Umiya Mobile IPO Overview

Umiya Mobile Limited’s SME IPO opens on 28 July 2025 and closes on 30 July 2025. The issue comprises 3,770,000 fresh equity shares (face value ₹10) at a fixed price of ₹66, raising ₹24.88 crore, with no offer-for-sale. Proceeds will primarily repay borrowings and meet general corporate purposes. The IPO is underwritten by a market maker and will be listed on the BSE SME platform.

Umiya Mobile Subscription Status

| Category | Subscription (x) |

| QIBs | 0.00 |

| NIIs | 2.49 |

| Retails | 2.43 |

| Total | 2.38 |

| Last Updated: 30 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 66 | |

| Last Updated: 30 July 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

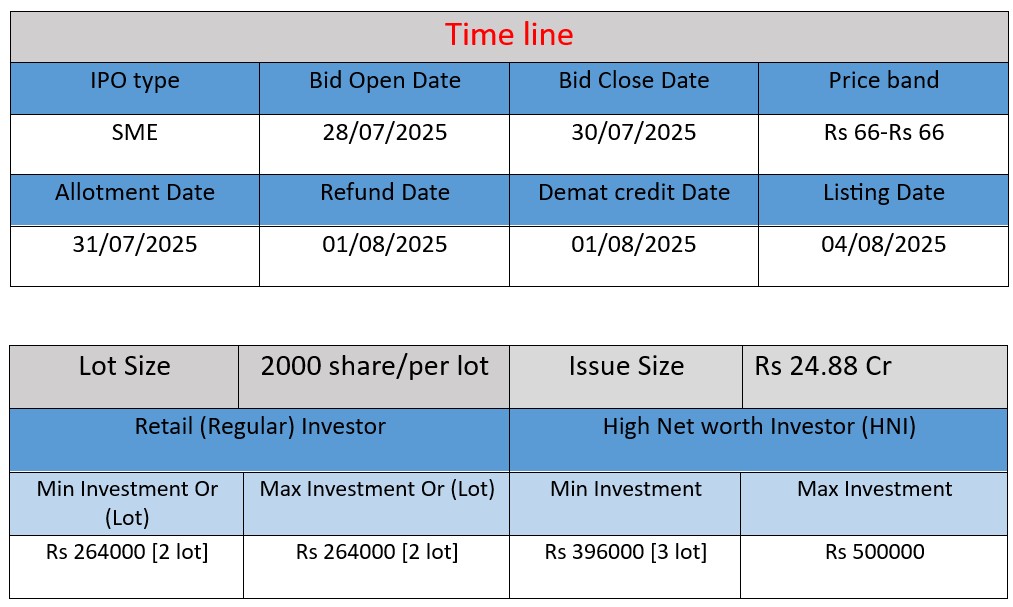

IPO Key Date

Core Business & Overview

- Incorporated in December 2012 (originally as a Private Limited), Umiya Mobile Limited transitioned to public limited status in early 2025.

- Headquartered in Rajkot, Gujarat, it operates as a multi-brand retailer of smartphones, mobile accessories, and consumer electronics (including televisions, air conditioners, refrigerators, and more).

- As of March 31, 2025, the company operates 219 stores spanning Gujarat, Maharashtra, and Dadra & Nagar Haveli and Daman & Diu—with approximately 20 owned stores and 199 retail partner outlets across 40 cities.

Business Activities

- Multi‑brand retail: The company sells smartphones and consumer durables from renowned brands such as Apple, Samsung, Realme, Xiaomi, Sony, LG, Panasonic, Godrej, Bajaj, among others.

- Financial services: Offers credit and EMI options through banks and financial institutions to improve affordability and encourage purchase.

- After‑sales services: Provides warranty-backed support and repairs across both owned and franchise outlets, reinforcing customer satisfaction and trust.

Strengths

Based on expert analysis and IPO documents:

- Extensive retail network: A strong presence with 219 stores across western India, enhancing reach and brand visibility.

- Diverse product portfolio: Wide-ranging offerings across smartphones, laptops, tablets, accessories, and major home appliances catering to varied customer needs.

- Experienced promoter team: Led by promoters with over 12 years’ industry experience in mobile and consumer electronics trading.

- Strategic store locations: Positioned in high-traffic areas, with product display zones for hands-on experience, enhancing buyer confidence and footfall.

Risks

Identified in the company’s IPO filings and expert commentary:

- Supplier concentration: Heavy dependence on a limited set of key suppliers could disrupt operations if supply chains are affected.

- Regional revenue concentration: Majority of business is within Gujarat and Maharashtra, which may limit geographical diversification and expose it to regional economic shifts.

- Litigation exposure: Existing legal cases could have financial or reputational repercussions if adverse outcomes arise.

- Leverage and borrowing risk: Ongoing borrowings introduce vulnerability; loan facilities—if unsecured—could be recalled unexpectedly.

- Liquidity and listing risk: This being the company’s first public issue, a formal market for its equity is not yet established. Listing on the SME platform of BSE may result in thin trading and price volatility post-listing.

Financial Performance Table

| Financial Year | Revenue | Net Profit | Total Assets |

| FY 2022 | 212.11 | 0.25 | 36.91 |

| FY 2023 | 333.31 | 0.18 | 53.40 |

| FY 2024 | 451.48 | 2.35 | 66.74 |

Revenue

- FY22 to FY23: Revenue jumped from ₹212.11 Cr to ₹333.31 Cr – a growth of 57%, indicating good sales momentum.

- FY23 to FY24: Revenue further increased by 35%, reaching ₹451.48 Cr.

Strong, consistent growth in revenue over 3 years.

Net Profit

- FY22 to FY23: Despite higher revenue, profit fell from ₹0.25 Cr to ₹0.18 Cr — suggesting rising costs or lower margins.

- FY23 to FY24: A sharp increase to ₹2.35 Cr, which is over 13 times higher than the previous year, showing strong profitability improvements and better cost control.

Total Assets

Assets increased steadily from ₹36.91 Cr in FY22 to ₹66.74 Cr in FY24 — showing capital expansion, possibly due to store growth and inventory investment.

| ✅ Pros of Umiya Mobile IPO |

| Strong Revenue Growth : Revenue rose from ₹212.11 Cr (FY22) to ₹451.48 Cr (FY24), showing consistent and healthy top-line growth. Sharp Profit Turnaround : Net profit jumped from ₹0.18 Cr (FY23) to ₹2.35 Cr (FY24), indicating better operational efficiency and margin improvement. Wide Retail Network : Operates 219 retail outlets across Gujarat, Maharashtra, and Daman & Diu — giving the company strong regional presence and customer access. Multi-Brand, Diversified Product Portfolio : Sells mobile phones, tablets, laptops, TVs, washing machines, ACs, etc. from brands like Apple, Samsung, Sony, Realme — reducing dependency on any one product or brand. Asset Growth & Business Expansion : Assets increased from ₹36.91 Cr to ₹66.74 Cr in 3 years, showing company expansion through infrastructure, stock, or outlet setup. Purposeful Fund Use: IPO proceeds to be used for repaying ₹19+ Cr loans, improving the company’s balance sheet and reducing interest burden. Franchise & Owned Store Model : Business operates through both company-owned stores and retail partner stores, allowing fast expansion without heavy capital investment. |

| ⚠️ Cons of Umiya Mobile IPO |

| Narrow Profit Margins : Despite high revenue, profit was only ₹2.35 Cr in FY24 (Net Profit Margin ~0.52%), which is considered low. Geographical Concentration : Major business operates only in select regions (mainly Gujarat), exposing it to regional economic and political risks. High Working Capital Requirement : Inventory-heavy business like electronics retailing requires constant working capital — which can strain cash flows in low-sales periods. Stiff Market Competition : Faces competition from online giants (Flipkart, Amazon), big retail chains (Reliance Digital, Croma), and local retailers. Past Volatility in Profitability : Profit declined from ₹0.25 Cr (FY22) to ₹0.18 Cr (FY23) despite rising revenue — indicating possible inefficiencies or external pressure. SME Listing Risks : The IPO is on the BSE SME platform, where liquidity is often low, and post-listing price volatility can be high. High Dependency on Brands : The company relies on external brands for its products — any conflict or withdrawal of dealership rights could impact sales. |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.