Euro Pratik IPO Overview

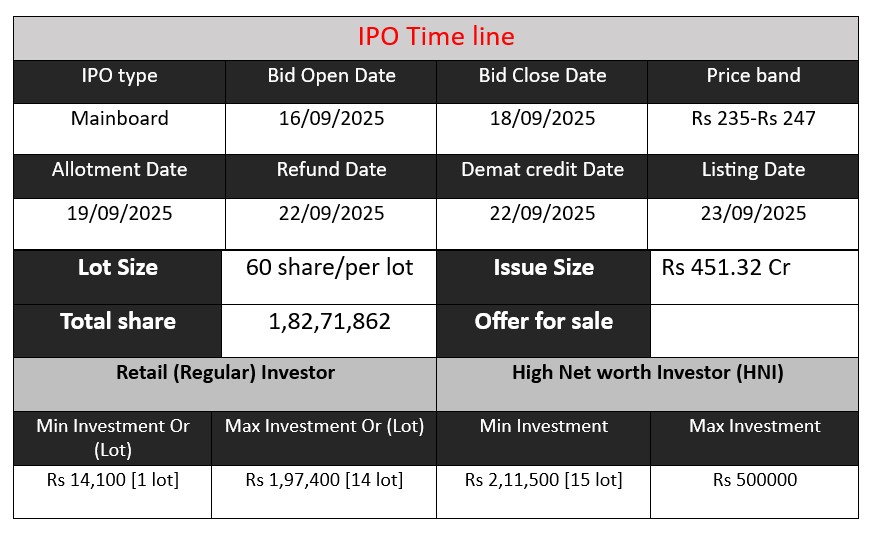

Euro Pratik Sales Ltd IPO opens for subscription on 16 September 2025 and closes on 18 September 2025, with a price band of ₹235-₹247/share. It is an Offer for Sale (OFS) issue sized at ₹451.31 crore, involving 18,271,862 equity shares offered by promoters/promoter group. The company itself will not receive proceeds; the IPO is purely for selling existing shares.

Euro Pratik GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 8 | 235-247 |

| Last Updated: 17 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Euro Pratik Core Business & Overview

- Euro Pratik Is a design-led seller/marketer of decorative wall panels and decorative laminates in India.

- It follows an asset-light model, i.e. it does not own many heavy manufacturing facilities itself but outsources much of its production to contract manufacturers, both domestic and overseas. That lets it focus on design, branding, distribution etc.

- It operates under brands like “Euro Pratik” and “Gloirio”.

Product portfolio: It has a wide variety of designs and SKUs (stock keeping units). More than 30 product categories, over 3,000 designs.

Distribution: It has a pan-India reach via a network of distributors (around 180 distributors across 25 states). Also exports to several countries.

So, their strength is in design, branding, variety, distribution, rather than owning huge capital intensive plants.

Strengths

Pulling together from multiple sources:

- Strong market position in its niche

The company has 15.87% market share in the organized decorative wall panels industry in India. That gives it visibility, possible pricing power, brand recognition. - Asset-light model

Because much of manufacturing is outsourced, capital expenditure (CapEx) burden is lower. This tends to help margin and return ratios. Also flexibility in choosing manufacturers and adapting design trends. - Wide & growing product/design variety

They offer many designs (3000+), many SKUs, frequent new catalogs, strong design capability. Helps meet varied preferences in different geographies and segments. - Strong financial performance & return metrics

According to analysts, they show high margins, good return on capital, low debt relative to equity etc. For example, EBITDA margins are very strong (38-40%) relative to many peers. ROE and ROCE are also strong. - Distribution reach & brand visibility

Broad distributor network, reach across many states, presence in many cities, exports. Strong brand.

Risks

From the same documents, here are the risks and challenges:

- Dependence on wall panels / product concentration

A large part of revenue comes from decorative wall panels. If demand for that falls (due to substitution, change in design taste, cost of raw materials, etc.), that can hurt them. - Reliance on contract manufacturers / lack of direct ownership of some key assets

Because manufacturing is outsourced, they depend on the reliability, quality, and cost discipline of their contractors. Any disruption (quality, supply chain, geopolitical, logistic) could impact production. Also, there is a point that they do not own the “Euro Pratik” trademark; it is owned by one of the promoters and licensed to the company. That could pose legal/regulatory risk. - Concentration risk

This appears in multiple forms: geographic, distributor concentration, supplier concentration. Also, warehousing/distribution logistics (if leasing warehouse in particular location) could be vulnerable to local disruptions. - Cyclicality and exposure to macroeconomic / real-estate / construction sector slowdown

Demand for decorative wall panels / laminates is linked to real estate, interiors, construction, which in turn depends on consumer spending, their income, housing starts etc. A slowdown or real estate downturn can reduce demand. - Competitive pressure

Competition from both organized and unorganized players. Also from larger, established brands in laminates, interiors etc. They need to continuously innovate in design, maintain quality, brand image. Otherwise, margins may be pressured. - Regulatory / material cost risks

Raw materials (resins, laminates, PVC etc.) could be subject to import tariffs, supply constraints, input cost inflation. Also environmental rules might affect how products are made (especially if they use plastics, chemicals, etc.). These could increase cost or force design changes. Some of this is implicit in the prospectus risk sections.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | 263.58 | 59.56 | 159.12 |

| FY 2024 | 221.70 | 62.91 | 174.49 |

| FY 2025 | 284.23 | 76.44 | 273.84 |

Revenue

- FY 2025: ₹284.23 crore

- FY 2024: ₹221.70 crore

Revenue dropped in FY 2024 compared to FY 2023 but rebounded strongly in FY 2025, showing a 28% YoY growth. This rebound suggests improved demand and stronger market positioning.

Profit

- FY 2025: ₹76.44 crore

- FY 2024: ₹62.91 crore

Profit has grown consistently for three years. Despite the revenue dip in FY 2024, profit still rose due to better cost management or higher margins. FY 2025 profit surged 21.5% YoY, reflecting operational efficiency.

Total Assets

- FY 2025: ₹273.84 crore

- FY 2024: ₹174.49 crore

Assets expanded significantly (57% growth in FY 2025). This indicates investments in capacity, expansion, or higher receivables, showing the company’s scaling phase.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.