Highway Infrastructure IPO Overview

Highway Infrastructure Ltd IPO opens on 5 August 2025 and closes on 7 August 2025. The total issue size is ₹130 crore via 1.85 crore equity shares (face value ₹5), including a fresh issue of 1.39 crore shares (₹97.52 cr) and an offer‑for‑sale of 46 lakh shares (₹32.48 cr). Proceeds will fund working capital (₹65 cr) and general corporate purposes. Listing is proposed on BSE & NSE.

Highway Infrastructure Subscription and GMP Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 22,92,914 | 96,43,33,511 | 420.57 |

| NIIs | 58,92,914 | 2,63,60,08,863 | 447.32 |

| Retails | 78,57,218 | 1,22,24,21,326 | 155.58 |

| Employees | |||

| Shareholders | |||

| Total | 1,60,43,046 | 4,82,27,63,700 | 300.61 |

| Last Updated: 07 Aug 2025 Time: 7 PM (Note: This data is updated every 2 hours) | |||

| GMP (₹) | IPO Price (₹) |

| 36 | 70 |

| Last Updated: 07 Aug 2025 Time: 7 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

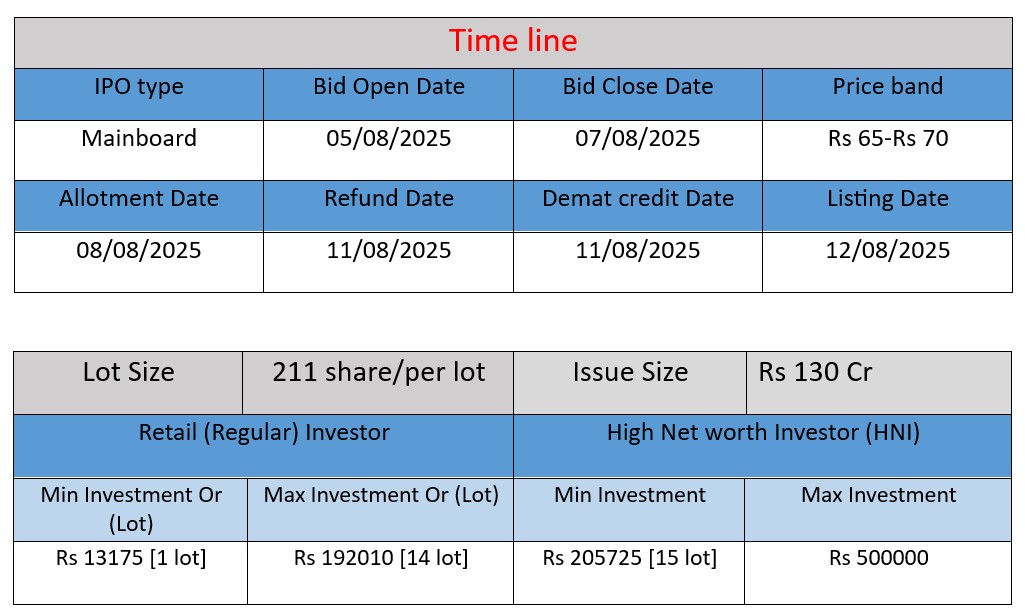

IPO Key Date

Core Business & Overview

Highway Infrastructure Limited (HIL), incorporated in 1995, is an Indian integrated infrastructure development company operating across three main verticals:

- Tollway Collection

Manages toll operations across 11 states and 1 Union Territory using ANPR (Automatic Number Plate Recognition), FASTag and RFID-based ETC systems. Among the few to use ANPR on routes like the Delhi–Meerut Expressway. As of May 31, 2025, it had completed 27 toll projects and is operating 4 active toll plazas.

- EPC (Engineering, Procurement & Construction) Infrastructure

Executes civil projects such as roads, bridges, irrigation works, government welfare scheme constructions (e.g. PMAY, PMGSY, Jal Jeevan Mission), and commercial/civil buildings—primarily in Madhya Pradesh (Indore, Bhopal, Ratlam, Dhar, Khandwa). As of May 2025: 66 completed projects (4 pending certification), and 24 under execution.

- Real Estate Development

Develops and sells residential and commercial properties through gated communities in Indore, including projects like Karuna Sagar, New York City, and upcoming phases of Beverly Plaza and Highway Greens. This remains the smallest revenue segment.

✅ Strengths

- Established track record & pan-India presence: Nearly three decades of experience, executing toll and EPC infrastructure across multiple states with consistent delivery.

- Technological leadership in tolling: Early adopter of ANPR and ETC systems on high-traffic corridors, significantly improving collection efficiency and reducing congestion and leakage.

- Robust financial and order-book base: As of May 31, 2025, HIL’s consolidated order book stood at ₹ 666.31 Crore, with ₹ 59.53 Cr from toll and ₹ 606.78 Cr from EPCprojects. Revenue growth has been steady and profit margins improving.

- Moderate leverage & financial health: Gearing around 0.55–0.61×; interest coverage ratio around 4–5×; current ratio ~1.6×, indicating manageable financial risk.

Potential Risks

- High dependence on government contracts: Most revenue stems from tender-based toll and EPC projects with public agencies (e.g., NHAI). Delays or policy changes can affect cash flow and margins.

- Working capital intensity: EPC operations require high investment—average net GCA days around 127–200 and inventory retention up to 30‑45 days. Lower margins in toll segment further compress cash cycles.

- Limited revenue diversification: Toll collection constitutes ~75–77% of revenue, with smaller contributions from EPC and minimal real estate income; this concentration increases vulnerability to sectoral disruptions.

- Price escalation exposure: EPC projects are fixed-price contracts, making margins susceptible to rise in raw material, fuel and labor costs.

- Geographical skew: Many EPC and real estate projects are concentrated in Madhya Pradesh, limiting geographic diversification and increasing regional risk exposure.

- Tender competition pressures: The tender-based nature of infrastructure contracts is highly competitive, often forcing aggressive bidding that compresses margins

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit (PAT) | Total Assets |

| FY 2022 | 355.03 | 8.52 | 155.09 |

| FY 2023 | 455.13 | 13.80 | 156.59 |

| FY 2024 | 573.45 | 21.41 | 202.63 |

Revenue

- FY 2022 to FY 2023: ~28% growth (₹355.03 Cr → ₹455.13 Cr)

- FY 2023 to FY 2024: ~26% growth (₹455.13 Cr → ₹573.45 Cr)

This shows the company’s strong order execution in toll and EPC infrastructure.

Profit

Net profit (PAT) rose from ₹8.52 Cr in FY 2022 to ₹21.41 Cr in FY 2024, indicating:

- Improved efficiency

- Better margin control

- Increased scale of operations

Profit more than doubled in two years.

Total Assets

Assets remained steady from FY 2022 to FY 2023, but rose significantly in FY 2024 to ₹202.63 Cr, suggesting:

- Investments in infrastructure

- Expansion of toll/EPC projects

- Possible addition of equipment or real estate under development

✅ Pros

- Diversified presence in toll, EPC, and real estate segments.

- Strong revenue and profit growth over the last three years.

- Technologically advanced toll systems (ANPR, RFID).

- Robust order book providing future revenue visibility.

- Government project experience ensures credibility.

❌ Cons

- High dependency on government contracts and tenders.

- Working capital intensive business model.

- Limited geographic diversification in EPC and real estate.

- Fixed-price contracts expose margins to cost escalations.

- Real estate segment contributes minimally to revenue.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.