Ganesh Consumer IPO Overview

Ganesh Consumer Products Ltd launches IPO from 22-24 September 2025, offering ₹408.80 crore through a mix of fresh issue (₹130 crore) and offer-for-sale. Priced at ₹306-₹322 per share, total shares on offer 1.27 crore. Fresh funds will repay working capital loans; build a gram & roasted gram flour unit near Siliguri/Darjeeling; balance for general corporate use. Listings on BSE & NSE to follow.

Ganesh Consumer GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 10 | 306-322 |

| Last Updated: 23 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

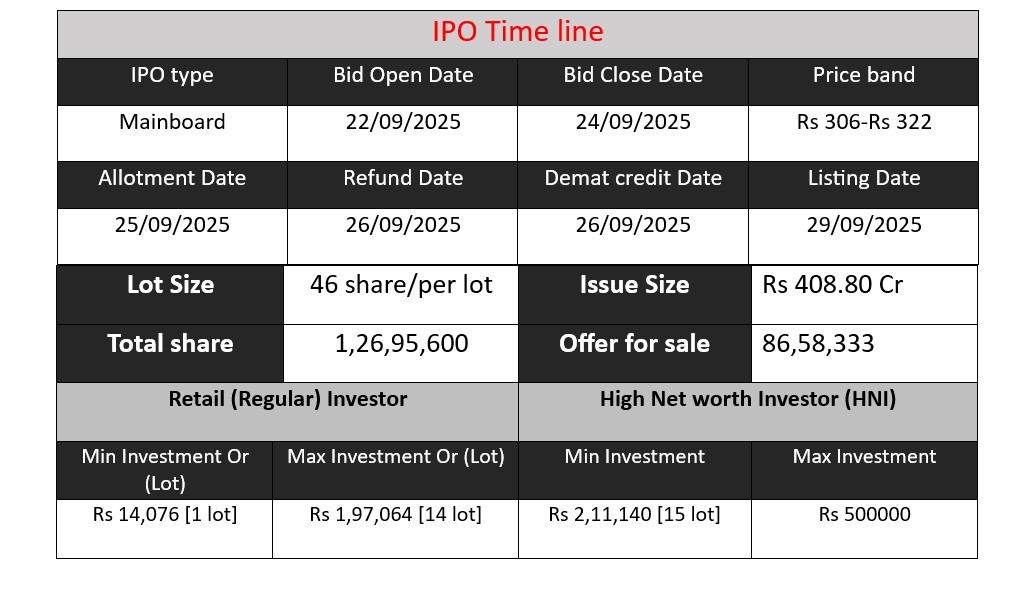

IPO Key Detail

Ganesh Consumer Core Business & Overview

Ganesh Consumer Products Ltd (GCPL) is a fast-moving consumer goods (FMCG) company, incorporated in 2000, headquartered in Kolkata, West Bengal.

Products: The company focuses on packaged food staples—especially wheat- and gram-based products: atta (whole wheat flour), maida, sooji, dalia, sattu, besan etc. They also offer ethnic snacks, spices, instant food mixes, and specialty flours (like bajri, singhara).

Geographical Focus: Their strongest presence is in East India—West Bengal, Jharkhand, Bihar, Odisha, Assam. There are production facilities/manufacturing plants in West Bengal, Uttar Pradesh, and Telangana.

Distribution & Channels: They use a multi-channel distribution network: general trade via C&F agents, super stockists, distributors; also modern trade and e-commerce are part of their channels.

Strengths

Here are some of GCPL’s key strengths:

- Strong regional brand & market share

In East India, GCPL is one of the leading brands in wheat- and gram-based staples. For example, it is the largest in wheat-derivatives like maida, sooji, and dalia in East India, and among the top two in sattu and besan in that region. - Diversified product portfolio & SKU expansion

They are not just sticking to basic staples; they have been launching new products and SKUs over recent years across categories (instant mixes, ethnic snacks, spices, special flours) which provides more levers for revenue growth and margin improvement. - Manufacturing footprint & location advantage

Having manufacturing units in wheat-producing or grain-rich states gives them advantages in sourcing raw materials, reducing logistics cost. Also quality certifications are maintained. - Distribution reach and channel mix

The company has built a relatively deep distribution network (C&F agents, super stockists, distributors) especially in Eastern India. They also have modern trade and e-commerce components, giving flexibility and reach. - Growing demand in their core markets

East India’s packaged staples market is growing, with rising consumer demand, increasing preference for branded/stapled food, etc. This tailwind supports GCPL’s business.

Risks

Alongside the strengths, there are several risks that the company faces:

- Dependence on raw material supply & price volatility

As an agro-based company, fluctuations in wheat, gram, and other raw material prices; seasonality; supply disruptions (due to weather, transportation, regulatory controls) could hurt margins and operations. - Geographical concentration

A substantial portion of the company’s turnover comes from East India and in particular West Bengal. Such concentration increases exposure to local/regional disruptions—e.g. local climate issues, regulatory changes, infrastructure bottlenecks, or even socio-political risks. - Competition & commoditization

Many staple food items are commoditized; price competition from unbranded or low-cost players can limit margin expansion. Also, growing brands entering the region could increase pressure. - Regulatory / policy risk

Changes in government policies regarding food grains procurement, subsidies, export/import restrictions, food safety, labelling etc. could have material impact. Also, agro-climatic regulation / standards could shift. - Margins are modest; leverage and debt exposure

While scale is growing, net profit margins are moderate (in the range of 3-4%) and the company has some debt; its performance depends on maintaining cost control, efficient operations.

Financial Performance Overview (₹ in Crore)

| Fiscal Year | Revenue | Profit | Assets |

| FY 2023 | 610.75 | 27.10 | 343.30 |

| FY 2024 | 759.07 | 26.99 | 308.64 |

| FY 2025 | 850.46 | 35.43 | 341.74 |

Revenue

- FY 2023: ₹610.75 crore

- FY 2024: ₹759.07 crore

- FY 2025: ₹850.46 crore

Revenue shows consistent growth, with 24% increase in FY24 and 12% in FY25. This reflects strong demand and expansion in distribution and product portfolio.

Profit

- FY 2023: ₹27.10 crore

- FY 2024: ₹26.99 crore

- FY 2025: ₹35.43 crore

Profit was flat in FY24 despite higher revenue, suggesting cost pressures or thinner margins. In FY25, profit jumped by 31%, showing improved cost efficiency and stronger profitability.

Assets

- FY 2023: ₹343.30 crore

- FY 2024: ₹308.64 crore

- FY 2025: ₹341.74 crore

Assets dropped in FY24, possibly due to debt repayment, reallocation, or reduced capital investment. In FY25, assets recovered close to FY23 levels, indicating a stronger balance sheet position.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.