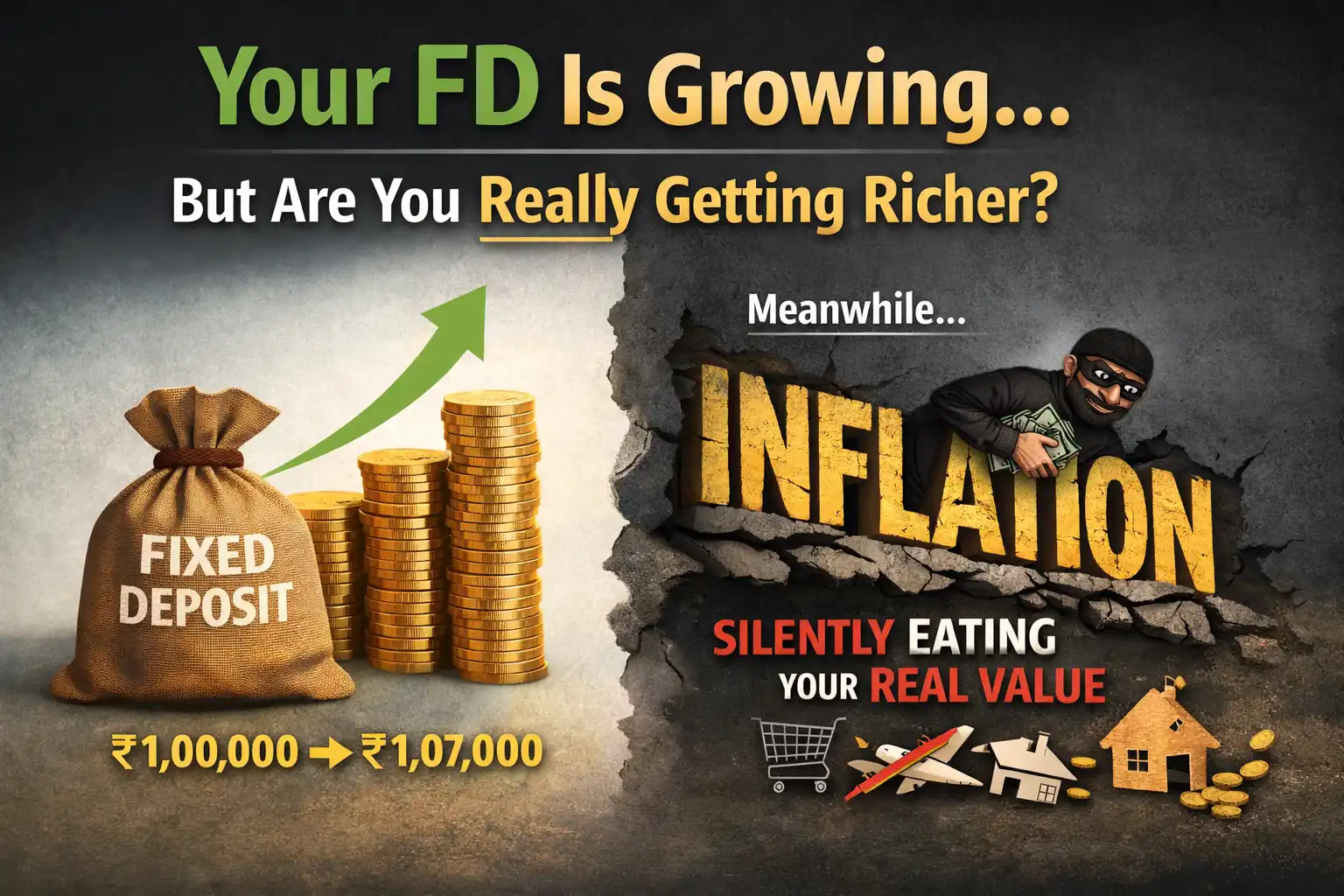

Your FD Looks Safe… But Is Your Money Really Growing?

Almost every family hears this advice at some point:

“Put your money in a Fixed Deposit. It’s safe.”

And honestly, it sounds sensible.

Banks are trusted, returns are fixed, and there’s no daily stress like the stock market.

Every year, when your FD matures, you receive a comforting message:

“₹1,00,000 has become ₹1,07,000.”

You feel relieved.

You feel smart.

You feel financially responsible.

But here’s the uncomfortable question most people never ask:

👉 Can ₹1,07,000 today buy the same things that ₹1,00,000 could buy last year?

If the answer is no — and in most cases it is — then something has gone wrong.

That “something” is inflation.

It doesn’t send alerts.

It doesn’t show up in your bank statement.

But slowly, silently, it reduces the real value of your money, even while your FD balance keeps increasing.

That’s why Fixed Deposits often feel safe —

but quietly fail to make you financially stronger.

Inflation Is Not Just Rising Prices — It’s Shrinking Money Power

Most people think inflation simply means prices are going up.

But the real meaning is far more dangerous:

Your money loses its ability to buy the same lifestyle over time.

A Simple Real-Life Example:

Five years ago, ₹100 could get you:

- a movie ticket

- popcorn

- a cold drink

Today?

₹100 might not even cover the ticket.

Your money didn’t change.

Its power did.

This loss of purchasing power is exactly what inflation does — and when your FD return is lower than inflation, your money becomes weaker every year.

The Biggest FD Illusion: “Guaranteed Returns”

Banks proudly advertise:

“7% guaranteed interest on Fixed Deposits.”

That statement is technically true — but dangerously incomplete.

FD guarantees:

✔ Your capital is safe

✔ Interest rate is fixed

FD does not guarantee:

❌ Growth in your lifestyle

❌ Increase in purchasing power

❌ Protection against inflation

Your money grows in numbers, not in real value — and that distinction changes everything.

Nominal Return vs Real Return: Where Most People Get Trapped

🔹 Nominal Return (What You See)

This is what your bank statement shows.

Example:

- FD interest rate: 7%

- Investment: ₹1,00,000

- Value after 1 year: ₹1,07,000

Most people stop thinking right here.

🔹 Real Return (What You Actually Gain)

Real return considers inflation.

Example:

- FD return: 7%

- Inflation: 6%

👉 Real return = 1%

So while your statement shows a ₹7,000 gain,

your real improvement in lifestyle value is only around ₹1,000.

The remaining ₹6,000 is silently absorbed by inflation.

Purchasing Power: The Cost Your Bank Never Explains

Purchasing power simply means:

How much life your money can buy.

Let’s break it down:

Last year, with ₹1,00,000 you could manage:

- household groceries

- school fees

- fuel

- occasional outings

This year, even with ₹1,07,000:

- groceries are costlier

- fees have increased

- fuel prices are higher

- travel is more expensive

So what happens?

- Vacations get postponed

- lifestyle gets compromised

- savings feel tighter

Your money increased —

but your life became more expensive.

That is inflation quietly defeating your FD.

Tax + Inflation: The Silent Double Attack

Inflation alone is bad.

But inflation combined with tax is brutal.

FD interest is:

- fully taxable

- added to your income

- taxed according to your slab

Detailed Example:

- FD interest rate: 7%

- You fall in the 30% tax bracket

Tax on interest ≈ 2.1%

Net return = 4.9%

Now compare with inflation at 6%.

Real return = –1.1%

This means:

You are losing money every year —

while believing your investment is “safe.”

The worst part?

This loss doesn’t feel painful — because it’s invisible.

Why Fixed Deposits Hurt the Most in the Long Term

In the short term, FD damage looks small.

Over long periods, it becomes massive.

Inflation compounds — just like interest.

10-Year Illustration:

- FD return: 7%

- Inflation: 6%

₹1,00,000 becomes ₹1,97,000 on paper.

But in real terms, that amount only has the purchasing power of about ₹1,25,000 today.

👉 Nearly ₹72,000 was just an illusion.

This is why people feel financially stuck even after decades of saving.

“FD Is the Safest Investment” — A Dangerous Half-Truth

Yes, FD protects your capital.

But it can slowly destroy your future if used incorrectly.

The biggest mistakes:

- retirement money kept in FD

- long-term goals funded only through FD

- inflation completely ignored

FD provides safety, not growth.

And safety alone is not enough.

Where Fixed Deposits Actually Make Sense

FD is not bad — it’s often misused.

FD works best for:

✔ emergency funds

✔ short-term goals

✔ mental peace

FD performs poorly for:

❌ wealth creation

❌ retirement planning

❌ beating inflation

Understanding this difference changes everything.

The Smarter Way to Fight Inflation

Smart investors don’t avoid FDs —

they balance them.

They:

- keep FDs for safety

- use growth assets for long-term goals

- focus on real returns, not just guaranteed numbers

Inflation is not optional.

Planning for it is.

Final Truth: What Really Matters Is Not the Number

Your FD statement may look comforting.

Your balance may grow every year.

But the real question is:

👉 Can your money buy you a better life in the future?

If the answer is uncertain,

then inflation has already started winning.

Fixed Deposits don’t look risky —

they just quietly fail to protect your future.

And that silent failure is far more dangerous than visible risk.