Telge Projects IPO Overview

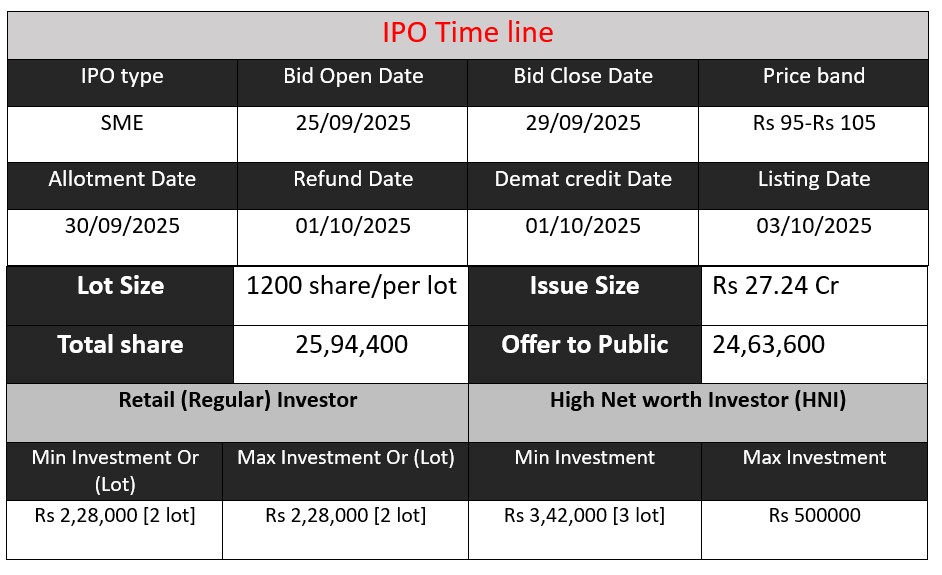

Telge Projects Ltd is launching an SME IPO of ₹27.24 crore, offering 25,94,400 equity shares at a price band of ₹95–₹105 per share. The issue opens on 25 September 2025 and closes on 29 September 2025. The raised capital will fund expansion of office space, purchase of computers and software, hiring manpower, investment in subsidiary, and for general corporate purposes.

Telge Projects GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 95-105 |

| Last Updated: 29 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Telge Projects Core Business & Overview

Telge Projects Limited is an engineering-design / BIM (Building Information Modeling) company incorporated in January 2018.

The company serves clients in the Architecture, Engineering & Construction (AEC) industry, including EPC contractors, fabricators, and contractors.

It has a global presence: delivering projects in 11+ countries (including USA, UK, Australia, Singapore, etc.), with operations in India (headquartered in Pune, offices also in Latur) and a subsidiary in the US.

Operations

- BIM Modelling & Coordination: High level of detail models (LOD 100-500), and coordinating among architects, structural designers, MEP etc.

- Structural Engineering Design: Structural steel and pre-cast concrete designs form a significant part of its work.

- 2D Drafting & Architectural Services: Shop/fabrication drawings, architectural documentation.

- Material Take-Offs (MTO): Quantifying material requirements which helps in cost estimates & procurement.

Strengths

Here are what appear to be Telge Projects’ key strengths:

- Strong Revenue & Profit Growth

Revenue more than doubled from FY24 to FY25 (from ₹12.5 crore to ₹25.65 crore) and profit after tax also more than doubled. - High Margins

EBITDA margins are high (about 32-3%) and PAT margins are also healthy (21-22%). - Global Footprint and Diversified Clientele

Working across multiple countries gives exposure to various markets; revenues mainly from exports in recent years. - Technology Adoption/Expertise

Deep focus on BIM, use of advanced tools like Tekla Structures, Revit, etc. This supports precision, reduces errors, coordination etc. - Order Book / Client Base

As of FY25, an order book with multiple projects (81 projects) globally.

Risks

Here are some of the risks or areas of concern:

- Dependence on Exports / International Clients

Large share of revenue comes from overseas contracts. This exposes the company to foreign exchange risk, changing regulations abroad, delays, or geopolitical issues. - Competition & Price Pressure

The engineering design / BIM services sector is competitive, with many firms globally and locally. Maintaining differentiation (quality, technology, delivery time) is essential. Pricing pressures or cost overruns can hurt margins. - Scaling Challenges (Manpower / Technology / Capacity)

To handle increasing projects, they need to expand skilled workforce, invest in software/hardware, possibly expand infrastructure. If growth outpaces operational capacity, quality or delivery could suffer. Also, recruiting / retaining specialized staff is often challenging in BIM/engineering sectors. - Financial Leverage / Debt Risk

While financial performance is improving, risks exist if the company takes on high debt to scale or if there’s a slowdown in revenue growth, making servicing debt harder. Some sources mention borrowings as potential pressure in adverse situations. - Dependence on Technology and Standards

BIM tools, software, data management practices need continuous updating. If the company fails to keep up with evolving standards & tools (or security/data integrity issues), that could hamper reputation or delivery. - Order Book / Backlog Volatility

Order book of ₹4.42 crore in FY25 across 81 projects is decent, but delays or cancellations can affect revenue visibility. Also, small domestic contribution indicates exposure to international project risks.

Financial Performance Overview (₹ in Crore)

| Fiscal Year | Revenue | Profit | Assets |

| FY 2023 | 7.44 | 0.90 | 5.87 |

| FY 2024 | 12.41 | 2.66 | 10.37 |

| FY 2025 | 25.08 | 5.38 | 25.56 |

Revenue

- Grew from ₹7.44 crore in FY23 to ₹25.08 crore in FY25.

- That’s a CAGR of 90% over 2 years.

- Indicates strong demand for its BIM and engineering services, expansion in global markets, and ability to scale project execution.

Profit

- Jumped from ₹0.90 crore in FY23 to ₹5.38 crore in FY25.

- Profit margins improved (approx. 12% in FY23 → 21% in FY25).

- Suggests better cost efficiency, higher billing rates, and strong operational control.

Assets

- Increased significantly from ₹5.87 crore in FY23 to ₹25.56 crore in FY25.

- Reflects reinvestment of profits, possibly capacity expansion (technology, manpower, and infrastructure).

- The asset base almost quadrupled, showing strong capital growth and balance sheet strengthening.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.