Saatvik Green Energy IPO Overview

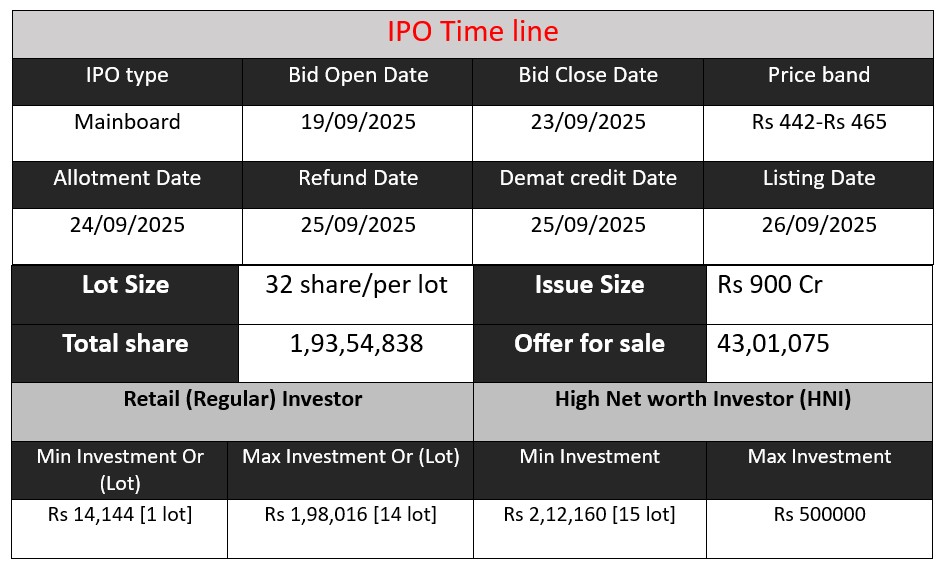

Saatvik Green Energy’s IPO opens 19 September 2025 and closes 23 September 2025. The issue size is ₹900 crore, comprising a fresh issue of ₹700 crore and an offer for sale of ₹200 crore. Shares are priced at ₹442-465 each, lot size 32 shares. Proceeds will be used to repay debt, invest in its subsidiary Saatvik Solar Industries, set up a 4 GW solar PV module manufacturing facility in Odisha, and for general corporate purposes.

Saatvik Green Energy GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 18 | 442-465 |

| Last Updated: 22 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Saatvik Green Energy Core Business & Overview

SGEL was incorporated in May 2015, began manufacturing in 2016.

It is a solar PV module manufacturing company. They also provide EPC (Engineering, Procurement, Construction) services and O&M (Operations & Maintenance) services.

Manufacturing Capacity & Products

- As of February 28, 2025, SGEL has an operational module manufacturing capacity of about 3.80 GW.

- Products include Mono PERC and N-TOPCon modules, in monofacial & bifacial variants.

Geographical Presence & Expansion Plans

- Main facilities are in Ambala, Haryana.

- The company is expanding: a 4 GW module facility in Odisha targeted by FY26, and a 4.8 GW solar cell line by FY27. Also plans for more backward integrations (ingot-wafer-cell-module) in Madhya Pradesh.

Markets / Segments

- Serves residential, commercial, industrial, and utility-scale customers.

- Also sells internationally; exploring markets such as US, GCC, Sri Lanka.

Strengths

From its filings, analysts’ commentary, and company disclosures, here are some of SGEL’s competitive strengths:

- Strong Growth & Improving Financials

- Revenue grew substantially: from ₹609 crore in FY23 to ₹2,158 crore in FY25. Profit after tax also improved sharply.

- EBITDA margin expanded significantly (from 3.9% in FY23 to 16.4% in FY25).

- Good Order Book & Diversified Client Base

- They have a solid order book which provides visibility of future revenues.

- They serve different market segments (utility, commercial, rooftop, etc.) and both domestic and international clients. This diversification reduces dependence on a single segment.

- Technology Adoption & Product Offering

- Early adoption of newer, more efficient technologies like N-TOPCon, bifacial modules.

- Advanced module features and variety.

- Strategic Expansion & Vertical Integration Plans

- The Odisha facility (module line) and expected cell-manufacturing capacity increase suggest move toward more backward integration. This can reduce import dependence, costs, and improve margins.

- Regulatory Tailwinds & Policy Support

- Being part of India’s strong renewable energy push; favourable policies for solar, PLI (Production Linked Incentives), etc.

- Reputation / Recognition as Employer & Workplace

- Certified “Great Place to Work®” for 2025-26.

- Recognised among “Best Organisations to Work 2025” by ET Now.

Risks

Some of the key risks and challenges SGEL may face, based on RHP (Red Herring Prospectus), analyst commentary, and market reports:

- Customer Concentration

- A large portion of revenue comes from top customers. The top 10 customers accounted for 57.77%, 63.86%, and 79.38% of revenue in Fiscals 2025, 2024, and 2023 respectively. Losing or reducing business from any major client could significantly impact performance.

- Raw Material / Supply Chain Dependence & Volatility

- The company depends on third-party suppliers for critical inputs like solar cells, glass, frames, etc. Price fluctuations or supply disruptions could hurt margins.

- Import dependence or global supply risk is relevant.

- Regulatory / Policy Risk

- Solar sector in India is heavily dependent on government support: incentives, import tariffs, duty structures, subsidies, etc. Changes in these could adversely affect demand or margins.

- Delays in approvals, permissions may delay projects, expansion.

- Execution / Expansion Risk

- Big capital projects (e.g., establishing new factories in Odisha, cell-manufacturing lines) carry risks: cost overrun, time delays, technical issues.

- Capacity utilisation risk: if demand falls or ramp up is slower, some capacity might be under‐utilised.

- Competitive Pressure

- Many players in solar module manufacturing, both domestic & international, some with larger scale or lower cost. Pricing pressure could compress margins.

- Technology Risk

- Solar is a fast-evolving field. E.g. moving from PERC → TOPCon → possibly newer technologies (perovskite, tandem etc). Keeping up demands ongoing R&D, investment. If SGEL lags, competitive disadvantage.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 608.59 | 4.74 | 263.00 |

| FY 2024 | 1087.96 | 100.47 | 688.04 |

| FY 2025 | 2158.39 | 213.93 | 1635.74 |

Revenue

- FY 2025: ₹2,158.39 crore

- FY 2024: ₹1,087.96 crore

Revenue almost doubled in FY25, showing strong growth momentum. From FY23 to FY25, revenue has increased more than 3.5 times, highlighting demand growth and successful expansion.

Profit

- FY 2025: ₹213.93 crore

- FY 2024: ₹100.47 crore

Profit has more than doubled year-on-year. Compared to FY23 (₹4.74 crore), profitability has improved sharply, showing efficiency, better margins, and scale benefits.

Total Assets

- FY 2025: ₹1,635.74 crore

- FY 2024: ₹688.04 crore

Assets have grown significantly, reflecting capacity expansion, investment in infrastructure, and preparation for future growth. Rising assets indicate strengthening of the company’s balance sheet.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.