Dhillon Freight Carrier IPO Overview

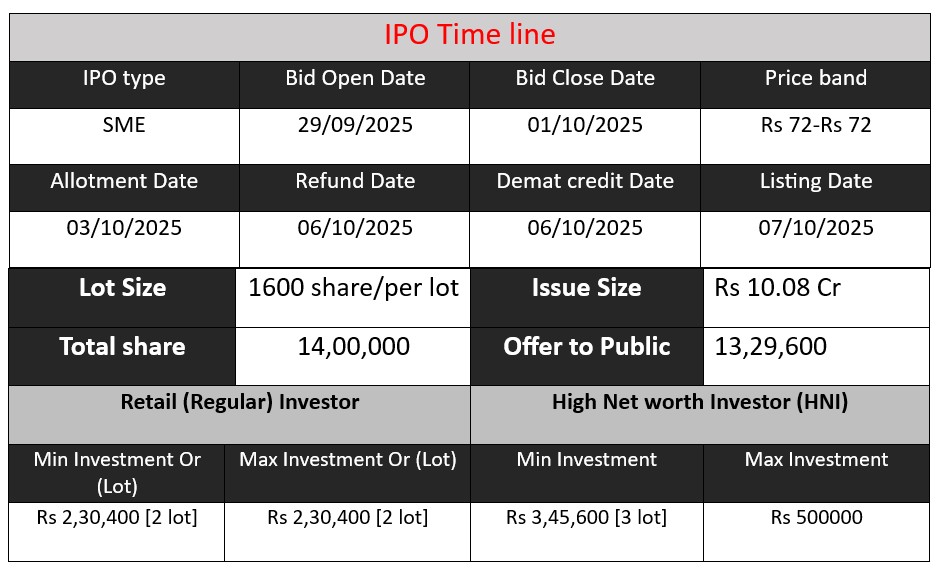

Dhillon Freight Carrier is launching an IPO of ₹10.08 crore, offering 14,00,000 equity shares at ₹72 each. The issue opens on 29 September 2025 and closes on 1 October 2025. Proceeds will fund purchase and fabrication of transportation vehicles, corporate purposes, and issue expenses. The shares will be listed on BSE SME

Dhillon Freight Carrier GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 72 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Dhillon Freight Carrier Core Business & Overview

DFCL was founded in 2014 by Karan Singh Dhillon. It started as Dhillon Freight Carrier Private Limited and later became a public company. It is ISO 9001:2015 certified, meaning its quality management systems are audited to a standard recognized globally.

Services:

Parcel / Less-Than-Truck Load (LTL) deliveries, meaning transporting smaller shipments grouped together rather than full truckloads.

Contract logistics — handling supply chain, warehousing, order fulfilment etc.

Fleet rental / fleet leasing services: providing vehicles on hire, apart from their owned fleet.

Geography & Infrastructure:

Operates mainly in West Bengal, Bihar, Delhi, and Uttar Pradesh.

Infrastructure includes 22 booking offices, pickup facilities, warehouses, delivery offices, and agency networks.

Fleet size: 62 in-house vehicles.

Recent Expansion: Acquired 18,000 sq ft land in Howrah, West Bengal for a new warehouse to expand its warehousing & distribution capacities in eastern India.

Strengths

Here are key strengths that seem to make DFCL promising:

- Diverse service offerings — Because they provide LTL, contract logistics, plus fleet leasing/rental, they are less dependent on any single revenue stream.

- Established presence & infrastructure — Having 62 owned vehicles, plus a network of 22 offices etc., gives them capacity and geographical reach.

- Focus on quality and standards — ISO certification, disciplined fleet operations, and recent investment in warehousing show focus on building solid foundations.

- Growing infrastructure — The warehouse acquisition in Howrah is aimed at better serving industrial clusters (textile, steel, etc.) in eastern India, likely improving logistics efficiency and service levels.

Risks

Even though there are positives, there are several risks to be aware of:

- Dependence on third-party vehicles / outsourcing

- A significant share of transport & fleet-related services is via hired or outsourced trucks. Delays or disruptions in availability of these, or cost escalations, could hurt operations.

- Geographic concentration

- Revenue is heavily derived from a few states (West Bengal, Bihar, Uttar Pradesh). That means any regulatory, economic or infrastructural problems in those states can disproportionately affect the business.

- Procurement & capital cost risks

- They plan to purchase new vehicles / fabricate them; any delays, cost overruns, or supply issues (for vehicles, parts, etc.) could impact planned expansion or lead to cost pressures.

- Competition and branding

- In the logistics & transportation space, there are many established players. Smaller/newer players often face challenges in achieving brand recognition, negotiating power, high margins, or in scaling. (Mentioned in IPO‐risk disclosures.)

- Operational risks related to fleet

- Vehicles require maintenance; breakdowns, theft, damage can impact operations. Also, some of their loans are secured by vehicles; problems could risk assets.

- Financial risks

- Interest rate fluctuations, working capital demands, perhaps negative cash flows in some years or years of capex might stretch resources.

- Control / governance risks

- Even after IPO, promoters are retaining a large share. Combined with other risks like personal guarantees, this could lead to potential conflict of interest or risk exposure for investors.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 29.58 | 0.36 | 6.78 |

| FY 2024 | 24.02 | 1.09 | 9.16 |

| FY 2025 | 24.74 | 1.73 | 9.71 |

Revenue

- FY 2023: ₹29.58 crore

- FY 2024: ₹24.02 crore (drop of 19%)

- FY 2025: ₹24.74 crore (slight recovery, +3% vs FY24)

The company faced a decline in revenue in FY24, possibly due to demand slowdown or reduced operations, but managed a small rebound in FY25.

Profit

- FY 2023: ₹0.36 crore

- FY 2024: ₹1.09 crore (tripled)

- FY 2025: ₹1.73 crore (+59%)

Despite lower revenues compared to FY23, profitability has improved steadily. This indicates better cost control, higher efficiency, or improved margins.

Assets

- FY 2023: ₹6.78 crore

- FY 2024: ₹9.16 crore (+35%)

- FY 2025: ₹9.71 crore (+6%)

Assets have grown consistently, showing the company is investing in infrastructure, fleet, or warehouses. Growth slowed in FY25, suggesting more measured expansion after a strong FY24 jump.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.