Before starting futures trading, it is very important to understand that futures are not of just one type. In the market, there are mainly two popular types of futures contracts:

- Index Futures

- Stock Futures

Although both follow the same structure (expiry, lot size, margin), their behavior, volatility, risk level, and purpose are different.

If you want to become serious about futures trading, you must clearly understand:

- When to trade index futures

- When stock futures are better

- The difference in risk

- Which one is safer for beginners

Let us understand everything step by step.

What Are Index Futures?

Index futures are contracts that are based on a stock market index.

An index represents:

A group of selected stocks that together show the overall direction of the market.

Examples of Index Futures:

- Nifty 50 Futures

- Bank Nifty Futures

- Sensex Futures

When you trade index futures, you are not betting on a single company. Instead, you are trading the overall market or a specific sector.

How Index Futures Work

Suppose:

- Nifty Futures price: 22,000

- Lot size: 50

If Nifty rises by 200 points:

- Profit = 200 × 50 = ₹10,000

If Nifty falls by 200 points:

- Loss = ₹10,000

Here, the price movement depends on overall market sentiment rather than one company’s performance.

Key Features of Index Futures

✔ Based on multiple companies

✔ Less affected by single company news

✔ Generally more stable than stock futures

✔ Commonly used for hedging and short-term trading

✔ Cash settled on expiry

What Are Stock Futures?

Stock futures are contracts based on the shares of a specific company.

Examples:

- Reliance Futures

- TCS Futures

- HDFC Bank Futures

Here, you are directly trading the price movement of one particular company.

How Stock Futures Work

Suppose:

- Reliance Futures price: ₹2,500

- Lot size: 250

If the price increases to ₹2,560:

- Profit per share: ₹60

- Total profit = 60 × 250 = ₹15,000

If the price falls to ₹2,440:

- Loss = ₹15,000

Here, the movement depends on company-specific factors such as:

- Quarterly earnings results

- Management announcements

- Government policies

- Sector-related news

Key Features of Stock Futures

✔ Based on a single company

✔ More volatile than index futures

✔ Higher risk and higher reward

✔ Strongly influenced by company news

✔ May involve physical settlement (as per exchange rules)

Major Differences – Index vs Stock Futures

| Feature | Index Futures | Stock Futures |

| Based On | Group of stocks | Single company |

| Risk Level | Moderate | Higher |

| Volatility | Lower | Higher |

| News Impact | Market-wide news | Company-specific news |

| Settlement | Cash settled | Often physical settlement |

| Suitable For | Beginners & hedging | Experienced traders |

Which One Is Safer for Beginners?

Generally, Index Futures are considered slightly safer because:

- Risk is diversified across multiple companies

- One company’s bad news does not cause major crashes

- Price movement is relatively smoother

In stock futures:

- Sudden 5–10% moves are possible

- High volatility during earnings announcements

Therefore, for beginners:

👉 Index futures can be a better starting point.

When Should You Trade Index Futures?

Index futures are suitable when:

- You are confident about overall market direction

- Major events like elections, budget, or central bank policy are approaching

- You want to hedge your existing stock portfolio

Example:

If you have a ₹5 lakh stock portfolio and fear a market fall, you can sell index futures to hedge against potential losses.

When Should You Trade Stock Futures?

Stock futures are useful when:

- You have a strong view on a specific company

- You expect a breakout after strong earnings

- There is strong short-term momentum

Example:

If a company reports strong quarterly results and breaks resistance levels, traders may use stock futures to benefit from leverage.

Risk Comparison (Important Section)

Index Futures Risk:

- Controlled volatility

- Broader market-based movement

- Lower manipulation risk

Stock Futures Risk:

- Sudden gap up or gap down

- Sharp moves driven by operators

- Impact of unexpected company news

In stock futures, strict risk management and stop-loss discipline are even more important.

Final Understanding

Index Futures = Trading the direction of the overall market

Stock Futures = Trading the direction of a specific company

Index = Stability + Diversification

Stock = Volatility + Opportunity

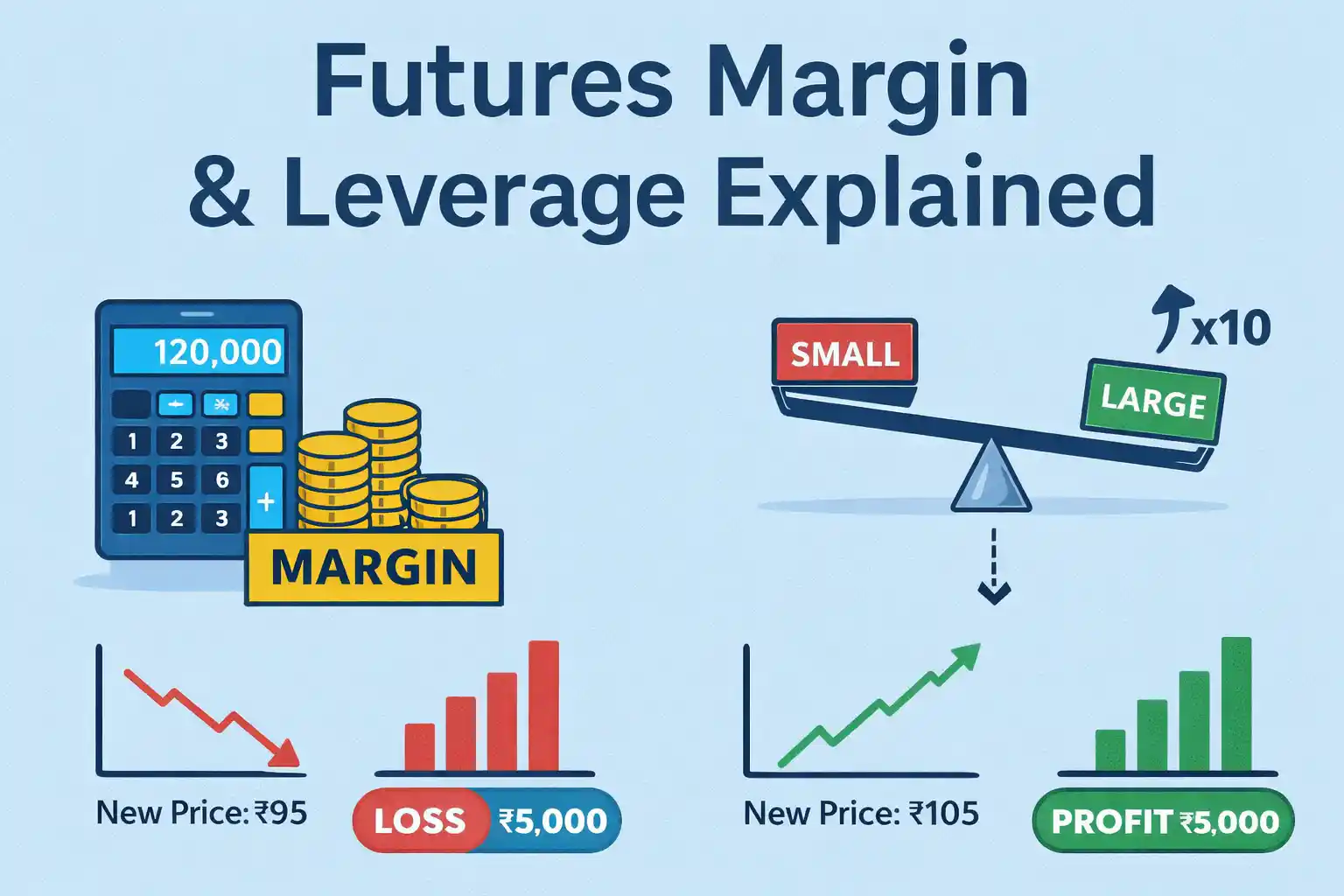

Both follow the same margin and leverage structure, but their risk profile is different.