Medistep Healthcare IPO Overview

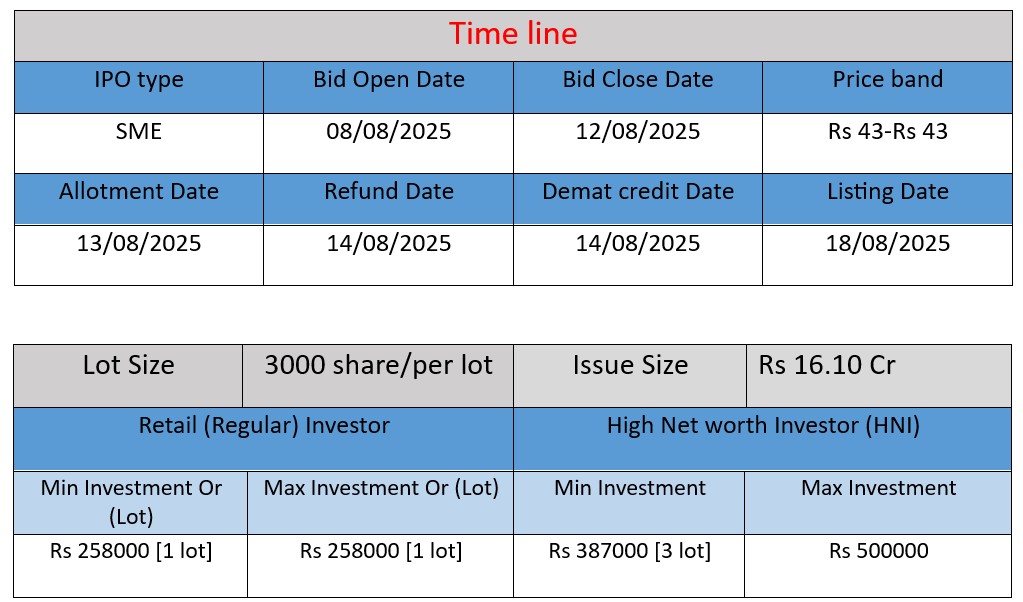

Medistep Healthcare Ltd’s SME IPO of ₹16.10 Crore (fresh issue of 37.44 lakh equity shares at ₹43/share) opens on August 8, 2025 and closes on August 12, 2025. Funds will support expansion via new plant & machinery, working capital needs, and general corporate purposes. Listing is expected on NSE Emerge on August 18, 2025.

Medistep Healthcare Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.00 |

| NIIs | 149.44 |

| Retails | 364.97 |

| Total | 273.52 |

| Last Updated: 12 Aug 2025 Time: 8 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 13 | 43 |

| Last Updated: 12 Aug 2025 Time: 8 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Incorporation & Location

Medistep Healthcare Limited was incorporated on June 5, 2023, as a public limited company under the Companies Act, 2013. It’s headquartered in Daskroi, Gujarat, India, with CIN U21009GJ2023PLC141841. - Business Scope

The company is active in both manufacturing and trading within the pharmaceutical and healthcare sector. Its manufacturing includes sanitary pads and energy powder, while its trading portfolio covers a broad spectrum of products including pharmaceuticals, nutraceuticals, intimate-care, and surgical products.

Strengths

Product Diversification

A combined in-house manufacturing capability (sanitary pads and energy powder) plus a widespread trading network gives it a balanced and flexible business model.

Risks

- Early-Stage Company

As a young company incorporated in mid-2023, Medistep faces challenges typical to new ventures—limited operating history and unproven long-term performance. - IPO-Related Uncertainty

The primary public offering presents risks: there’s no assurance of active or sustained trading post-listing, and the issued price may not reflect true market value. - Regulatory & Currency Fluctuations

Risks cited in its draft prospectus include potential exchange rate fluctuations affecting returns for foreign investors, and differences in shareholder rights under Indian law vs. other jurisdictions.

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY 2022 | ₹7.62 | ₹0.19 | ₹7.10 |

| FY 2023 | ₹27.65 | ₹0.92 | ₹14.66 |

| FY 2024 | ₹31.61 | ₹2.91 | ₹14.96 |

Revenue

- FY 2022 → FY 2023: Revenue grew from ₹7.62 Cr to ₹27.65 Cr (📈 263% increase), showing a significant expansion in operations or product reach.

- FY 2023 → FY 2024: Revenue rose to ₹31.61 Cr, a moderate increase of around 14.3%, indicating continued, though slower, growth.

Profit

- FY 2022 → FY 2023: Net Profit jumped from ₹0.19 Cr to ₹0.92 Cr, a 384% growth, reflecting improved efficiency and cost control.

- FY 2023 → FY 2024: Net Profit soared further to ₹2.91 Cr—a 216% increase, suggesting that the company is now scaling profitably.

Total Assets

- FY 2022 → FY 2023: Asset base doubled from ₹7.10 Cr to ₹14.66 Cr, likely due to investment in inventory, infrastructure, or equipment.

- FY 2023 → FY 2024: Slight increase to ₹14.96 Cr (2% growth), indicating that asset investment has stabilized while revenue and profits still increased.

✅ Pros

- Diversified product portfolio in pharma and healthcare.

- Strong revenue and profit growth over 3 years.

- IPO proceeds to boost capacity and working capital.

- Low debt and asset-light model improves efficiency.

❌ Cons

- Very new company with limited operating history.

- Post-IPO stock performance is uncertain.

- High dependency on a few key products.

- Regulatory and currency risks for investors.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.