Bhavik Enterprises IPO Overview

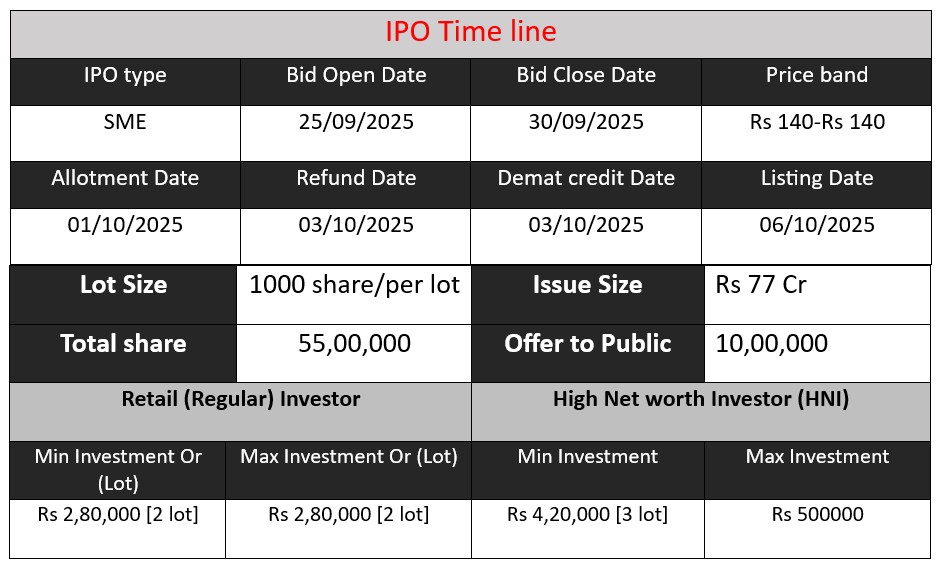

Bhavik Enterprises IPO opens on September 25, 2025, and closes on September 30, 2025, with an issue size of ₹77 crore. The IPO offers equity shares at a price band of ₹140 per share. Funds raised will be used for working capital requirements, repayment of borrowings, and general corporate purposes. The company operates in polymer distribution, serving diverse industries including packaging, agriculture, and consumer goods.

Bhavik Enterprises GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 140 |

| Last Updated: 29 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Bhavik Enterprises Core Business & Overview

Incorporation: Founded on September 15, 2008, and registered under CIN: U51900MH2008PLC186771.

Leadership: Led by Chairman Mr. Mukesh Thakkar and Managing Director Mr. Bhavik Thakkar.

Business Model: Operates on a B2B model, importing polymer materials, storing them in strategically located warehouses, and distributing them to manufacturers of plastic products such as pipes, films, containers, and technical components.

Operations

- Product Range: Offers a wide array of PE and PP products in various grades, including LLDPE, LDPE, HDPE, MLLDPE, homo polymer, impact co-polymer, and random co-polymer.

- Industry Applications: Supplies materials used in manufacturing pressure and non-pressure pipes, films, foams, fabrics, containers, and other plastic products

Strengths

- Diverse Product Portfolio: Extensive range of polymer products catering to multiple industries.

- Established Supplier Network: Strong relationships with suppliers ensure reliable supply chains.

- Strategic Warehouse Locations: Warehouses situated in key locations help in reducing logistics costs and improving delivery efficiency.

- Long-standing Client Relationships: Established client base ensures repeat business and sustained revenue streams.

Risks

- Market Volatility: Fluctuations in global commodity prices can impact profitability.

- Competitive Landscape: Intense competition in the polymer distribution sector may affect market share and margins.

- Regulatory Changes: Potential changes in trade policies and regulations can affect import-export dynamics and operational costs

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 487.26 | 494.12 | 527.27 |

| Profit | 15.56 | 7.89 | 5.68 |

| Assets | 157.46 | 136.52 | 173.22 |

Revenue

- FY 2023 to FY 2024: Revenue grew from ₹487.26 Cr to ₹494.12 Cr, a modest increase of 1.4%.

- FY 2024 to FY 2025: Revenue increased to ₹527.27 Cr, a stronger growth of 6.7%, indicating improving sales and demand for the company’s products.

Profit

- FY 2023 to FY 2024: Profit dropped sharply from ₹15.56 Cr to ₹7.89 Cr (49.3% decline).

- FY 2024 to FY 2025: Profit further declined to ₹5.68 Cr (28% decline), despite higher revenue.

- Observation: While sales are increasing, profit margins are shrinking. This may be due to rising raw material costs, operational expenses, or competitive pricing pressure.

Assets

- FY 2023 to FY 2024: Total assets decreased from ₹157.46 Cr to ₹136.52 Cr (13.3% drop), suggesting possible reduction in inventory, receivables, or other asset adjustments.

- FY 2024 to FY 2025: Assets increased significantly to ₹173.22 Cr (26.9% growth), possibly indicating investments in warehouses, inventory, or expansion of business operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.