Copper Sector (India)

This rally is sector-wide, but performance differs based on business exposure.

🔹 Hindustan Copper Ltd (Pure Mining Play)

- India’s only listed pure copper mining company

- Direct beneficiary of rising copper prices

- PSU-backed company

Performance:

- Strongest rally within the sector

- Higher volatility

- Highly sensitive to commodity cycles

👉 Suitable for investors who understand commodity risk

🔹 Vedanta Ltd (Diversified Metal Exposure)

- Copper, aluminium, zinc, oil & gas

- International exposure to copper markets

📌 Benefit:

- Indirect copper upside

- Stable cash flows during commodity upcycles

🔹 Hindalco Industries (Copper + Aluminium)

- Copper smelting operations

- Strong downstream integration

- Exposure to EV and renewable sectors

Viewed by the market as a long-term structural metal play

🔹 Cable & Wire Companies (Demand-Side Beneficiaries)

These companies use copper as a raw material but benefit from strong demand.

Key names:

- Polycab India

- KEI Industries

- RR Kabel

- Havells (partial exposure)

📌 Rising copper prices may increase costs, but:

- Higher infrastructure demand

- Volume growth

- Inventory gains

help offset pressure.

Is This Rally New or Already Priced In?

- Copper stocks were moving earlier, but without strong confirmation

- The current rally is supported by:

- Price breakout in copper

- Strong global demand outlook

- Broad sector participation

📌 This indicates a fundamental-driven move, not pure speculation.

🌍 Impact on the Broader Market

✅ Positive Impact

- Improved sentiment in metal stocks

- Support for infrastructure and capital goods sectors

- Renewed interest in PSU mining companies

⚠️ Cautious Areas

- Margins of copper-consuming companies may face pressure

- Inflation expectations could rise if metal prices remain high

Future Outlook for the Copper Sector

📌 Short Term

- Volatility likely

- Profit booking at higher levels

- News-driven price movements

📌 Medium to Long Term

- Structural demand from EVs and renewable energy

- Expected global copper deficit

- Limited supply expansion

➡ Many analysts now call copper the “New-Age Oil”.

What Should Investors Track?

✔ Global copper prices (LME / COMEX)

✔ China and US manufacturing data

✔ EV policy developments

✔ Company-specific margin and debt levels

✔ Government mining and infrastructure policies

⚠️ Key Risks Investors Should Know

❌ Copper is a cyclical commodity

❌ Sharp corrections are possible

❌ PSU stocks can be volatile

❌ Global recession fears may impact prices

👉 Best approach:

- Avoid chasing prices

- Use proper position sizing

- Think in terms of themes, not tips

Final Verdict

The recent rise in copper stocks is not limited to a single company.

It reflects a broader sector trend driven by:

- Rising copper prices

- Global demand-supply imbalance

- Long-term structural themes like EVs and green energy

For investors, copper offers opportunity, but only with:

Discipline, patience, and risk awareness.

Source: Analysis based on verified news reports, copper commodity data, and market sources

Disclaimer:

This article is for educational and informational purposes only. It does not constitute any investment advice. Readers are advised to do their own research or consult a financial advisor before making any investment decisions.