Glottis IPO Overview

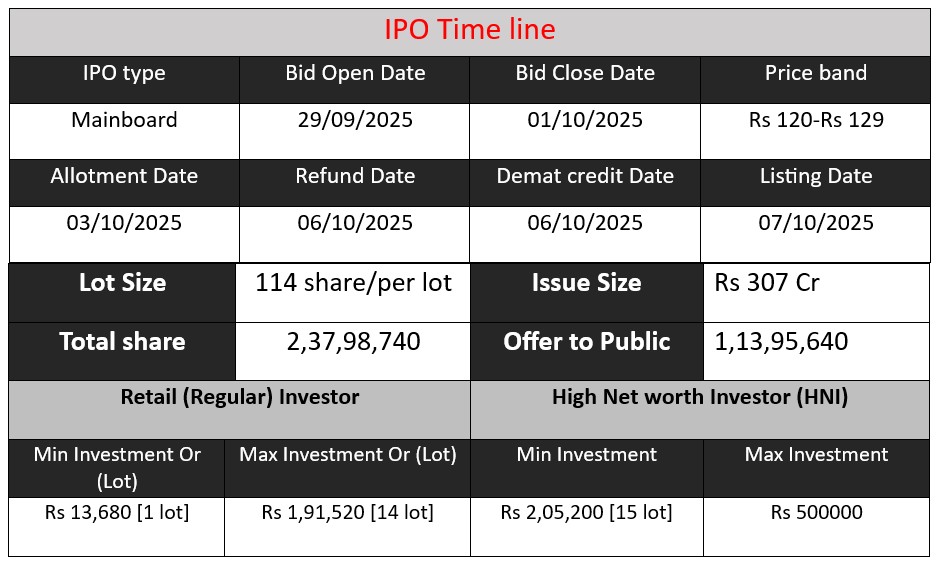

Glottis Limited’s IPO opens 29 September 2025 and closes 1 October 2025, offering ₹307 crore via approx. 2.38 cr equity shares (fresh issue ₹160 cr + offer for sale ₹147 cr). The price band is ₹120–129 per share (face value ₹2). Proceeds will fund capital expenditure (vehicles, containers) and general corporate purposes. Shares to be listed on BSE & NSE.

Glottis GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 1 | 120-129 |

| Last Updated: 3 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Glottis Core Business & Overview

Glottis Limited is a public limited company, incorporated on 18 April 2022 (converted from a partnership) under CIN U63090TN2022PLC151443.

Before that, it was a partnership firm (M/s Glottis) established in 2004, which was converted into a private limited and then to a public limited company in 2024.

The registered office is in Chennai, Tamil Nadu, India. The company has branch presence in multiple locations across India (8 branches)

Core Services

Glottis is a logistics / freight forwarding / supply chain services company. Its offerings span multiple modes and domains:

- Freight forwarding (air, sea, road)

- Multimodal transport (combining sea, air, land)

- 3PL & warehousing services (storage, inventory management)

- Customs brokerage / clearing & forwarding

- Breakbulk / heavy / oversized cargo handling

- Vessel chartering for large volume ocean cargo

Additionally, a subsidiary or group-company, Glottis Shipping Pvt. Ltd., deals with NVOCC (Non-Vessel Operating Common Carrier) services and vessel operating agent functions, especially for Far East / Southeast Asia routes.

Markets / Segment Focus

- The company serves domestic and international clients, positioning itself as a global logistics partner.

- It caters to multiple industries such as agriculture, automobiles, chemicals, electronics, renewable energy, medicals, e-commerce, etc.

Strengths

- End-to-end & multimodal logistics capability

Because Glottis offers a broad suite of services (air, sea, road, warehousing, customs, vessel chartering), it can serve clients across the value chain and offer integrated logistics solutions. This reduces reliance on third parties and enables more control over service delivery. - Experience & domain focus

Though the company in its current legal form is relatively new, its business heritage stretches back to 2004. The promoters have long experience in freight forwarding, which gives industry knowledge, relationships, and operational expertise. - Sectoral specialization (Renewable / Project Cargo)

Emphasizing large project cargo and the renewable energy sector gives Glottis a niche where margins can be higher and competition more limited (versus generic freight forwarding) — assuming it executes well. - Network & Branch Presence

Having multiple branches pan-India (8 branches) helps in local connectivity and first/last mile operations.

Risks

- Revenue concentration / dependency risks

- If a significant portion of revenue comes from a few large clients, the loss of any one major client can severely impact earnings.

- Heavy reliance or overexposure to certain sectors (e.g. renewable energy or project cargo) can make the company vulnerable to downturns in those sectors.

- Market volatility, especially in ocean freight / shipping

Freight forwarding, specially ocean freight, is subject to global trade cycles, fuel price fluctuations, freight rate volatility, port congestion, regulatory shifts, and disruptions (e.g. geopolitical events, trade wars). Such external risks can sharply affect margins. (This is a general risk for logistics / forwarding businesses, but particularly relevant for Glottis given its ocean freight exposure.) - Operational/Logistics execution & asset constraints

- As a forwarding / logistics company, smooth operations (transport, customs, warehousing) are complex, and any breakdown (delays, damage, regulatory hurdles) can hurt reputation and profitability.

- Dependence on third-party service providers (truckers, ports, warehouses, shipping lines) introduces risks of counterparty failure, delays, or cost escalation.

- Scaling the infrastructure (warehouses, special handling, equipment) may require capital investment; returns may take time.

- Capital / financial risk and leverage

- The company already has significant open charges (₹74.12 crores) per TheCompanyCheck.

- As it scales, it may need debt or further equity, which increases leverage risk.

- Any interest rate hikes or tightening of lending conditions could pressure cash flows.

- Regulatory / compliance / customs risk

Operating in multiple jurisdictions (imports, exports, customs) exposes Glottis to regulatory changes, trade policies, customs rules, taxation changes, or compliance lapses. - Competition & margin pressure

The logistics / freight forwarding domain in India is competitive, with many regional players, global integrators, and digital disruptors offering aggressive pricing or technological edge. Maintaining margins and differentiation is challenging.

Financial Performance Overview (₹ in Crore)

| Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 478.27 | 497.18 | 941.17 |

| Profit | 22.44 | 30.96 | 56.14 |

| Assets | 72.08 | 81.72 | 156.10 |

Revenue

- FY 2023: ₹478.27 Cr

- FY 2024: ₹497.18 Cr (growth of 3.95%)

- FY 2025: ₹941.17 Cr (89.2% growth)

Revenue remained nearly flat between FY23–FY24, showing only marginal growth. However, FY25 witnessed an exceptional jump, almost doubling compared to the previous year. This suggests that Glottis either expanded into new contracts/sectors, or scaled operations aggressively (possibly linked to pre-IPO growth).

Profit

- FY 2023: ₹22.44 Cr

- FY 2024: ₹30.96 Cr (38% growth)

- FY 2025: ₹56.14 Cr (81% growth)

Profit growth outpaced revenue growth in both FY24 and FY25, showing improved operating efficiency and cost management. The FY25 profit more than doubled in two years, highlighting strong profitability momentum.

Total Assets

- FY 2023: ₹72.08 Cr

- FY 2024: ₹81.72 Cr (13.4% growth)

- FY 2025: ₹156.10 Cr (91% growth)

The company nearly doubled its asset base in FY25, in line with the surge in revenue. This suggests major investments into infrastructure, logistics assets, or expansion of operational capacity.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.