Rukmani Devi Garg Agro IPO Overview

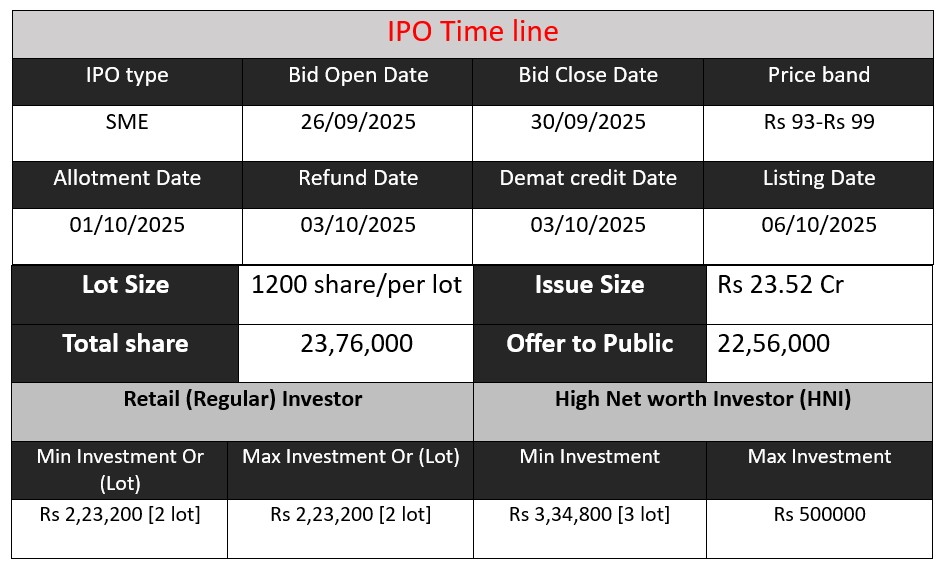

Rukmani Devi Garg Agro Limited IPO opens on 26 Sept 2025 and closes on 30 Sept 2025, offering 23.76 lakh equity shares priced between ₹93-₹99. The company aims to raise ₹23.52 crore to expand its wheat processing units and strengthen its supply chain. Investors can participate to gain exposure to a leading agricultural commodities aggregator with a strong growth trajectory and improving profitability.

Rukmani Devi Garg Agro GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 15 | 93-99 |

| Last Updated: 30 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Rukmani Devi Garg Agro Core Business & Overview

Rukmani Devi Garg Agro Impex Limited (RDG Agro) is a Rajasthan-based agricultural company established in 1998. Headquartered in Kota, the company specializes in aggregating, processing, and distributing a variety of agricultural commodities.

RDG Agro began with a mission to empower farmers by ensuring they receive fair prices for their produce. Over the years, it has evolved into a trusted leader in agricultural commodity aggregation and supply-chain management. The company operates two fully automated wheat processing units in the RIICO Industrial Area, Kota, with an installed capacity of 200 MT/day and 3,500 MT storage.

RDG Agro’s primary activities include:

- Commodity Aggregation: Sourcing agricultural produce such as wheat, mustard, coriander, maize, flax seeds, and soybeans from over 500 agents across Rajasthan and Madhya Pradesh.

- Processing & Grading: Cleaning, grading, and processing the sourced commodities to meet quality standards.

- Distribution: Supplying processed products to corporates, flour mills, solvent-extraction plants, and oil mills across India.

Strengths

- Established Market Presence: With over two decades in the industry, RDG Agro has built strong relationships with farmers and customers, ensuring a steady supply chain.

- Modern Processing Facilities: The company’s state-of-the-art processing units enhance efficiency and product quality, catering to a diverse clientele.

- Robust Financial Performance: In FY2025, RDG Agro reported a 34% year-on-year increase in revenue to ₹327.32 crore, with a 51% rise in net profit to ₹7.57 crore.

Risks

- Market Volatility: Fluctuations in commodity prices can impact profit margins.

- Operational Challenges: Dependence on a vast network of agents and processing units may pose logistical and quality control issues.

- Regulatory Changes: Alterations in agricultural policies or trade regulations can affect business operations.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 248.05 | 0.47 | 45.69 |

| FY 2024 | 244.37 | 5.02 | 55.6 |

| FY 2025 | 326.99 | 7.57 | 110.81 |

Revenue

- FY 2023–FY 2024: Revenue slightly decreased from ₹248.05 crore to ₹244.37 crore (1.5% decline), possibly due to market fluctuations or lower commodity prices.

- FY 2024–FY 2025: Revenue jumped significantly to ₹326.99 crore (34% increase), showing strong growth and effective scaling of

After a minor dip, the company demonstrated strong revenue growth in FY 2025, indicating increasing demand for its agricultural products and successful business expansion.

Profit

- FY 2023–FY 2024: Profit rose sharply from ₹0.47 crore to ₹5.02 crore, despite the slight drop in revenue. This suggests better cost management, operational efficiency, or higher margins.

- FY 2024–FY 2025: Profit further increased to ₹7.57 crore (51% growth), in line with rising revenue.

Profitability is improving consistently, which reflects strengthening financial health and effective expense management.

Assets

- FY 2023–FY 2024: Total assets increased from ₹45.69 crore to ₹55.6 crore, a 21.7% growth, likely due to investment in processing facilities or inventory.

- FY 2024–FY 2025: Assets surged to ₹110.81 crore (99% increase), possibly because of expansion in processing capacity, storage, or working capital to support larger operations.

Asset growth indicates the company is scaling its infrastructure and operations to meet higher demand.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.