Solvex Edibles IPO Overview

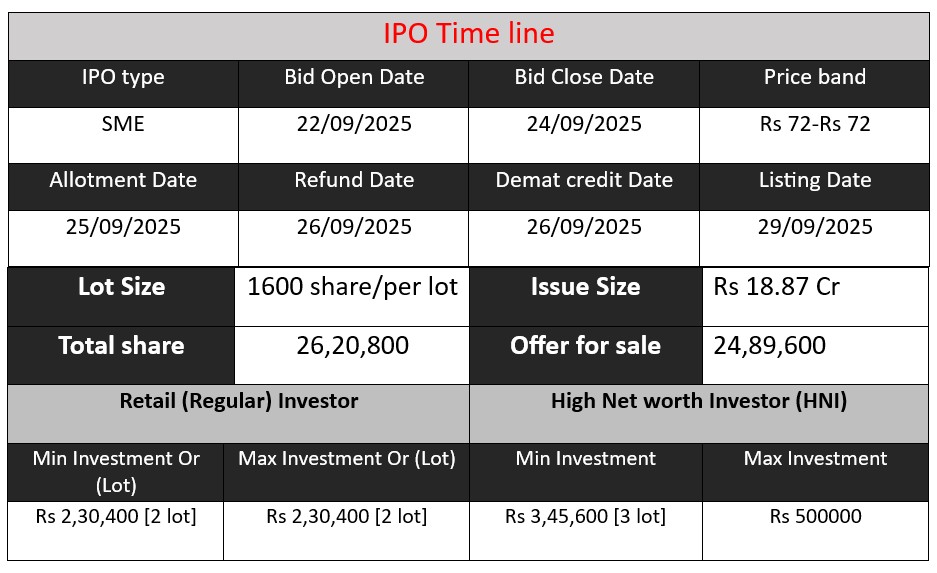

Solvex Edibles Ltd IPO opens 22-Sep-2025, closes 24-Sep-2025. Total issue size: ₹18.87 crore through 26,20,800 fresh shares priced at ₹72 each. Offered on BSE SME, with a face value of ₹10 per share. IPO proceeds will be used for purchase of plant & machinery, repayment of outstanding borrowings, and general corporate purposes. Listing expected on 29-Sep-2025.

Solvex Edibles GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 72 |

| Last Updated: 23 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Solvent Edibles Core Business & Overview

Incorporated: 2013, based in Uttar Pradesh.

Main business: Agro-processing / edible oils industry. Specifically:

• Solvent-extracted rice bran oil (REO)

• De-oiled rice bran (DORB) cakes

• Mustard oil, mustard cakes (by-products)

Manufacturing & Capacity: They have a plant in Kemri, Bilaspur, Uttar Pradesh, capable of processing ~200 tonnes per day, across ~12,140 sq. metres. Distribution is in about 18 states. They also have two subsidiaries: Shree Oils & Fats (200 TPD plant in Bareilly) and Golden Pearl Oil Products (60 TPD refinery in Baheri).

Product mix / revenue sources: In FY25, 51.12% of revenue came from de-oiled rice bran, 5.58% from rice bran oil. Mustard oil / by-products make up part of the rest.

Strengths

Based on recent evaluation, here are what seem to be Solvex’s competitive advantages:

- Diversified product mix

Having multiple edible oil / by-product streams (oil, de-oiled cakes, mustard oil etc.) helps reduce dependency on a single product. The by-products (like de-oiled cakes) are used in animal feed etc., which gives an additional revenue buffer. - Good processing capacity / scale

The Kemri plant with 200 TPD capacity, plus subsidiaries, gives reasonable scale for an SME. Also geographical spread of distribution (18 states) helps reach markets. - Recent financial improvement

FY25 saw a strong rebound in revenue and profit. According to reports, revenue approx. ₹135-136 crore, and PAT (profit after tax) growing substantially. - Focus on managing debt / using IPO proceeds for expansion

The IPO proceeds are planned to finance new plant & machinery, plus repay existing borrowings. That could improve margins, reduce financing costs.

Risks

No company is without risk. Based on disclosures and sector dynamics:

- Raw material price volatility

The business depends heavily on agricultural commodities (rice bran, mustard seed etc.). Prices of these inputs can fluctuate due to weather, supply chain issues, agricultural policy, etc. That can squeeze margins. - Working capital & liquidity stress

Agro-processing businesses often have high receivables, inventory, and seasonal fluctuations. Reports mention negative cash flows from operations in recent periods, which could create stress, particularly if input and storage costs rise. - Competitive pressures

The edible oils market is crowded, with large, established brands, regional players, import competition, price wars, etc. For a relatively smaller company, maintaining market share, brand, distribution, margins may be challenging. - Regulatory / environmental / compliance risks

Food safety norms, environmental regulation, labeling laws, taxation etc. can impose cost / compliance burdens. Any change in such regulations could require updating or changing practices. - Capacity utilization risk

Although they have capacity, actual utilization matters. If plants are under-utilized, fixed costs remain, but revenue is lower. The IPO doc mentions utilization in certain product lines is below full capacity.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 93.03 | 0.33 | 22.72 |

| FY 2024 | 71.27 | 0.99 | 37.51 |

| FY 2025 | 74.71 | 2.84 | 42.18 |

Revenue

- FY 2023: ₹93.03 crore

- FY 2024: ₹71.27 crore

- FY 2025: ₹74.71 crore

Revenue dipped sharply in FY 2024 (-23% YoY), likely due to market or raw material fluctuations, but rebounded slightly in FY 2025 (+4.8%). Growth is modest, showing the business still faces demand or pricing challenges.

Profit

- FY 2023: ₹0.33 crore

- FY 2024: ₹0.99 crore

- FY 2025: ₹2.84 crore

Despite revenue pressure, profits improved consistently. Net profit grew 3x in FY 2024 and nearly 3x again in FY 2025. This reflects better cost management, improved efficiency, or higher-margin product contribution.

Total Assets

- FY 2023: ₹22.72 crore

- FY 2024: ₹37.51 crore

- FY 2025: ₹42.18 crore

Assets almost doubled between FY 2023 and FY 2025, showing expansion, investment in capacity, or inventory buildup. This suggests growth strategy and balance sheet strengthening.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.