KVS Castings IPO Overview

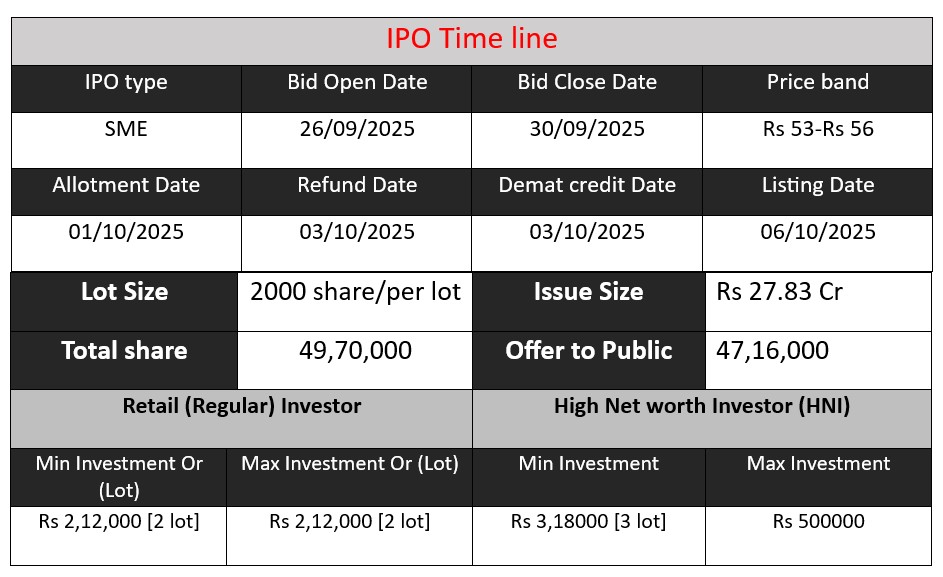

KVS Castings Ltd launches a ₹27.83 crore IPO via a fresh issue of 49.70 lakh equity shares at a price band of ₹53 to ₹56. The issue opens on 26 September 2025 and closes on 30 September 2025. Proceeds will be used for capital expenditure and general corporate purposes, supporting capacity expansion and strengthening operations.

KVS Castings GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 53-56 |

| Last Updated: 30 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

KVS Castings Core Business & Overview

The company traces its roots to a partnership firm named Kashi Enterprises, formed in 2005.

Kashi Enterprises was converted into a private limited company “KVS Castings Private Limited” in 2019 (CIN: U27100UR2019PTC012217). In 2024, via shareholder resolution, it was converted into a public limited company, and renamed “KVS Castings Limited.”

Its registered office is in Kashipur, Uttarakhand, India (Industrial Estate, Bazpur Road).

It functions as the Foundry / casting division of the broader KVS Premier Group.

Business Scope & Products

- KVS Castings is engaged in ferrous castings manufacturing, especially cast iron and ductile iron.

- It also offers casting in other metals (e.g. stainless steel, alloy steel) depending on customer needs.

- The company’s product portfolio is fairly broad: they offer 150+ SKUs including suspension brackets, brake drums, gearbox housings, pump bodies, oil filters, etc.

- Their clientele spans multiple sectors: automobiles, railway, heavy machinery, energy / power, infrastructure, agricultural machinery.

- The automobile segment is particularly important: ~ 80% of revenue comes from automotive / auto-component customers.

Strengths

Below are some of the strengths the company claims (or are evident) from filings and analysis:

- Diverse Product Range & Flexibility

- Having over 150 SKUs allows them to cater to varied customer demands and reduce dependency on a single product line.

- Their ability to develop in-house tooling, pattern-making, CAD/CAM, machining gives better control over design changes, cost, and lead times.

- Strong Customer / OEM Relationships

- Long-standing relationships with OEMs and Tier-1 suppliers in auto, railway, heavy machinery sectors.

- The ability to service multiple sectors provides some cushion in downturns in one sector.

- Quality & Certifications

- The company holds certifications such as IATF 16949:2016, ISO 9001:2015, and RDSO (for supplies to railways).

- They have in-house tool & pattern-making, CAD/CAM/CAE, and machining capabilities, which adds to their technical strength and flexibility.

Risks

From the DRHP and public analyses, here are significant risks:

- High Dependence on the Automobile Sector

- Since ~80% of revenue comes from the auto / auto-components sector, any downturn, slowdown, or regulatory disruption in that sector can heavily impact the company’s performance.

- If demand for auto-component products falls, revenue will be directly affected.

- Customer Concentration

- A high dependence on a few customers, especially top 10 customers contributing a large share of revenues, means losing major contracts could hurt business.

- Any contract disruption or renegotiation risk with key OEMs can be damaging.

- Power / Utilities Dependency & Cost Volatility

- Castings and foundry operations are energy-intensive. Any interruption in power supply, or steep hikes in power tariffs, can hurt margins.

- Fluctuations in raw material costs (iron, alloys, fuel) add cost pressure.

- Leased Operations & Asset Ownership

- The properties used for operations are not owned; they are under lease / leave & license. If leases are terminated or renewals are unfavorable, operations could be impacted.

- Under-utilization of capacity or inability to ramp up proposed capacity could reduce return on investments.

- Regulatory / Legal / Contingent Liability Risks

- The company faces ongoing legal proceedings, and any adverse outcomes could affect its financials.

- Contingent liabilities disclosed in the DRHP could create downside risk.

- There is risk in achieving sustained profitability, especially with negative cash flows from investing / financing activities in past periods.

Financial Performance Overview (₹ in Crore)

| Year | Revenue ( | Profit | Assets |

| FY 2023 | 57.26 | 4.84 | 32.01 |

| FY 2024 | 54.16 | 5.95 | 31.35 |

| FY 2025 | 50.11 | 6.62 | 47.75 |

Revenue

- FY 2023: ₹57.26 crore

- FY 2024: ₹54.16 crore

- FY 2025: ₹50.11 crore

Revenue has shown a downward trend, falling 12% over three years. This indicates either reduced demand, lower order volumes from key clients, or sector slowdown (especially in auto components).

Profit

- FY 2023: ₹4.84 crore

- FY 2024: ₹5.95 crore

- FY 2025: ₹6.62 crore

Despite declining revenue, profit has steadily increased (up 37% in 3 years). This suggests cost efficiency, better margin management, or higher-value product mix. It reflects operational strength in controlling expenses.

Total Assets

- FY 2023: ₹32.01 crore

- FY 2024: ₹31.35 crore

- FY 2025: ₹47.75 crore

Assets grew sharply in FY 2025 (up 52%). This rise may be due to capacity expansion, new equipment, or IPO-related capital infusion. A stronger asset base indicates potential for higher production and future revenue growth, provided demand improves.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.