Matrix Geo Solutions IPO Overview

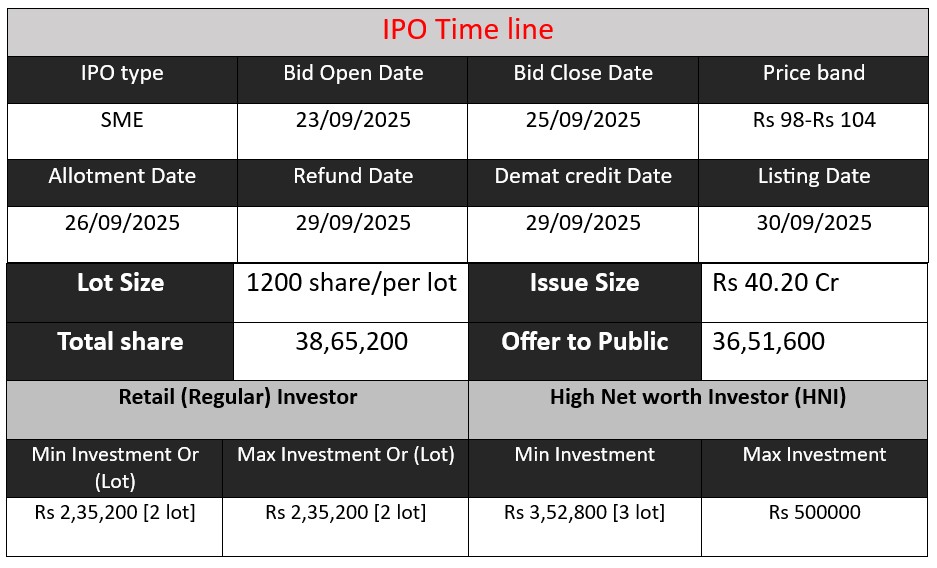

Matrix Geo Solutions Limited IPO opens on September 23, 2025, and closes on September 25, 2025. The issue size is ₹40.2 crore with a price band of ₹98-104 per share. The IPO comprises fresh equity shares to fund business expansion, technology upgrades, and working capital requirements. Investors get an opportunity to participate in India’s leading drone and geospatial solutions company, listed on NSE SME platform.

Matrix Geo Solutions GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 6 | 98-104 |

| Last Updated: 25 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Matrix Geo Solutions Core Business & Overview

Matrix Geo Solutions Limited, established in 2008, is a Delhi-based geospatial technology and engineering consultancy. The company specializes in advanced survey technologies such as photogrammetry, LiDAR, GIS, and remote sensing using drones and satellite imagery. Their services are utilized across various sectors, including railways, roads, irrigation, mining, and power. Matrix Geo aims to empower decision-makers by providing precise geospatial insights that drive smarter decision-making across industries.

Core Services

Matrix Geo Solutions offers a range of services, including:

- Drone-based Surveys: Utilizing unmanned aerial vehicles for aerial data collection.

- LiDAR Scanning: Employing laser scanning technology for high-precision measurements.

- Satellite Imagery Analysis: Processing satellite data for various applications.

- GIS Mapping: Creating detailed geographic information systems for spatial analysis.

- 3D Digital Twin Modeling: Developing virtual models of physical assets for simulation and analysis.

These services cater to both government and private sector clients, with a significant portion of revenue derived from government projects.

Strengths

- Diverse Clientele: Matrix Geo serves a wide range of sectors, including railways, roads, irrigation, mining, and power, showcasing its versatility and expertise across industries.

- Advanced Technology: The company employs cutting-edge tools like drones, LiDAR, satellite imagery, and ground-penetrating radar to provide advanced surveying, mapping, and data analysis services.

- Pan-India Presence: With operations across India, Matrix Geo has established a strong national footprint, enhancing its ability to undertake large-scale projects.

Risks

- Government Dependency: A significant portion of revenue comes from government contracts, which may expose the company to risks associated with policy changes and budget allocations.

- Geographic Concentration: With headquarters in Delhi, the company may face challenges related to regional economic fluctuations or regulatory changes .

- Technology Reliance: Heavy dependence on advanced technology requires continuous investment in research and development to stay competitive and mitigate obsolescence risks

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 6.66 | 13.69 | 22.09 |

| Profit | 1.09 | 3.35 | 5.86 |

| Assets | 14.53 | 16.66 | 30.71 |

Revenue

- Revenue has grown from ₹6.66 Cr in FY 2023 to ₹22.09 Cr in FY 2025.

- This represents a CAGR of 84%, indicating rapid business expansion.

- The sharp increase from FY 2023 to FY 2024 (more than double) suggests strong market demand and scaling of operations.

Profit

- Profit increased from ₹1.09 Cr in FY 2023 to ₹5.86 Cr in FY 2025.

- The profit margin has improved, reflecting operational efficiency alongside revenue growth.

- This indicates the company is not just growing top-line revenue but also managing costs effectively.

Assets

- Total assets grew from ₹14.53 Cr to ₹30.71 Cr over three years.

- Significant asset growth in FY 2025 aligns with expansion plans, possibly for technology investments, equipment (drones, LiDAR), and project scaling.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.