DSM Fresh Foods IPO Overview

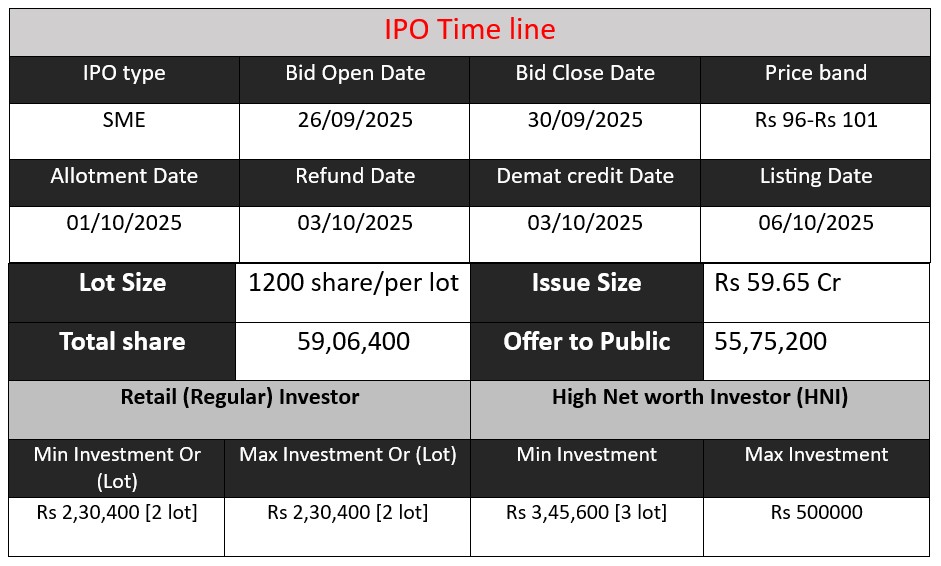

DSM Fresh Foods IPO opens on September 26, 2025, and closes on September 30, 2025. The company, operating under the brand Zappfresh, is issuing shares worth ₹59.65 crore. The IPO aims to raise funds for business expansion, working capital, and infrastructure development. Total shares offered and pricing range between ₹96–₹101 per share. Investors can participate through the online platform or stock exchanges for potential growth in the fresh meat and ready-to-cook food sector.

DSM Fresh Foods GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 96-101 |

| Last Updated: 5 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

DSM Fresh Foods Core Business & Overview

DSM Fresh Foods Limited, operating under the brand name Zappfresh, is an Indian company specializing in the online retail of fresh meat and ready-to-cook/eat non-vegetarian products. Incorporated on May 20, 2015, the company transitioned from a private limited to a public limited entity on July 9, 2024.

Business and Offerings

Zappfresh provides a wide range of products, including fresh chicken, mutton, pork, seafood, specialty meats, marinated meats, cold cuts, and ready-to-eat items like kebabs and nuggets. These products are available through its user-friendly website and mobile app, catering to the growing consumer demand for hygienically sourced, packaged, and convenient food options.

Strengths

- Established Brand: Zappfresh has built a strong brand presence in the online meat retail sector, recognized for its quality and convenience.

- Diverse Product Range: The company offers a comprehensive selection of meat products, appealing to a wide customer base.

- User-Friendly Platform: Its digital platforms provide a seamless shopping experience, enhancing customer satisfaction and loyalty.

Risks

- Operational Challenges: The company operates on rented premises across all locations, creating potential disruption risks if required to vacate.

- Financial Liquidity: Negative cash flows from operations in recent years may continue impacting liquidity.

- Regulatory Compliance: Non-compliance with various statutory provisions in the past, attracting potential penalties.

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 56.28 | 90.44 | 130.73 |

| Profit | 2.74 | 4.67 | 9.05 |

| Assets | 22.01 | 49.99 | 84.04 |

Revenue

Revenue has shown strong growth over the three years:

- FY23 to FY24: (90.44−56.28)/56.28=60.7%(90.44 – 56.28)/56.28 \approx 60.7\%(90.44−56.28)/56.28=60.7% growth

- FY24 to FY25: (130.73−90.44)/90.44=44.6%(130.73 – 90.44)/90.44 \approx 44.6\%(130.73−90.44)/90.44=44.6% growth

This indicates a robust expansion in the company’s sales and market presence.

Profit

Profit has increased significantly:

- FY23 to FY24: (4.67−2.74)/2.74=70.4%(4.67 – 2.74)/2.74 \approx 70.4\%(4.67−2.74)/2.74=70.4% growth

- FY24 to FY25: (9.05−4.67)/4.67=93.9%(9.05 – 4.67)/4.67 \approx 93.9\%(9.05−4.67)/4.67=93.9% growth

Profit growth is outpacing revenue growth, suggesting improved operational efficiency and cost management.

Asset

Total assets have nearly quadrupled over three years:

- FY23 to FY24: (49.99−22.01)/22.01=127.3%(49.99 – 22.01)/22.01 \approx 127.3\%(49.99−22.01)/22.01=127.3% growth

- FY24 to FY25: (84.04−49.99)/49.99=68.1%(84.04 – 49.99)/49.99 \approx 68.1\%(84.04−49.99)/49.99=68.1% growth

Rapid asset growth could indicate expansion in infrastructure, inventory, and working capital to support business scaling.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.