GK Energy IPO Overview

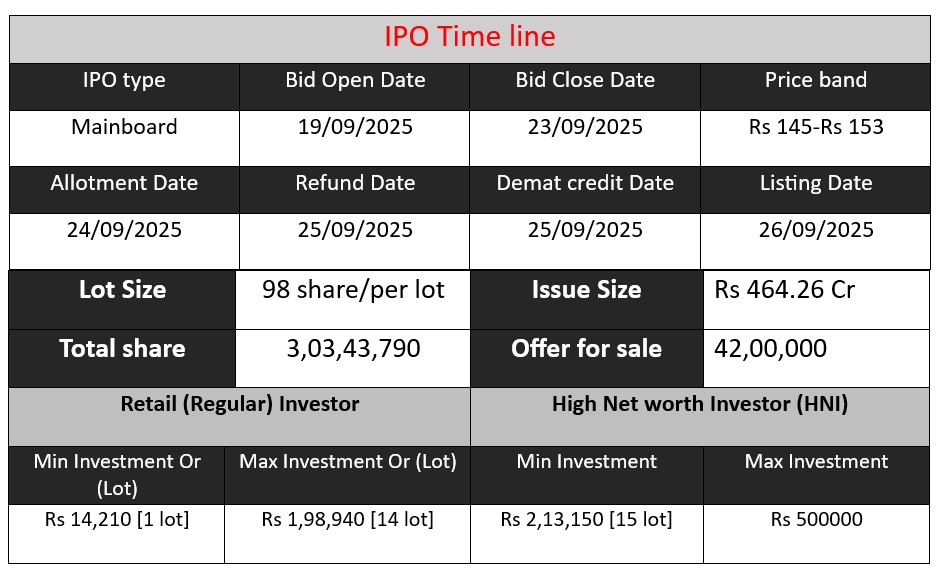

GK Energy Ltd’s IPO opens on 19 September 2025 and closes on 23 September 2025, offering 30,343,790 shares (₹464.26 crore), comprising a fresh issue of ₹400 crore and an offer-for-sale of ₹64.26 crore. Price band is ₹145-₹153 per share. The proceeds will primarily be used to meet long-term working capital requirements, with remaining funds for general corporate purposes. Shares to list on NSE & BSE on 26 September.

GK Energy GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 25 | 145-153 |

| Last Updated: 22 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

GK Energy Core Business & Overview

GK Energy Ltd is an Indian EPC (Engineering, Procurement, and Commissioning) service provider focused primarily on solar-powered agricultural water pump systems, especially under the Government of India’s PM-KUSUM scheme.

It also provides related EPC work: water storage and distribution systems under the Jal Jeevan Mission, rooftop solar installations, and supplying solar components/products via third-party suppliers.

The company operates an asset-light model, meaning it does not own all parts of the manufacturing, especially of key components (solar modules, inverters, etc.). Instead, it procures from vendors and focuses on design, installation, maintenance, and overall execution.

GK Energy has benefited from strong government policy support. PM-KUSUM and other schemes are central to its business plan.

Strengths

Here are several strengths that come from the sources:

- Strong growth and margin expansion

The company has shown very large year-on-year growth in revenue, EBITDA, and profits. Margins have improved markedly. - Order Book and Revenue Visibility

GK Energy has amassed a sizable order backlog, which gives visibility into near-term revenues. As of certain reports, order book was in hundreds of crores. - Policy Tailwinds / Government Schemes

Because much of the demand is driven by policy (PM-KUSUM, Jal Jeevan Mission, etc.), GK Energy benefits from government support, subsidy programs, and scheme-funded demand. - Asset-light model / Scalability

Since they don’t need heavy investment in manufacturing (at least until potential backward integration), they can scale operations more flexibly; lower fixed costs help if demand fluctuates. - Geographic Presence and Empanelment

They are empanelled under PM-KUSUM in several states (Maharashtra, Haryana, Rajasthan, Uttar Pradesh) and are seeking to expand; this gives them reach.

Risks

While there are good positives, sources also point out risks. Here are at least three major ones:

- Heavy Dependency on Government Schemes & Policy Risk

• A large majority of revenue comes from PM-KUSUM scheme and similar government subsidy-driven work. If policies change, subsidies are reduced or delayed, or schemes are not renewed, there could be a big drop in revenue.

• The PM-KUSUM scheme is scheduled to end on 31 March 2026; what happens after that is uncertain. - Working Capital / Cash-Flow and Receivables Risk

• The company has had growing receivables; cash used in operating activities has been negative in some periods.

• Because of the nature of the business (EPC contracts, government payments), delays in payments can strain liquidity. - Customer / Geographic Concentration

• A significant chunk of revenue comes from a few states (especially Maharashtra). If there is a regulatory change or economic issue in those states, it could affect the business materially.

• Also, dependence on top customers: losing a major customer could hurt revenues. - Supplier / Input Cost Risk

• Since GK Energy uses components from third parties (panels, pumps etc.), supply chain disruptions, price volatility, or quality issues pose risks. - Competitive Pressure and Backward Integration Challenges

• Competitors who also manufacture solar panels or have greater scale may offer pricing advantages. GK Energy is moving toward backward integration, but setting up and running such operations has its own risks (capex, scale, margins).

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 285.03 | 10.08 | 142.82 |

| FY 2024 | 411.09 | 36.09 | 214.08 |

| FY 2025 | 1094.83 | 133.21 | 583.52 |

Revenue

- FY 2023: ₹285.03 crore

- FY 2024: ₹411.09 crore

- FY 2025: ₹1094.83 crore

Revenue has shown strong growth, rising 44% in FY 2024 and a massive 166% in FY 2025. This indicates increasing project execution capacity, strong order inflows, and greater demand under government schemes.

Profit

- FY 2023: ₹10.08 crore

- FY 2024: ₹36.09 crore

- FY 2025: ₹133.21 crore

Profit has grown even faster than revenue, reflecting better cost management and operating efficiency. Profit margins have expanded significantly, showing scalability of the business.

Total Assets

- FY 2023: ₹142.82 crore

- FY 2024: ₹214.08 crore

- FY 2025: ₹583.52 crore

Asset base has grown almost 4x in two years, showing expansion to support larger projects. However, this also means higher capital employed and potential increase in working capital requirements.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.