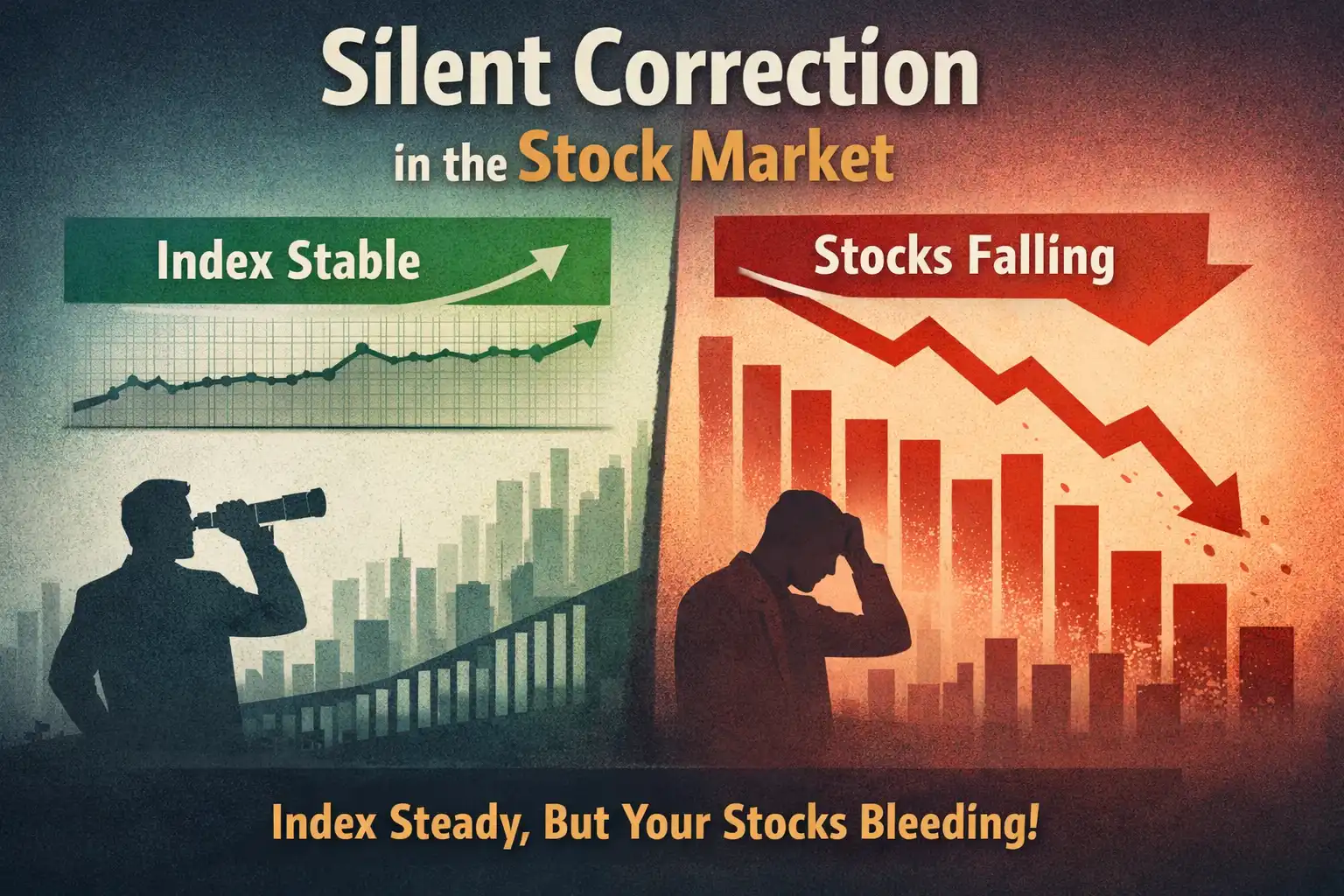

Many times, investors feel relaxed when they see Sensex or Nifty moving sideways or staying stable. Headlines say “Market is steady”, and it looks like there is no major risk.

But suddenly, when you open your portfolio, you notice that several stocks are already down 10–20%.

This situation is called Silent Correction.

A silent correction is dangerous because the market does not warn you loudly. There is no panic, no big red candles on the index chart, and no breaking news. Yet, money is quietly moving out of certain stocks and sectors.

Understanding silent correction is very important because the market is much bigger than just an index number.

What Is Silent Correction?

A silent correction happens when:

- The index (Sensex/Nifty) stays flat or slightly positive

- But many individual stocks fall sharply

- Especially mid-cap and small-cap stocks

In short:

Index looks stable, but internal market weakness is increasing.

Unlike normal corrections, silent corrections do not scare people immediately, which is why many investors realize it only after losses have already happened.

Normal Market Correction vs Silent Correction

| Point | Normal Market Correction | Silent Correction |

| Index Movement | Index falls 10% or more | Index stays flat or slightly moves |

| Market Mood | Panic everywhere | Calm on the surface |

| Media Coverage | Heavy coverage | Mostly ignored |

| Impact | Whole market | Select stocks & sectors |

| Risk for Retail | Visible | Hidden and slow |

Why Does Silent Correction Happen? (Key Reasons)

1. Sector Rotation

Big investors move money from one sector to another.

- Example: Money moves from mid-cap stocks to banking or IT

- Some stocks fall, but heavyweight stocks keep the index stable

This creates internal damage without index damage.

2. Profit Booking in Mid & Small Caps

After a strong rally:

- Smart money books profits in small and mid-cap stocks

- Large-cap stocks hold the index

Result:

📉 Many stocks fall

↔️ Index remains stable

3. Index Weightage Effect

A few large companies control the index.

For example:

- Top 10 stocks may control 50–60% of index movement

- Even if 30–40 stocks fall, the index may not show it clearly

This is one of the biggest reasons behind silent correction.

4. Earnings Disappointment

Some companies report:

- Weak revenue

- Poor margins

- Lower guidance

But if these companies have low index weight, the index does not react strongly, even though stock prices fall sharply.

5. Smart Money Exit

Institutional investors exit quietly:

- Low volumes

- No panic selling

- Slow distribution

Retail investors usually enter late and become liquidity providers during this phase.

How Can the Index Stay Stable While Stocks Fall?

Understanding Market Breadth

Market breadth means:

- How many stocks are rising

- How many stocks are falling

In silent correction:

- More stocks fall than rise

- Only a few big stocks support the index

So the index gives a false sense of safety.

Simple Real-Life Example of Silent Correction

Imagine this situation:

- Nifty is up by 0.3%

- Banking & IT stocks rise by 1–2%

- 70% of mid-cap stocks fall by 8–15%

What happens?

- Index looks positive

- Most investors feel safe

- Portfolios start bleeding silently

This is a classic silent correction phase.

Common Signs of Silent Correction

If you see these signals together, be alert:

🔹 Falling Market Breadth

More stocks falling than rising

🔹 Sector Divergence

Some sectors strong, others consistently weak

🔹 Weak Stocks on High Volume

Selling pressure increases in weaker stocks

🔹 Index Stability with Portfolio Loss

Index flat, portfolio negative

Why Silent Correction Is Dangerous for Retail Investors

- No panic → No urgency to exit

- Losses increase slowly → ignored initially

- Investors average bad stocks

- When panic comes, damage is already done

Silent correction tests patience, discipline, and risk management.

What Should Investors Do During Silent Correction?

✔️ Focus on individual stock strength, not the index

✔️ Avoid blindly buying mid & small caps

✔️ Check earnings quality and cash flows

✔️ Reduce overexposure to weak sectors

✔️ Keep cash ready for real opportunities

Silent correction is not always bad — it cleans weak stocks and creates better entry points later.

The Real Market Truth

A silent correction proves one important lesson:

The stock market is not the index.

The index can hide weakness, but your portfolio cannot.

Investors who understand silent correction:

- Protect capital better

- Avoid emotional decisions

- Enter strong stocks at better valuations

Silent correction does not shout.

It whispers — and only prepared investors listen.