हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

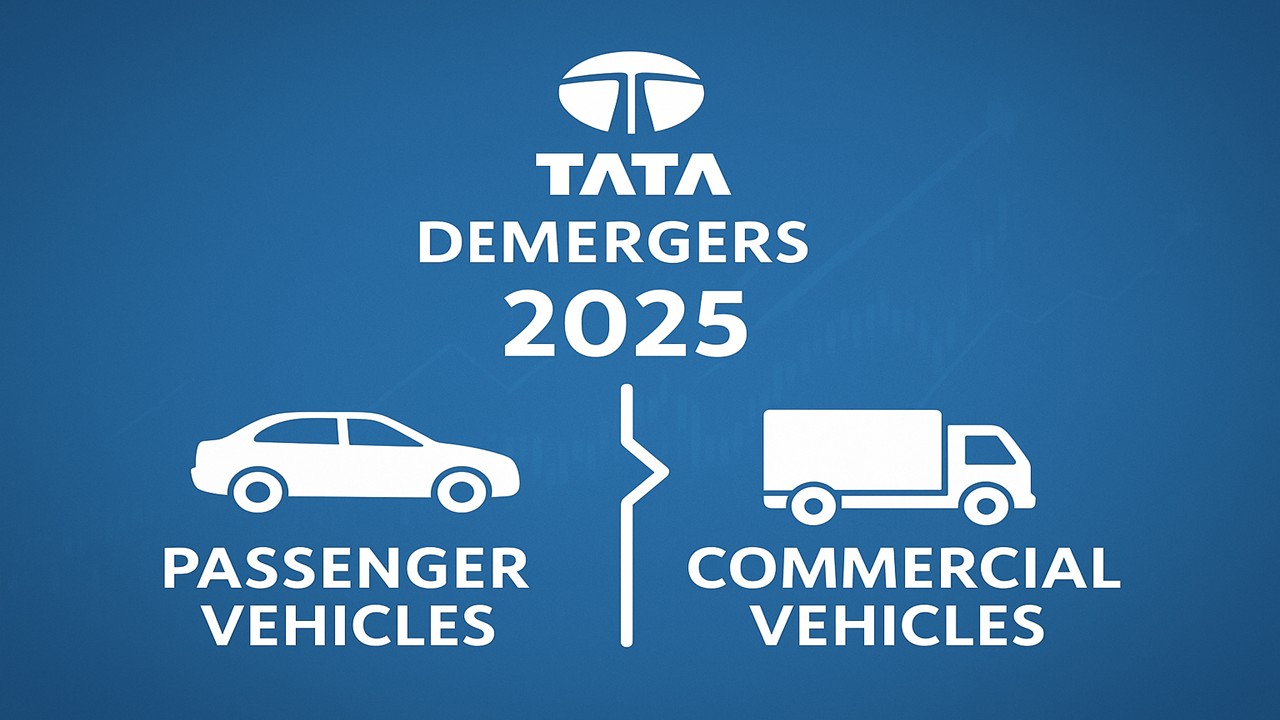

Tata Motors has announced a major restructuring plan to split its Commercial Vehicles (CV) and Passenger Vehicles (PV) businesses into separate listed companies. The demerger will be effective from October 1, 2025, aiming to enhance operational efficiency and provide greater clarity for investors.

NCLT Approves Demerger

On September 26, 2025, the National Company Law Tribunal (NCLT) approved Tata Motors’ demerger plan. The approval from NCLT allows the company to formally implement the restructuring, following earlier approval from its board of directors.

Share Allocation for Shareholders

After the demerger, every Tata Motors shareholder will receive one new share in Tata Motors Commercial Vehicles Ltd (TMLCV) for each existing Tata Motors share, a 1:1 ratio. This process ensures transparency for investors and provides clear identification of the two independent businesses.

Structure of the New Companies

- Tata Motors Commercial Vehicles Ltd (TMLCV):

This company will primarily operate in the commercial vehicle segment, including trucks, buses, and other heavy vehicles. - Tata Motors Passenger Vehicles Ltd (TMPV):

This company will focus on passenger vehicles, including cars and electric vehicles.

Both companies will be independently listed and have separate management teams.

Leadership Changes

Along with the demerger, Tata Motors has appointed Shailesh Chandra as the new Managing Director and CEO. Shailesh Chandra has been leading the company’s passenger vehicle and electric mobility divisions and will now head the new TMPV company.

Purpose of the Demerger

- Enhanced Operational Efficiency: Each business can focus independently on its core operations.

- Transparency for Investors: Financial performance and strategies of each company will be clear.

- New Growth Opportunities: Independent businesses can grow and strategize faster.

Investor Guidance

- Wait for Share Allocation: Monitor the announcement of the record date for share allocation.

- Evaluate Company Performance: Assess the financial performance and growth prospects of both companies.

- Plan for Long-term Investment: The demerger offers an opportunity to diversify portfolios by investing in two independent companies.

Outcome

Tata Motors’ demerger brings new opportunities for the company and greater clarity for investors. Shareholders will now have shares in two separate companies, providing portfolio diversification and clearer insight into each business’s performance.

Source: Tata motors-NSE BSE Order