TechDefence Labs IPO Overview

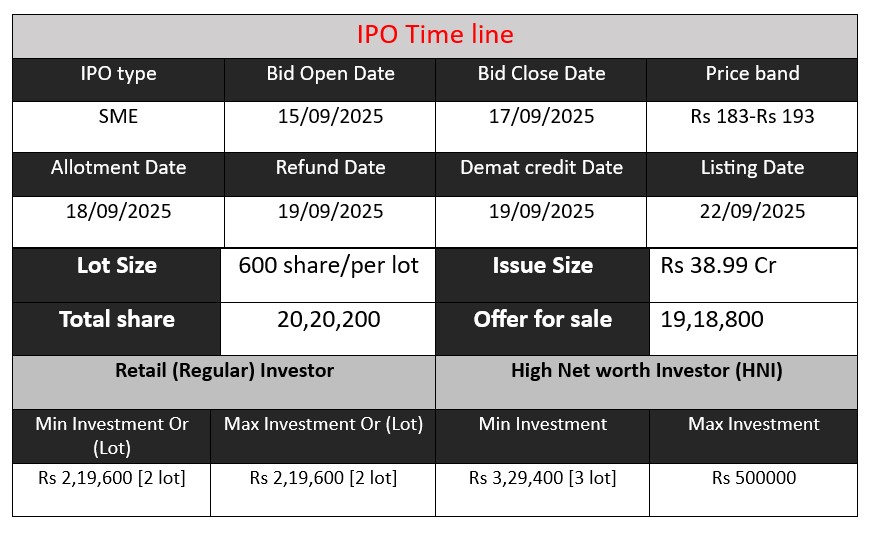

TechD Cybersecurity Ltd IPO offers 20,20,200 equity shares (face value ₹10 each) in a book-built issue to raise ₹38.99 crore at a price band of ₹183-₹193 per share. The IPO opens on 15 September 2025 and closes on 17 September 2025, with proceeds earmarked for investment in human resources, setting up a Global Security Operation Centre (GSOC) at Ahmedabad, and general corporate purposes.

TechDefence Labs GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 160 | 183-193 |

| Last Updated: 17 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Techdefence Labs Solutions Core Business & Overview

TechD Cybersecurity Limited (formerly Techdefence Labs Solutions Ltd) is a cybersecurity services company based in Ahmedabad, Gujarat, India.

Incorporated initially as a private limited company in January 2017; converted to public status in late 2024. Name also changed recently to “TechD Cybersecurity Limited.”

Offers end-to-end cybersecurity services: vulnerability assessment & penetration testing (VAPT), managed security services (MSSP), security operations centre (SOC) services, compliance consulting, digital forensics & incident response, staff augmentation, and training/workshops.

Has CERT-In empanelment, ISO 27001 certification, which indicate regulatory compliance / security standard adherence.

Client base includes notable corporates: Adani Group, Zensar Technologies, Astral Limited, Kedia Capital, ETO Gruppe GmbH, IQM Corporation etc.

Strengths

From various sources, the following strengths emerge:

- Strong Growth in Revenues & Profitability

The company has shown steep increases in revenue and profit after tax over recent years. For example, revenue from operations has nearly doubled or more year-on-year, and net profits rising correspondingly. - Regulatory & Standards Compliance

CERT-In empanelment and ISO 27001 certification give credibility in markets (especially government, BFSI) that demand compliance. - Comprehensive & Diversified Service Offering

They provide a broad suite of cybersecurity services (VAPT, SOC, MSSP, compliance, incident response, training) rather than focusing on just one niche. This allows cross-selling, and resilience across different cybersecurity demand areas. - Client Profile & Industry Presence

Having marquee clients gives validation. Also their presence in multiple industries (BFSI, manufacturing, healthcare, aviation) reduces dependence on just one sector. - Strong Management & Promoter Credentials

The founders/promoters have experience in cybercrime / cybersecurity investigations, and the company has established ties (training, talent sourcing) with universities etc., which helps in building internal capabilities. - Financial Leverage & Low Debt

As of FY25, company has low debt-to-equity ratio, healthy margins etc. This gives more flexibility for scaling.

Risks

No company is without risk. Key risks for TechD Cybersecurity (TechDefence) include:

- Customer Concentration

A substantial portion of revenue comes from a few clients. The top 3-10 customers contribute large fractions of revenue. If any major client pulls back business, it could affect revenues significantly. - Geographic / Regional Concentration

A heavy portion of revenue comes from the states of Gujarat and Maharashtra. Regional dependence means that local regulatory, economic, or competitive changes could adversely affect results. - High Dependency on Skilled Talent / Attrition

Cybersecurity is expert-driven. Retaining skilled personnel, keeping them up to date with threats, tools, etc., is expensive and competitive. Also staff costs are a big line item, so increases there or inability to scale human resources smoothly pose risk. - Possible Overreliance on Few OEM Partners or Inputs

Some services or tools may depend on licenses, software from specific OEMs. Disruption or change in terms could impact their offerings. - Regulatory / Compliance Risk, & Sector Risk

Given cyber laws, data protection, cross-border compliance issues are evolving. Also potential for adverse legal outcomes (for example in tax, or statutory compliance) if not kept up to date.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 7.56 | 15.07 | 29.79 |

| Profit | 0.94 | 3.24 | 8.40 |

| Assets | 6.98 | 9.14 | 29.08 |

Revenue

- FY 2023: ₹7.56 Cr

- FY 2024: ₹15.07 Cr

- FY 2025: ₹29.79 Cr

Revenue has grown almost 4x in two years, showing strong business expansion and rising demand for services. The company has maintained consistent upward growth momentum.

Profit

- FY 2023: ₹0.94 Cr

- FY 2024: ₹3.24 Cr

- FY 2025: ₹8.40 Cr

Profit has increased nearly 9x from FY 2023 to FY 2025. This indicates not only revenue growth but also better cost management and operational efficiency. Profit margins are improving steadily.

Total Assets

- FY 2023: ₹6.98 Cr

- FY 2024: ₹9.14 Cr

- FY 2025: ₹29.08 Cr

Assets have jumped significantly, especially in FY 2025, suggesting major investments in infrastructure and capacity expansion. This positions the company for future scalability.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.