Manas Polymers IPO Overview

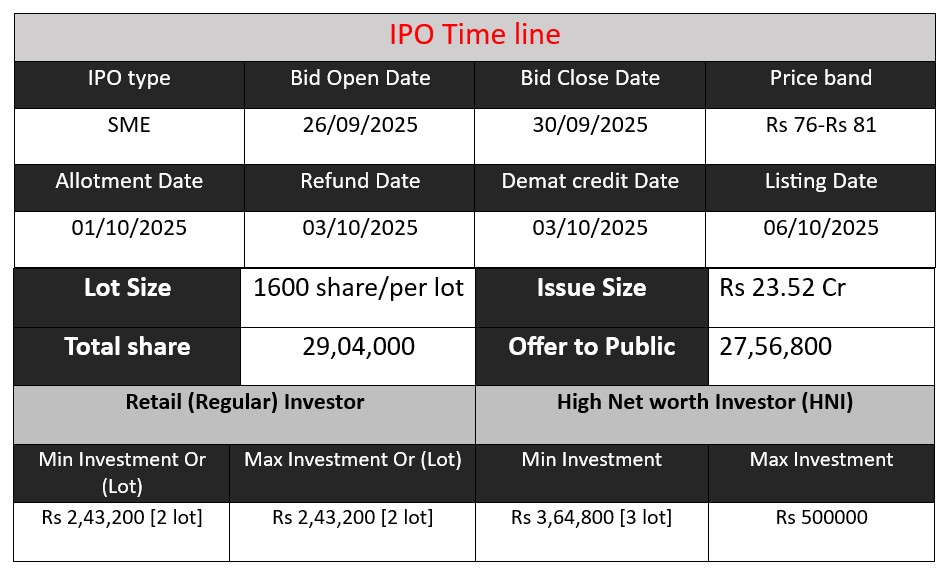

Manas Polymers & Energies Limited IPO opens on September 26, 2025, and closes on September 30, 2025. The company aims to raise ₹23.52 crore through a fresh issue of 29.04 lakh shares. Funds will be used for business expansion, capital expenditure, and working capital requirements. Investors can participate in this promising IPO to benefit from growth in PET manufacturing and renewable energy sectors.

Manas Polymers GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 76-81 |

| Last Updated: 30 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Manas Polymers Core Business & Overview

Manas Polymers and Energies Limited (MPEL) is a diversified industrial company based in Gwalior, Madhya Pradesh, India. Incorporated on January 19, 2024, MPEL specializes in manufacturing high-quality food-grade PET (Polyethylene Terephthalate) preforms, bottles, jars, and closure caps, primarily serving the Indian food and beverage industry. Additionally, the company is engaged in renewable energy generation and distribution, operating as an independent power producer.

Business Activities

- PET Manufacturing: MPEL operates state-of-the-art, fully automated injection molding facilities with an annual capacity of 4,000 metric tons. This enables efficient large-scale production of PET products tailored to packaging requirements.

- Renewable Energy: The company is actively involved in renewable power generation and distribution, contributing to sustainable energy solutions.

Strengths

- Dual Industry Engagement: MPEL’s involvement in both the PET industry and renewable energy sector positions it to capitalize on growth opportunities in these high-potential areas.

- ISO Certifications: The company holds several ISO certifications, including ISO 9001 (Quality Management), ISO 14001 (Environmental Management), and ISO 31000 (Risk Management), demonstrating its commitment to quality and sustainability.

- Experienced Leadership: MPEL is managed by a team with significant experience in the industry, providing strong leadership and strategic direction.

Risks

- Market Competition: The PET manufacturing and renewable energy sectors are highly competitive, which could impact MPEL’s market share and profitability.

- Regulatory Changes: Changes in environmental regulations or energy policies could affect the company’s operations and financial performance.

- Operational Challenges: As a company involved in manufacturing and energy production, MPEL may face operational risks related to equipment maintenance, supply chain disruptions, and energy production efficiency.

Financial Performance Overview (₹ in Crore)

| Financials | Revenue | Profit | Assets |

| FY 2023 | 20.35 | 0.79 | 14.72 |

| FY 2024 | 19.76 | 1.7 | 37.36 |

| FY 2025 | 31.54 | 4.29 | 29.61 |

Revenue:

- FY 2024 shows a slight decline in revenue (₹19.76 Cr) compared to FY 2023 (₹20.35 Cr), which may indicate temporary market slowdown or operational challenges.

- FY 2025 demonstrates strong growth, with revenue jumping to ₹31.54 Cr, a 59.5% increase over FY 2024. This suggests improved sales, expansion, or higher demand for the company’s PET products and energy services.

Profit:

- Profit more than doubled from FY 2023 (₹0.79 Cr) to FY 2024 (₹1.7 Cr), despite the slight revenue dip, indicating better cost management or operational efficiency.

- FY 2025 shows a significant increase in profit to ₹4.29 Cr, reflecting both higher revenue and efficient operations. Profit growth is proportionally higher than revenue growth, which is a positive sign of scalability.

Assets:

- Assets saw a huge jump from ₹14.72 Cr in FY 2023 to ₹37.36 Cr in FY 2024, likely due to investments in plant, machinery, or renewable energy infrastructure.

- FY 2025 assets slightly declined to ₹29.61 Cr, possibly because of asset sales, depreciation, or better asset utilization.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.