Urban Comapany IPO Overview

Urban Company’s highly anticipated IPO opens on 10 September 2025 and closes on 12 September 2025. The issue size is ₹1,900 crore, comprising a fresh equity issuance of ₹472 crore and an offer-for-sale of ₹1,428 crore (roughly 18.45 crore shares). Proceeds will fund technology & cloud infrastructure, office leases, marketing, and general corporate needs, marking a pivotal step in its public listing journey.

Urban Comapany Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 1.48 |

| NIIs | 18.22 |

| Retails | 17.68 |

| Employees | 13.45 |

| Total | 9.00 |

| Last Updated: 11 Sep 2025 | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 69 | 98-103 |

| Last Updated: 14 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

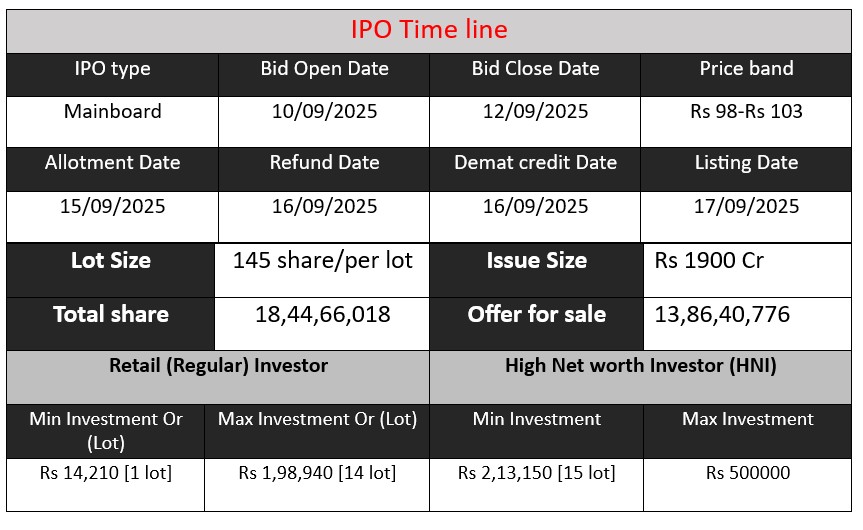

IPO Key Detail

Urban company Core Business & Overview

Urban Company (formerly UrbanClap), founded in 2014 and headquartered in Gurgaon, India, operates as a technology-driven marketplace connecting consumers with skilled professionals for a wide array of services—such as home cleaning, appliance repair, beauty, carpentry, plumbing, painting, and more.

- The platform follows a B2C model, offering digital aggregation of local services with transparent, fixed pricing and quality assurance through rigorous screening and training.

- It has expanded beyond India to serve markets in the UAE, Singapore, and Saudi Arabia.

- According to its Red Herring Prospectus (RHP), it operates in 51 Indian cities as of mid-2025 (excluding those under its Saudi JV).

Strengths

1. Trusted Consumer Brand & Broad Reach

- Urban Company has served 14.59 million unique customers as of June 2025, with nearly half acquired in just the prior three years.

- It remains the most searched home services brand in India, per Google Trends.

2. Robust Technology Platform & Innovation

- Utilizes AI, ML, and GenAI to power real-time matching (by skill, timing, location), route optimization, personalization, and fraud and quality controls.

- Introduced industry-first tools such as foam jet pumps for AC servicing, co-pilot diagnostic tools, and roll-on wax kits for beauty services.

3. Training Infrastructure & Professional Network

- Operates 247 in-house training classrooms across 17 cities; professionals onboarded earn 30–40% more than their offline peers.

- Over 83% of new service professionals (Apr 2022–Mar 2025) joined via organic referrals, highlighting high trust and retention.

- RHP also states a network of over 54,000 average monthly active experts with background checks and training.

Risks

A. Profitability & Financial Sustainability

- The company has historically incurred net losses, although margins have improved (e.g., adjusted EBITDA is now positive at 3.3% of NTV in FY25, vs –9.72% in FY23).

- RHP flagged that profit sustainability depends on consumer retention, cost control, and scaling new offerings.

B. Intense Competition & Market Risks

- Faces fierce competition from both offline service providers and other online platforms, which may reduce pricing flexibility and margins.

- Low online service adoption in certain regions remains a barrier.

C. Dependency on Service Professionals

- Retaining skilled professionals is critical. Attrition, dissatisfaction, or shifts in worker regulations could disrupt service capacity and quality.

- RHP cautions about the risk of platform disintermediation, where professionals may bypass the platform to service clients directly.

- Labor rights critiques: Wired documented that as Urban Company pushed for profitability, increased performance targets and reduced incentives led to worker dissatisfaction and protests.

- Wikipedia reports protests and concerns over ID blocks, rating policies, and working conditions among gig workers.

D. Operational & Regulatory Risks

- Rapid expansion puts pressure on quality, supply chain, and compliance in new markets; international operations also expose the company to currency risk and regulatory complexities.

- RHP mentions risks from data security, platform outages, negative publicity, and regulatory actions.

- Urban Company spends significantly on marketing, training, and incentives—elevating operational costs and pressuring margins

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | 636.6 | -312.48 | 1,631.22 |

| FY 2024 | 828.02 | -92.77 | 1,636.65 |

| FY 2025 | 1,144.47 | 239.77 | 2,200.64 |

Revenue

- FY 2023: ₹636.6 crore

- FY 2024: ₹828.02 crore

- FY 2025: ₹1,144.47 crore

Revenue has grown steadily year-on-year, with a strong 38% growth in FY 2025 compared to FY 2024. This reflects increasing consumer adoption, higher service demand, and successful expansion into new markets.

Profit

- FY 2023: –₹312.48 crore (loss)

- FY 2024: –₹92.77 crore (loss)

- FY 2025: ₹239.77 crore (profit)

The company turned profitable in FY 2025 after two consecutive years of losses. This turnaround highlights better cost management, efficiency in operations, and improved monetization of services.

Total Assets

- FY 2023: ₹1,631.22 crore

- FY 2024: ₹1,636.65 crore

- FY 2025: ₹2,200.64 crore

Assets remained almost flat between FY 2023 and FY 2024 but saw a sharp rise of ~34% in FY 2025, indicating significant investments in infrastructure, technology, and expansion capacity.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.