MPK Steels IPO Overview

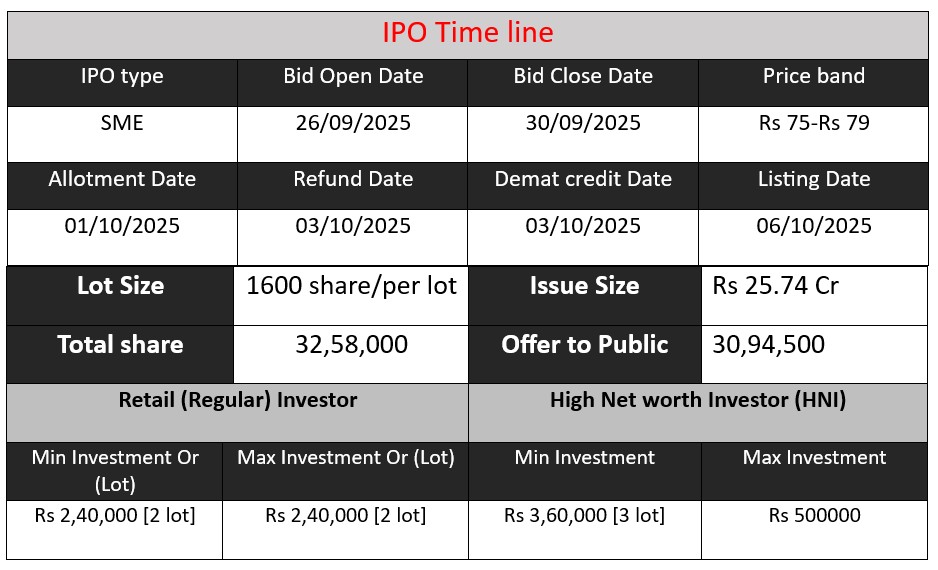

MPK Steels IPO opens on Sep 26 and closes on Sep 30, 2025, to raise ₹25.74 crore by issuing 32.58 lakh shares. The proceeds will be used for purchasing machinery, setting up a solar plant, and enhancing working capital. Invest in a leading structural steel manufacturer expanding its operations and strengthening its presence in construction, infrastructure, and industrial sectors.

MPK Steels GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 75-79 |

| Last Updated: 30 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

MPK Steels Core Business & Overview

MPK Steels (I) Limited is an Indian manufacturer specializing in general-purpose structural steel products. Established in 2005 and headquartered in Jaipur, Rajasthan, the company produces a range of mild steel (MS) items, including channels, beams, angles, flats, and bars. These products are integral to sectors such as construction, power, railways, automotive, and telecommunications.

Operations

MPK Steels operates dual plant facilities at a single location in Bagru, Jaipur. This setup enhances production flexibility and cost efficiency. The company utilizes an extensive range of specialized dies to cater to diverse customer requirements, ensuring precise manufacturing. Additionally, MPK Steels maintains rigorous quality assurance through in-house laboratories, upholding high product standards.

Strengths

- Established Brand and Client Relationships: MPK Steels has cultivated long-term relationships with distributors and dealers, ensuring repeat business and a strong market presence.

- Advanced Manufacturing Capabilities: The company’s dual plant operations and specialized dies allow for efficient and precise production, meeting diverse customer needs.

- Commitment to Quality: With in-house testing facilities and a focus on innovation and R&D, MPK Steels ensures that its products meet stringent national and international benchmarks for strength, durability, and safety.

Risks

- Raw Material Price Volatility: The company is susceptible to fluctuations in the prices of raw materials, which can impact profitability.

- Regulatory Compliance: MPK Steels faces challenges related to regulatory and environmental compliances, which can affect operations and costs.

Dependence on Cyclical Industries: The company’s performance is closely tied to industries with cyclical demand, such as construction and infrastructure, making it vulnerable to economic downturns

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 137.55 | 1.81 | 45.67 |

| FY 2024 | 186.6 | 3.11 | 56.64 |

| FY 2025 | 206.58 | 6.05 | 62.36 |

Revenue

- Revenue has increased steadily from ₹137.55 crore in FY 2023 to ₹206.58 crore in FY 2025.

- FY 2024 growth: (186.6−137.55)/137.55=35.7(186.6 – 137.55)/137.55 =35.7%(186.6−137.55)/137.55=35.7

- FY 2025 growth: (206.58−186.6)/186.6=10.7(206.58 – 186.6)/186.6 10.7%(206.58−186.6)/186.=10.7

The company shows strong revenue growth, though the pace slowed slightly in FY 2025 compared to FY 2024.

Profit

- Profit has grown significantly, from ₹1.81 crore in FY 2023 to ₹6.05 crore in FY 2025.

- FY 2024 growth: (3.11−1.81)/1.81=71.8(3.11 – 1.81)/1.81 = 71.8%(3.11−1.81)/1.81=71.8

- FY 2025 growth: (6.05−3.11)/3.11≈94.5(6.05 – 3.11)/3.11 = 94.5%(6.05−3.11)/3.11=94.5

Profit is growing faster than revenue, suggesting improved operational efficiency, better cost management, or higher-margin sales.

Asset

- Total assets increased from ₹45.67 crore in FY 2023 to ₹62.36 crore in FY 2025.

- FY 2024 growth: (56.64−45.67)/45.67=23.9(56.64 – 45.67)/45.67 = 23.9%(56.64−45.67)/45.67=23.9

- FY 2025 growth: (62.36−56.64)/56.64=10.1(62.36 – 56.64)/56.64 =10.1%(62.36−56.64)/56.64=10.1

Asset growth is steady, supporting revenue expansion and indicating healthy investment in plant, machinery, or working capital.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.