Gurunanak Agriculture India IPO Overview

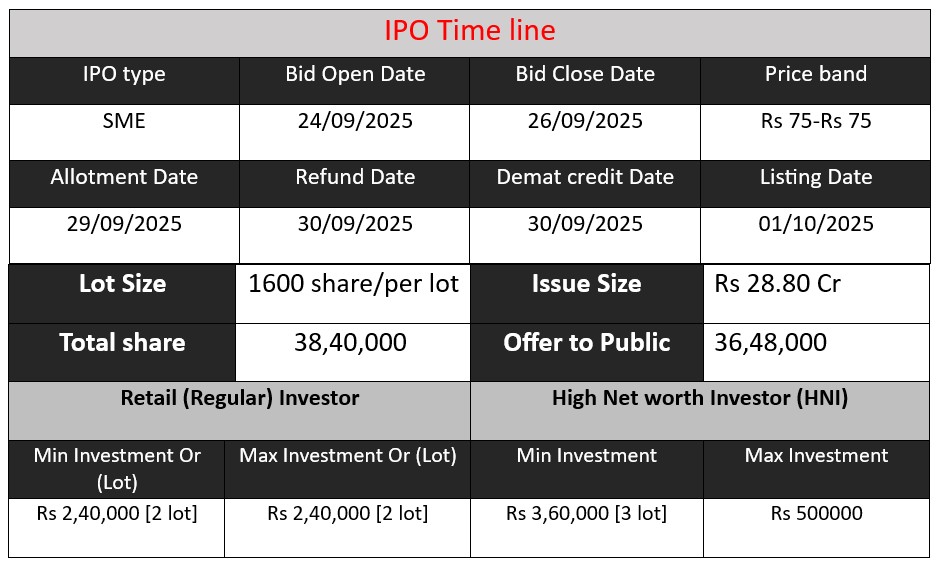

Gurunanak Agriculture India Ltd is launching a ₹28.8 crore IPO on the NSE Emerge platform. The issue opens on September 24, 2025, and closes on September 26, 2025. Investors can bid for 38.4 lakh equity shares at ₹75 each. The funds raised will support setting up a new harvester manufacturing unit, working capital requirements, and general corporate purposes. Listing is scheduled for October 1, 2025.

Gurunanak Agriculture India GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 75 |

| Last Updated: 26 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Gurunanak Agriculture India Core Business & Overview

Incorporated in 2010, Gurunanak Agriculture India Ltd is a Chhattisgarh-based manufacturer of agricultural machinery.

Products include threshers (various kinds: paddy, groundnut, wheat, maize, multi-crop), harvesters, reapers, rotavators, cultivators, etc.

They operate a manufacturing plant in Durg District, Chhattisgarh, over approx. 4.08 hectares.

They sell via a network of 48 dealers across seven states in India. Some exports too (Bhutan, Nepal, etc.) though domestically most revenue.

Strengths

From what is reported in IPO documents and media:

- Good growth in profitability

The jump in profit after tax from ₹2.45 crore to ₹6.05 crore in FY25 shows strong improvement. - Improved margins, lower debt

Margins, including EBITDA, have improved, and total borrowings have come down substantially. - Product / portfolio diversity

Variety of machines for different crops and farming needs (threshers, harvesters, reapers, etc.). - Manufacturing infrastructure and expansion plans

They are setting up a new harvester manufacturing unit, aiming to scale capacity (e.g. to 300 harvesters annually, etc.). - Strong dealer & state presence

48 dealers over seven states helps reduce over-dependence on one market; offers wider reach. - Export / international presence (though small)

While most revenue is domestic, there is some export.

Risks

Here are some of the key risks or challenges the company faces, based on disclosures and analysis:

- Revenue stagnation / Fluctuating topline

Revenue in FY2025 is almost flat or slightly down compared to FY2024. That indicates that growth isn’t strong in terms of volume or sales. - Dependence on certain product lines / crop seasons

A large portion of revenue comes from threshers (some sources say paddy thresher is 60%+ of revenue in FY25). This creates dependency risk if demand shifts, or crops affected by weather. - Geographical concentration

The manufacturing is in Chhattisgarh, a major share of domestic sales come from there. If that region faces disruption or competition, risk is higher. - Cyclicality / dependency on agriculture sector & weather

Farming depends on monsoon, government policy, subsidies. Any adverse weather or policy change can have outsized effect. Not unusual for agri-equipment makers. (General risk implicit). - Competitive pressure

Sector has many players (larger and smaller), both domestic & international. Maintaining margins, innovation, after-sales is critical. (Implied in some IPO commentary). - Scale / capacity constraints prior to expansion

Currently capacity may limit ability to meet large scale demand. The plan to build new harvester plant suggests current capacity is tight. Delay or cost overruns in expansion are possible risks.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 38.97 | 0.61 | 18.17 |

| FY 2024 | 44.02 | 2.45 | 21.99 |

| FY 2025 | 43.86 | 6.05 | 20.16 |

Revenue

- FY23 → FY24: Strong growth from ₹38.97 cr to ₹44.02 cr (+12.9%).

- FY24 → FY25: Marginal decline from ₹44.02 cr to ₹43.86 cr (-0.36%).

Revenue growth has stalled in FY25, showing dependence on existing product lines.

Profit

- FY23: ₹0.61 cr → very low.

- FY24: ₹2.45 cr → 4x growth.

- FY25: ₹6.05 cr → 2.5x jump.

Despite flat revenue in FY25, profit has surged, indicating better cost control, improved margins, or reduced finance costs.

Assets

- FY23 → FY24: Growth from ₹18.17 cr to ₹21.99 cr (+21%).

- FY24 → FY25: Decline to ₹20.16 cr (-8.3%).

Suggests possible debt repayment, asset revaluation, or disposal, which reduced total assets.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.