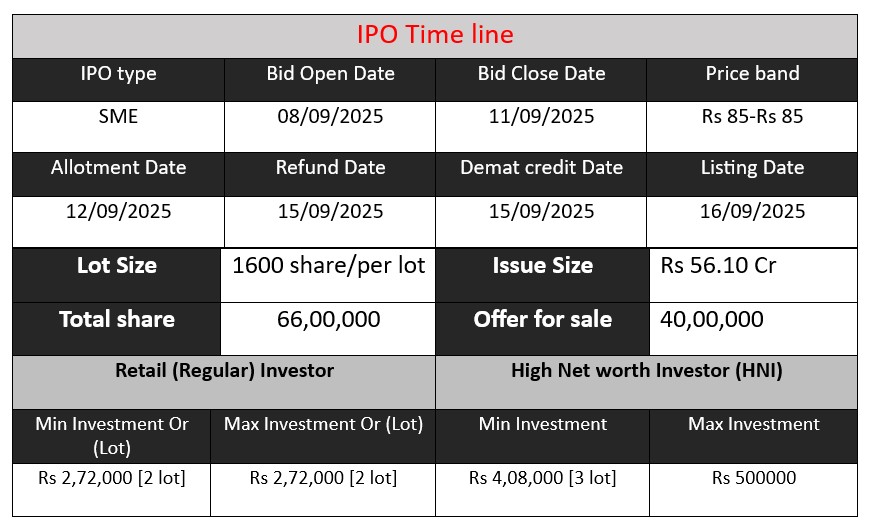

Nilachal Carbo Metalicks Ltd’s IPO opens on 08 Sep 2025 and closes on 10 Sep 2025. The fixed-price issue is ₹56.10 crore across 66 lakh equity shares at ₹85 each (face value ₹10). It includes a fresh issue of 26 lakh shares (₹22.10 cr) and offer-for-sale of 40 lakh shares (₹34 cr). Proceeds will fund capacity expansion, plant modernization, and general corporate purpose

Nilachal Carbo GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 4 | 85 |

| Last Updated: 11 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Nilachal Carbo Core Business & Overview

The company was originally incorporated on February 13, 2003 as Nilachal Carbo Metalicks Private Limited (CIN U23101OR2003PTC007061). It transitioned to a public limited company following a shareholders’ resolution in November 2023, and received a fresh certificate of incorporation on February 7, 2024 (CIN U23101OR2003PLC007061).

Activities & Location

The company engages in the manufacture of coke and related products, including low-ash metallurgical (LAM) coke, nut coke, blast furnace grade coke, and coke fines. Its primary operational facility is located in Baramana (Jajpur), Odisha, where it operates three non-recovery, bee-hive-type coke-oven batteries. Additionally, it uses leased capacity in Visakhapatnam.

Strengths

- Strategic Operational Footprint

Situated 100 km from Paradip Port and within 60–130 km of ferro-alloy plants, the Baramana facility benefits from reduced inbound and outbound freight costs. - Diverse Product Portfolio & Established Client Base

The company offers a broad spectrum of coke products—LAM coke, nut coke, blast furnace coke, foundry coke, and low-phosphorus coke fines—and maintains strong relationships with major ferro-chrome manufacturers. - Experienced Leadership

Promoter Mr. Bibhudatta Panda, with decades of experience in trading coal and minerals, leads day-to-day operations supported by a seasoned management team. - Positive Financial Recovery & Improvement

Following debt restructuring, the company rebounded. In FY22, operating income climbed to ₹199 cr (from ~₹116 cr in FY21), with improved margins, better gearing (1.15–1.18×), and stronger interest coverage (5.08×). - Expansion Plans Supported by IPO

Through its SME IPO (issue size ₹56.10 cr), the company aims to add a new coke oven battery, expand capacity, and modernize existing plants. Current total capacity is 60,000 MTPA at Baramana and 18,000 MTPA leased, with plans to increase by 34,400 MTPA, pushing total capacity to 112,400 MTPA.

Risks

- Raw Material Dependence & Price Volatility

The company heavily relies on a limited set of suppliers—including imports (e.g., from Australia)—making it vulnerable to supply disruptions and price fluctuations. - Concentration of Customers

A significant share of revenue comes from a few large ferro-alloy customers, exposing them to demand fluctuations in that segment. - Working Capital Intensity

Operations are capital-intensive, with significant funding needed for raw material procurement, which may put stress on liquidity during downturns. - Cyclicality of Downstream Industries

Demand is tied closely to the ferro-alloy industry, which is cyclical, potentially leading to volatile order flows. - Operational & Lease Dependency

Operations rely on specific plants—especially leased ones in Visakhapatnam—exposing the company to risks if those arrangements change or facilities underperform

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue (₹ Cr) | 266.21 | 265.11 | 201.51 |

| Profit (₹ Cr) | 14.82 | 15.82 | 14.01 |

| Assets (₹ Cr) | 93.21 | 114.49 | 123.33 |

Revenue

- FY 2023: ₹266.21 Cr

- FY 2024: ₹265.11 Cr

- FY 2025: ₹201.51 Cr

Revenue stayed stable from FY23 to FY24, showing resilience, but fell sharply by ~24% in FY25, reflecting either weaker demand or pricing pressure in the coke/ferro-alloy industry.

Profit

- FY 2023: ₹14.82 Cr

- FY 2024: ₹15.82 Cr

- FY 2025: ₹14.01 Cr

Profit rose modestly in FY24 despite flat revenue, indicating cost efficiency or better margins. However, profit dropped in FY25, in line with the revenue decline, suggesting limited cost absorption capacity.

Total Assets

- FY 2023: ₹93.21 Cr

- FY 2024: ₹114.49 Cr

- FY 2025: ₹123.33 Cr

Assets have steadily increased, reflecting capacity expansion and reinvestment. Despite the revenue dip in FY25, the company’s balance sheet shows strengthening through asset buildup, possibly linked to IPO proceeds and modernization plans.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.