Taurian MPS IPO Overview

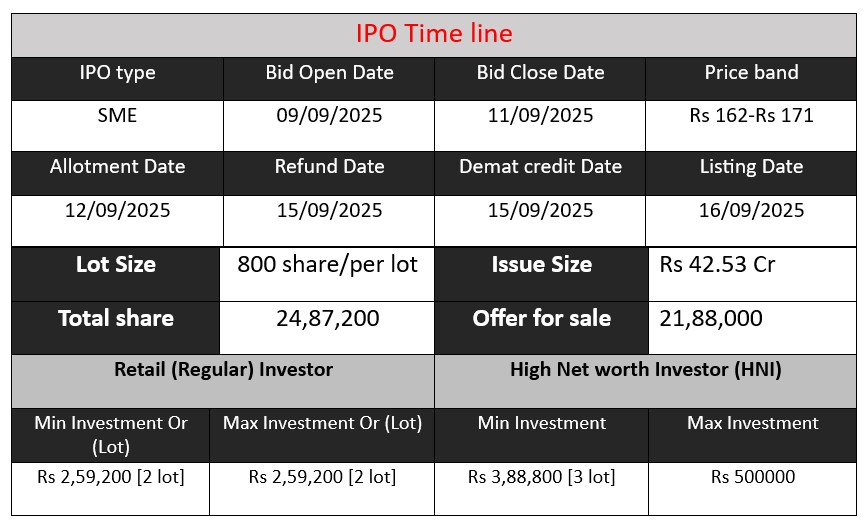

Taurian MPS Limited’s SME IPO opens on September 8, 2025, and closes on September 10, 2025, offering 2,487,200 equity shares (face value ₹10) with a price band of ₹162–₹171, raising approximately ₹42.53 crore through a fully fresh issue. The funds will be used for acquiring machinery, enhancing R&D capabilities, bolstering working capital, and meeting general corporate purposes. Expected to list on the NSE SME platform on or around mid-September, 2025.

Taurian MPS GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 5 | 162-171 |

| Last Updated: 11 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Taurian MPS Core Business & Overview

Taurian MPS Limited (CIN: U14200MH2010PLC250083) was incorporated on June 28, 2010. It is an Indian company operating primarily in the mineral processing and crushing equipment manufacturing sector—serving industries such as iron ore, coal, bauxite, limestone, and other minerals.

Product & Service Portfolio

The company manufactures a range of equipment including cone crushers, jaw crushers, skid steer units, and other mineral-handling machinery.

Strengths

According to the IPO analysis, Taurian MPS Limited highlights several competitive advantages:

- Comprehensive Product Portfolio – A wide variety of crushing and mineral processing equipment tailored to different industry needs.

- Strong Manufacturing Capabilities – Robust in-house facilities for production, supporting consistency and scalability.

- Quality Control Mechanism – Systems in place to ensure reliable and high-quality equipment performance.

- Dedicated Design & R&D Team – Focus on continuous improvement and innovation within its product lines.

- Industry Experience – Established presence and understanding of mineral processing demands.

Risks

- The company depends heavily on a limited number of customers and suppliers, creating revenue fluctuation risk.

- PAT dropped to ₹9.50 crore in FY 2025 from ₹11.32 crore in FY 2024 (–16%), showing unstable profitability.

- The company carries ₹9.11 crore in debt and plans to use ₹22.6 crore from IPO proceeds for working capital.

- It has only one manufacturing site and relies on third-party logistics for operations.

- The business depends on cyclical mining and construction demand, with concentration in a few large customers.

- Failure to meet strict quality standards may lead to order cancellations, legal disputes, and trademark issues.

For a more comprehensive list of risks (such as market volatility, regulatory changes, operational dependencies, etc.), reviewing the full Red Herring Prospectus is strongly recommended.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 10.82 | 0.22 | 28.66 |

| FY 2024 | 37.59 | 11.32 | 39.12 |

| FY 2025 | 73.53 | 9.50 | 73.17 |

Revenue

- FY 2023: ₹10.82 crore

- FY 2024: ₹37.59 crore

- FY 2025: ₹73.53 crore

Revenue has shown strong growth, increasing almost 7x from FY 2023 to FY 2025. This indicates that the company is successfully scaling its operations and capturing more market share.

Profit

- FY 2023: ₹0.22 crore

- FY 2024: ₹11.32 crore

- FY 2025: ₹9.50 crore

Profitability improved sharply in FY 2024, but saw a decline in FY 2025 despite higher revenue. This suggests rising costs, lower margins, or higher investments impacting profitability. The company needs to manage expenses better to maintain consistent profit growth.

Total Assets

- FY 2023: ₹28.66 crore

- FY 2024: ₹39.12 crore

- FY 2025: ₹73.17 crore

Assets have more than doubled in two years, showing expansion and capital infusion, likely for capacity building, R&D, and new equipment. This supports revenue growth but also increases pressure on efficient utilization.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.