Sheel Biotech IPO Overview

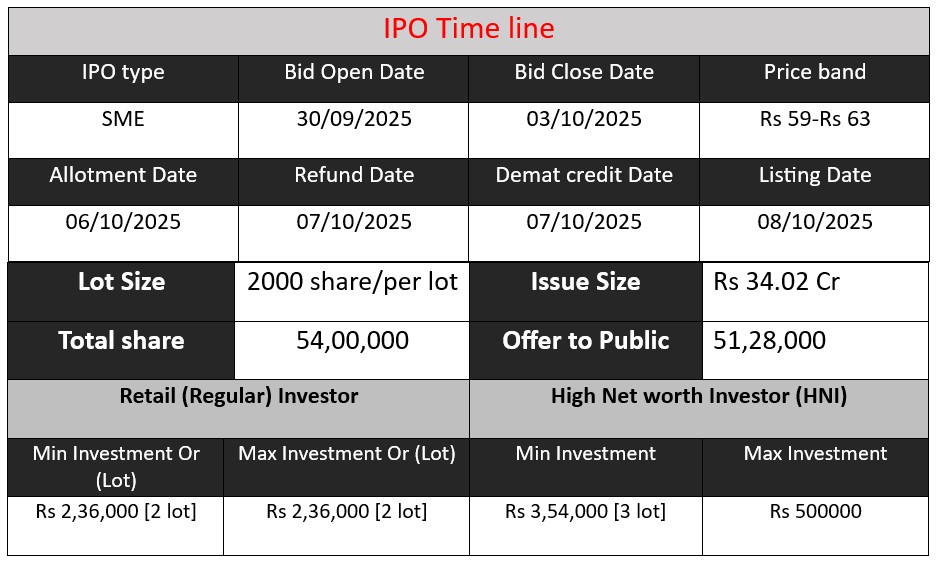

Sheel Biotech Limited is launching an IPO to raise ₹34.02 crore by issuing 5.4 million equity shares at a price band of ₹59–₹63. The IPO opens on September 30, 2025, and closes on October 3, 2025. The minimum investment is ₹2,36,000 for a lot size of 2,000 shares. The listing is expected on October 8, 2025, on the NSE SME platform. Proceeds will fund working capital, capital expenditure, and general corporate purposes.

Sheel Biotech GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 10 | 59-63 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Sheel Biotech Core Business & Overview

Sheel Biotech Limited, established in 1991, is an ISO 9001:2015, ISO 14001:2015, and ISO 45001:2018 certified company headquartered in New Delhi, India. The company operates across biotechnology, floriculture, horticulture, and organic farming sectors, offering a comprehensive range of services including tissue culture, greenhouse construction, and turnkey horticultural projects. With a presence in various regions of India, Sheel Biotech is recognized for its commitment to sustainable agricultural practices and innovation.

Core Areas of Operation

- Tissue Culture & Plant Propagation: Sheel Biotech specializes in the production of high-quality planting materials through advanced tissue culture techniques. Their R&D laboratory, recognized by the Department of Biotechnology, Government of India, has a production capacity of 10 million planting materials.

- Greenhouse & Horticultural Infrastructure: The company designs, constructs, and maintains various horticultural structures such as greenhouses, polyhouses, and net houses. They also provide services like climate control, fertigation, and automation to enhance yield and quality.

- Organic Farming & Certification: Sheel Biotech promotes organic farming practices and offers certification services, supporting sustainable agriculture and eco-friendly practices.

- Turnkey Projects & Training: The company executes comprehensive horticultural projects, including the establishment of Centres of Excellence (COEs) for fruits, vegetables, and flowers. These centers serve as hubs for demonstration and training, collaborating with state governments and agricultural universities.

Strengths

- Expertise in Biotechnology & Horticulture: With decades of experience, Sheel Biotech has developed strong capabilities in biotechnology, floriculture, and organic farming, forming the foundation of its business.

- Integrated Service Portfolio: The company offers a diverse range of services, including planting materials, greenhouse construction, organic certification, and training programs through farmer-producer organizations (FPOs).

- Sustainability & Recognition: Sheel Biotech operates with eco-friendly practices and holds government-recognized R&D facilities, ensuring quality, safety, and innovation in its operations.

Risks

- Operational Challenges in Tissue Culture: The precision required in tissue culture processes, including sterilization and temperature control, poses operational risks. Any lapses can lead to contamination and affect production quality.

- Market Competition: The agricultural biotechnology sector is competitive, with numerous players offering similar services. Sheel Biotech must continuously innovate and maintain quality to sustain its market position.

- Regulatory Compliance: Adherence to evolving agricultural and environmental regulations is crucial. Non-compliance can lead to legal issues and impact business operations.

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 84.39 | 88.94 | 103.11 |

| Profit | 4.51 | 5.08 | 10.51 |

| Assets | 93.08 | 93.90 | 105.95 |

Revenue

Revenue shows a steady upward trend, with a significant jump in FY 2024, indicating stronger sales and market expansion.

Profit

The profit has more than doubled in FY 2024. This suggests better cost management, improved operational efficiency, or higher-margin products/services driving profitability.

Asset

Asset growth is moderate in FY 2023 but accelerates in FY 2024, possibly due to expansion investments like infrastructure, equipment, or R&D capabilities.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.