Atlanta Electricals IPO Overview

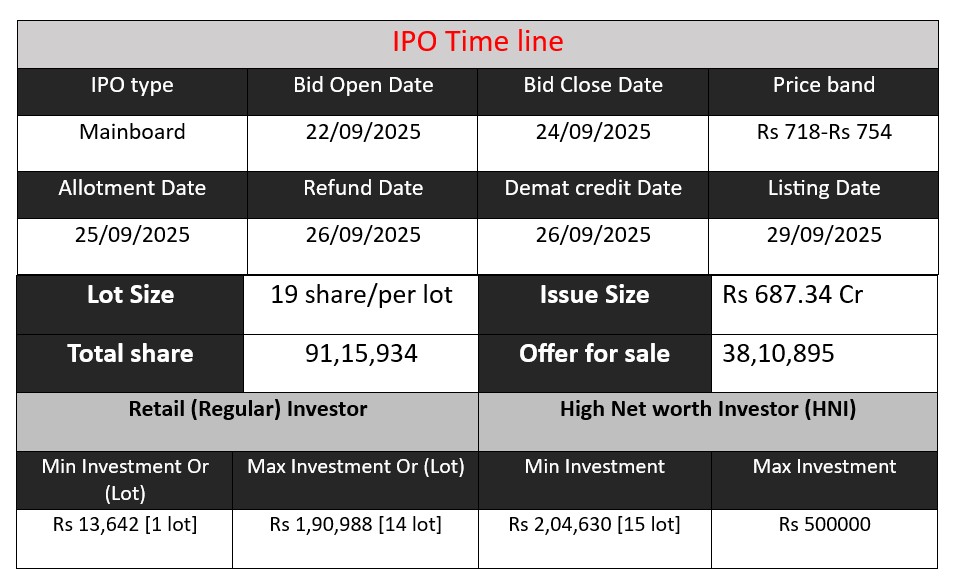

The Atlanta Electricals Limited IPO is scheduled to open on September 22, 2025, and close on September 24, 2025. The issue comprises a fresh issue of ₹400 crore and an offer for sale of ₹287.34 crore, totaling ₹687.34 crore. The price band is set between ₹718 and ₹754 per share, with a minimum lot size of 19 shares (₹14,642). The IPO aims to raise funds for repaying borrowings, meeting working capital requirements, and covering general corporate purposes. The tentative listing date is September 29, 2025, on both the BSE and NSE.

Atlanta Electricals GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 120 | 718-754 |

| Last Updated: 23 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Atlanta Electricals Core Business & Overview

Atlanta Electricals Limited is a prominent Indian manufacturer specializing in power, auto, and inverter duty transformers. Established in 1988 and headquartered in Anand, Gujarat, the company has evolved from a partnership firm into a public limited entity. With over three decades of industry experience, Atlanta Electricals has become a trusted supplier of transformers for various applications, including power distribution, renewable energy, and industrial sectors.

Core Operations

Atlanta Electricals designs and manufactures a diverse range of transformers, such as:

- Power Transformers (up to 220 kV and 200 MVA)

- Auto Transformers

- Inverter Duty Transformers

- Furnace Transformers

- Generator Transformers

- Special Duty Transformers

The company operates three manufacturing facilities across Anand, Gujarat, and Bengaluru, Karnataka, with a total installed capacity of 47,280 MVA. A fourth facility in Vadodara, Gujarat, is under construction to further enhance production capabilities. Atlanta Electricals has supplied over 4,400 transformers across 19 states and three Union Territories in India, catering to clients like GETCO, Adani Green, and Tata Power.

Strengths

- Robust Order Book & Client Base: With an order book of INR 1,642.96 crore, the company has a strong revenue visibility. Its clientele includes government entities and private sector players, ensuring payment security and credibility.

- Diverse Manufacturing Footprint: The company’s four manufacturing facilities across Gujarat and Karnataka enable efficient servicing of orders and scalability.

- Operational Legacy & Industry Trust: With over 30 years in the industry and 4,400+ transformers delivered, Atlanta Electricals enjoys customer confidence and has a skilled workforce of 301 professionals.

- Financial Strengths: The company has shown strong financial performance, with revenue growing from INR 873.88 crore in FY23 to INR 1,244.18 crore in FY25. Net income rose to INR 118.65 crore, and return ratios remain robust, highlighting efficient capital deployment.

- Strong Promoter & Governance Backing: The promoter family brings decades of technical and business experience, ensuring a stable long-term vision and commitment.

Risks

- Geographical Concentration: The company’s manufacturing facilities are primarily located in Gujarat and Karnataka, which may expose it to regional risks such as natural disasters or local regulatory changes.

- Heavy Reliance on Leased Facilities: Dependence on leased properties for manufacturing could lead to uncertainties related to lease renewals and cost escalations.

- Limited Downstream Diversification: Atlanta Electricals focuses primarily on transformer manufacturing, which may limit its ability to mitigate risks associated with fluctuations in demand within the transformer market

Financial Performance Overview (₹ in Crore)

| Financials | FY 2022 | FY 2023 | FY 2024 |

| Revenue | 625.66 | 873.88 | 867.55 |

| Profit | 55.25 | 87.54 | 63.36 |

| Assets | 414.58 | 560.76 | 559.25 |

Revenue

- Revenue grew significantly from ₹625.66 Cr in FY22 to ₹873.88 Cr in FY23, showing strong business growth (39.6% YoY).

- However, revenue slightly declined to ₹867.55 Cr in FY24, indicating a minor slowdown (0.7% YoY), which may be due to market fluctuations or order delays.

Profit

- Profit rose sharply from ₹55.25 Cr in FY22 to ₹87.54 Cr in FY23 (58.4% growth), reflecting efficient cost management and increased sales.

- In FY24, profit dropped to ₹63.36 Cr (27.6% decline), despite stable revenue. This suggests higher costs, operational challenges, or lower margins during the year.

Assets

- Total assets increased steadily from ₹414.58 Cr in FY22 to ₹560.76 Cr in FY23, supporting revenue growth and business expansion.

- FY24 shows almost stable assets at ₹559.25 Cr, indicating no major new investments or asset expansion during this period.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.