If you are new to F&O trading or have learned the basics of Futures and Options, the next important step is to understand the difference between them.

Futures and Options are both derivative instruments, but they differ in structure, risk, cost, and flexibility.

This article explains, step-by-step, the key differences between Futures and Options:

- Definition & obligation

- Risk & reward

- Cost / premium

- Hedging & strategies

- Real-life examples

Definition – What They Are

Futures:

A Futures contract is a binding agreement in which both the buyer and seller are obliged to buy or sell the underlying asset at a predetermined price on the contract’s expiry date.

Options:

An Options contract gives the buyer the right, but not the obligation, to buy or sell the underlying asset at a predetermined price. The seller has the obligation if the buyer chooses to exercise the option.

Example:

- Reliance share price = ₹2,500

- Futures: Buy a 1-month contract at ₹2,500 → You must buy at expiry

- Call Option: Right to buy at ₹2,500 → Optional, loss limited to premium

Key Insight: Futures involve mandatory obligation, Options provide choice.

Obligation – Mandatory vs Choice

- Futures: Both buyer and seller are obliged to execute the contract at expiry, regardless of market direction.

- Options: Buyer has choice to exercise; seller has obligation if exercised.

Example:

- Futures → Market moves to ₹2,600 or ₹2,400 → Contract must be executed

- Call Option → Market ₹2,600 → Buyer may choose to exercise; seller is obliged if exercised

Practical Tip: Futures trading involves high risk, Options provide controlled loss for buyers.

Risk & Reward

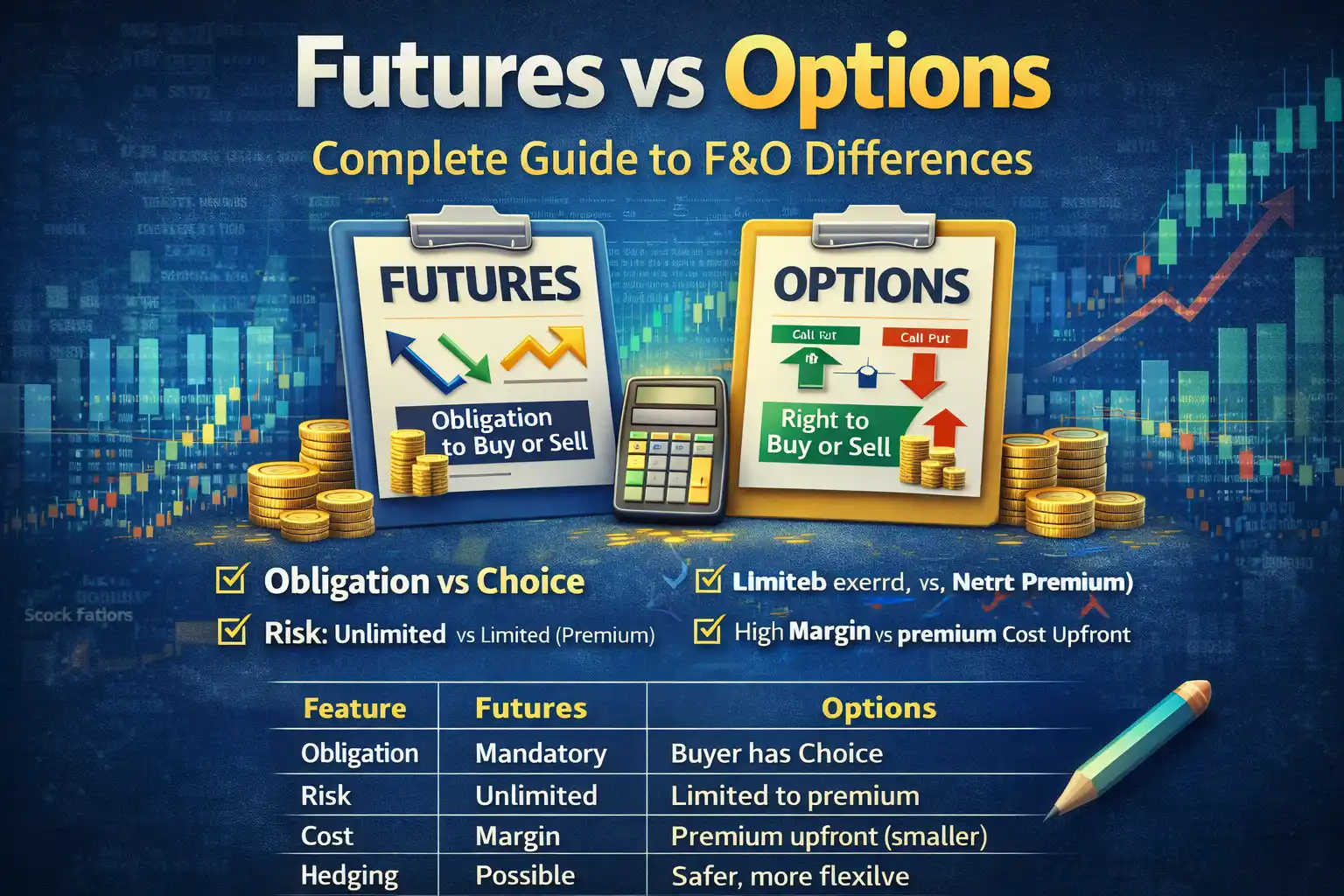

| Feature | Futures | Options |

| Maximum Profit | Unlimited | Unlimited for Call, limited for Put |

| Maximum Loss | Unlimited | Limited to Premium (for buyer) |

| Leverage | High | High, but controlled risk for buyer |

| Obligation | Mandatory | Buyer has choice |

| Hedging | Possible | Flexible and safer |

Example:

- Futures → Buy Nifty 50 at 20,000, market falls to 19,500 → Loss = 500 × lot size

- Call Option → Buy at 20,000, Premium ₹50, market falls → Loss = Premium × lot size

Key Insight: Futures = high risk & reward; Options = controlled risk for buyer.

Cost & Investment Requirement

- Futures: No premium; only margin required, usually 10–15% of contract value.

- Options: Buyer pays premium upfront; seller receives premium.

Example:

- Futures margin = ₹25,000 for 1 Nifty lot

- Options premium = ₹50 × 75 shares = ₹3,750

Practical Tip: Options allow smaller upfront investment with limited risk, whereas Futures require higher margin, but profit/loss is unlimited.

Flexibility & Trading Strategies

- Futures: Simple directional trading → profit/loss depends on market movement

- Options: Flexible → Can combine multiple options (spreads, straddles, hedges)

Example:

- Futures → Buy → Profit if market rises, loss if it falls

- Options → Buy Call + Buy Put (Straddle) → Profit possible even if market moves up or down

Key Insight: Advanced Options strategies allow controlled risk trading and portfolio protection.

Hedging & Portfolio Protection

- Futures: Can hedge portfolio, but risk of loss is unlimited, requires careful monitoring

- Options: Hedge portfolio with limited loss, more flexible

Example:

- Own 100 Reliance shares → Market falls

- Futures → Sell futures → Profit/loss depends on market movement, high risk

- Options → Buy Put → Loss limited to premium, portfolio protected

Practical Tip: Options are preferred for risk-averse investors who want hedging with limited downside.

Real-Life Comparison Example

| Feature | Futures | Call Option |

| Strike/Contract Price | ₹2,500 | ₹2,500 |

| Market Price (Expiry) | ₹2,600 / ₹2,400 | ₹2,600 / ₹2,450 |

| Loss / Profit | Unlimited | Limited to Premium for loss |

| Obligation | Mandatory | Buyer’s choice |

| Cost | Margin ₹25,000 | Premium ₹5,000 |

Observation:

- Futures → High risk & reward, mandatory execution

- Options → Controlled risk, optional execution, smaller upfront cost

Outcome

Futures and Options are both derivative instruments, but:

- Futures: Mandatory obligation, high risk & reward, margin required

- Options: Flexible, buyer’s loss limited, premium paid upfront, allows advanced strategies

Summary:

- Obligation: Futures > Options

- Risk: Futures high, Options limited for buyer

- Cost: Futures margin, Options premium

- Flexibility: Options > Futures

- Hedging: Options safer & more flexible

Understanding Futures vs Options prepares you for combined F&O strategies, smarter trading, and better portfolio management.