Infinity Infoway IPO Overview

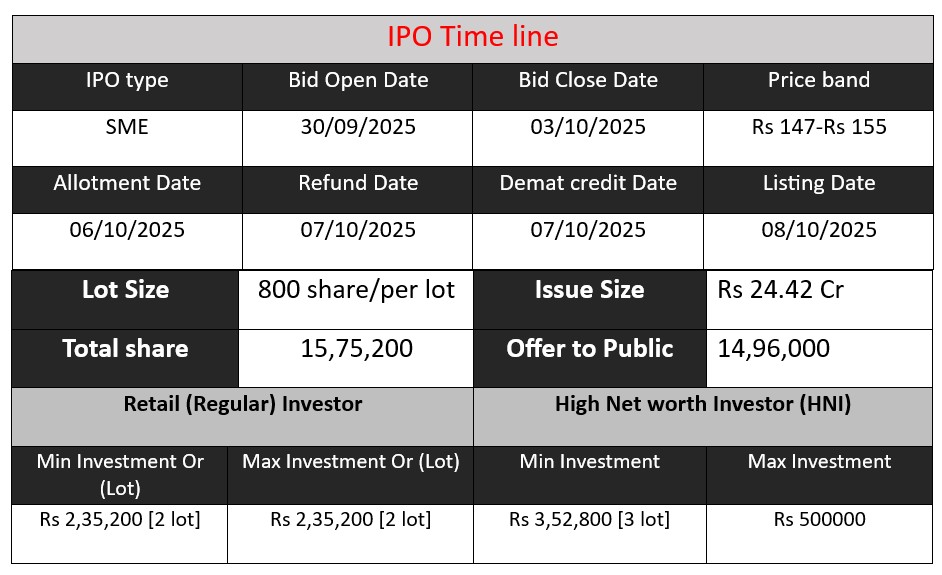

Infinity Infoway offers an SME IPO of 1575200 equity shares , raising about ₹24.42 crore. The IPO opens on 30 September 2025 and closes on 3 October 2025, with a price band of ₹147 to ₹155 per share. The issue aims to fund expansion of its ERP & digital exam delivery business, strengthen working capital and support product development & marketing.

Infinity Infoway GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 50 | 147-155 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Infinity Infoway Core Business & Overview

Infinity Infoway Limited is a SaaS (Software-as-a-Service) company incorporated in 2008, based in Rajkot, Gujarat, India.

It provides customised and integrated ERP solutions across several sectors: education, manufacturing, retail, and construction. Its solutions include Campus Management Systems (for educational institutions), Industrial ERP (for enterprises), Online Examination Systems, and related software products.

It also offers other digital learning / self-learning platforms (for students), and a product called ZEROTOUCH (which seems to be a “Device as a Service” / question-paper delivery / digital exam-oriented platform) among its recent product development focuses.

It has clients in universities and enterprises; for example, it has reportedly deployed its campus management system in 26 universities and industrial ERPs in 13 enterprises in recent years.

Strengths

- Strong growth in revenue & profitability in recent years

For example, its revenue from operations rose significantly from FY 2022-23 to FY 2024-25; profit after tax (PAT) also saw a high growth. - Product suite aligned with education policy & emerging needs

The company’s ERP offerings are aligned with India’s National Education Policy (NEP) 2020, which emphasizes digitalization in education. Also, the development of products like ZEROTOUCH, Online Exam/Exam-portal, question paper delivery system etc., show it is innovating in areas of high demand. - Experienced leadership & validated credentials

The promoters / management appear to have significant industry experience. The company claims various certifications (like ISO, etc.), external awards (like National Award for entrepreneurship), and an established customer base in universities and enterprises which gives credibility. - Recurring / subscription model components and long-term AMC (Annual Maintenance Contracts)

With ERP deployments, there are AMC / subscription components which help in recurring revenue, which can provide some stability.

Risks

- Dependence on a small number of clients

A large fraction of its revenue comes from its top 10 customers. Losing a major client could adversely affect revenue. - Geographical concentration risk

A very large portion of its revenue comes from a single state (Gujarat) in recent fiscal years. That makes it vulnerable to region-specific regulatory, economic, or competitive shocks. - Maintaining growth & execution risk

Rapid growth is difficult: it requires scaling operations, staffing, infrastructure, R&D, and customer support. Delays or failures in any of these could hurt performance. Also, developing new products (like ZEROTOUCH) involves risk of non-completion or failure to get patent/certification, etc. - Technology & competitive risk

SaaS / ERP market is competitive. Rapid changes in technology, changing customer expectations, cloud security concerns, regulatory changes can all pose hazards. Also, dependence on cloud infrastructure and the threat of obsolescence. - Regulatory / compliance risks

Disclosures note some delays or lapses in filings, possible litigation, patent application still under examination, sensitivity to regulatory approvals, etc. These can affect reputation or impose costs.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2022 | 5.68 | 0.94 | 3.30 |

| FY 2023 | 5.17 | 0.94 | 3.59 |

| FY 2024 | 10.17 | 3.47 | 8.10 |

Revenue

- FY 2022: ₹5.68 crore

- FY 2023: ₹5.17 crore

- FY 2024: ₹10.17 crore

Revenue dipped slightly in FY 2023 (–9%), but FY 2024 shows a sharp rebound with almost 96% growth YoY, indicating successful product adoption and market expansion.

Profit

- FY 2022: ₹0.94 crore

- FY 2023: ₹0.94 crore

- FY 2024: ₹3.47 crore

Profits were flat in FY 2022–23, but FY 2024 saw a nearly 270% jump, reflecting stronger operating efficiency and higher margins. Profitability is scaling with revenue growth.

Total Assets

- FY 2022: ₹3.30 crore

- FY 2023: ₹3.59 crore

- FY 2024: ₹8.10 crore

Assets almost doubled between FY 2023 and FY 2024, suggesting expansion in capacity, investment in new products (like ZeroTouch), and stronger balance sheet strength. This also supports scalability for future growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.