Sneha Organics IPO Overview

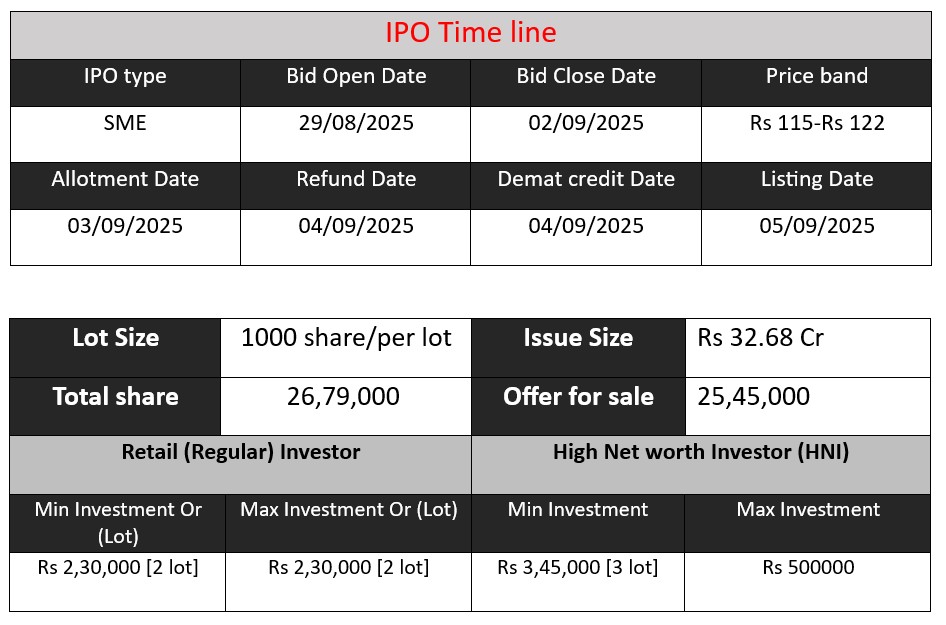

Snehaa Organics Ltd. IPO opens on August 29, 2025, and closes on September 2, 2025, offering 26.79 lakh equity shares (fresh issue) with a face value of ₹10 at a price band of ₹115–₹122, aggregating up to ₹32.68 crore; proceeds will fund working capital, loan repayment, general corporate purposes, and issue expenses, with listing scheduled on the NSE SME platform.

Sneha Organics Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 42.19 |

| NIIs | 15.61 |

| Retails | 37.75 |

| Total | 27.75 |

| Last Updated: 02 Sep 2025 5 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 4 | 115-122 |

| Last Updated: 02 Sep 2025 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Snehaa Organics specializes in the collection, purification, and recycling of spent solvents—offering sustainable solvent recovery solutions for industries. The company uses distillation and purification technologies, even for complex solvent mixtures, to either return reused solvents to clients or market them themselves.

Founded in 2017, headquartered in Hyderabad, Telangana, with significant operational expansion and development post-2019 under current management.

Strategic Process Flow: The workflow includes:

- Collection of used solvents from various industries.

- Purification and quality control through advanced distillation and pilot testing in controlled facilities.

- Distribution—either returning purified solvents to clients or selling/trading excess solvent inventory.

Strengths

- Sustainability Focus & Niche Positioning: Strong positioning in the eco-friendly chemicals market with an emphasis on sustainability, aligned with environmental trends.

- Operational Efficiency: High capacity utilization—rising from 82.2% in FY23, to 81.3% in FY24, reaching 88.2% in FY25. Installed capacity grew from 7,200 MTS (FY23) to 8,640 MTS (FY25).

- Leadership & Scalability:

- Experienced leadership with management taking over in 2019 and successfully scaling operations.

- Experienced promoters and growing customer base with scalable operations.

Risks

- Concentrated Customer Base: Heavy reliance on a few key customers; losing any could adversely impact results.

- Facility Lease & Location Risk: Core facilities are leased and localized in Telangana—any termination or regional disruption could be damaging.

- Supplier Dependency: Reliance on a limited number of suppliers introduces supply chain vulnerabilities.

- Operational & Regulatory Exposure:

- Handling and storage of hazardous solvents, with environmental, health, and labor regulations posing compliance risks.

- Insurance shortfalls, related-party transactions, legal proceedings—these may affect finances or reputation.

- Governance & Compliance Concerns:

- Frequent changes in auditors, delays in filings (e.g., ROC, GST, ESIC), limited track record as a public company, and lack of registered intellectual property (logo).

- Operational Risks:

- Limited operating history makes future stability uncertain.

- Managing working capital, high employee-related fixed costs, and dependence on utilities (electricity, water) are critical.

- Financial Risks:

- Additional debt taken on without guaranteed servicing capacity.

- IPO funding allocation based on management estimates, not independent appraisals.

- Market & Environmental Risks:

- Business closely tied to pharma sector performance; any downturn could hurt revenues.

- Risks from increased logistics costs and potential conflicts with affiliated group entities.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Assets |

| FY 2023 | 13.65 | 2.78 | 10.80 |

| FY 2024 | 23.72 | 3.66 | 17.10 |

| FY 2025 | 26.22 | 7.34 | 30.05 |

Revenue

- FY 2023: ₹13.65 Cr

- FY 2024: ₹23.72 Cr

- FY 2025: ₹26.22 Cr

Revenue nearly doubled in FY 2024 but growth slowed in FY 2025, showing a stabilization phase.

Profit

- FY 2023: ₹2.78 Cr

- FY 2024: ₹3.66 Cr

- FY 2025: ₹7.34 Cr

Profit has grown strongly, especially in FY 2025 where it doubled, indicating improving margins and cost efficiency.

Assets

- FY 2023: ₹10.80 Cr

- FY 2024: ₹17.10 Cr

- FY 2025: ₹30.05 Cr

Assets consistently rising, showing expansion and strengthening financial base.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.