Sampat Aluminium IPO Overview

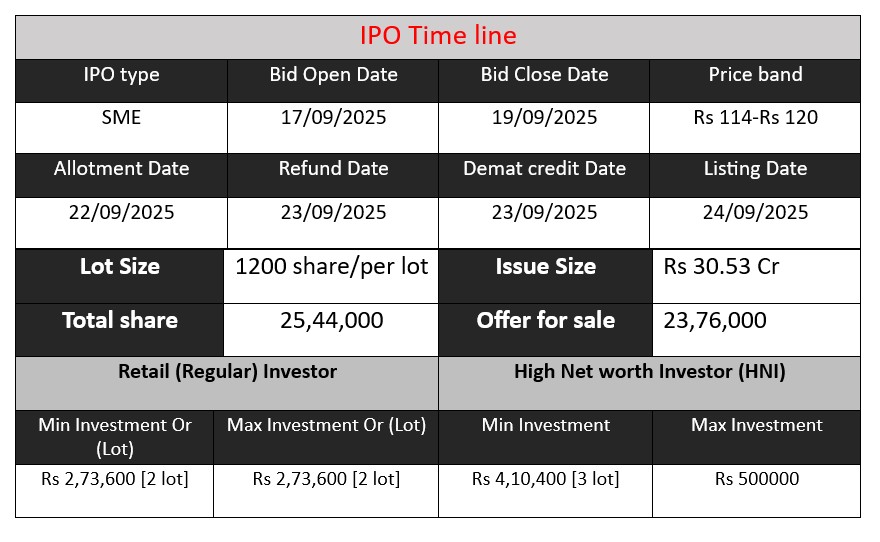

Sampat Aluminium Ltd’s SME IPO opens 17 September 2025 and closes 19 September 2025, offering 25,44,000 equity shares at a price band of ₹114-₹120/share. With an issue size of ₹30.53 crore, the IPO aims to raise fresh capital for setting up a new manufacturing facility at Borisana, Mehsana (Gujarat), and meet general corporate expenses. Shares will list on BSE-SME on 24 September 2025

Sampat Aluminium GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 21 | 114-120 |

| Last Updated: 19 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Sampat Aluminium Core Business & Overview

The company was originally incorporated as Sampat Aluminium Private Limited on 11 June 1999. In mid-2024, it converted into a public limited company and was renamed Sampat Aluminium Limited.

Location & Facilities

Main manufacturing facility is located in Kalol, Gujarat, with an installed capacity of about 8,400 metric tonnes per annum (MTPA).

It plans to set up a new facility at Borisana, Mehsana in Gujarat to expand its production capacity.

Sampat Aluminium manufactures aluminium long products, primarily:

| Product Type | Sizes |

| Wires | 5.5 mm & 6.5 mm |

| Rods | mm, 9.5 mm, 12.5 mm, 16 mm, 20 mm |

Production is via Properzi process (continuous casting and hot-rolling). It also recycles aluminium scrap.

Markets & Customers

Sampat Aluminium’s products are sold across many Indian states (around 13–14 states) and 2 union territories.

The company has a diversified customer base: Number of customers served in recent years include 100-130 per FY.

Strengths

Based on the sources, here are at least three strong points for Sampat Aluminium:

- Diversified Customer Base & Geographic Reach

They serve many customers (100-130+) across multiple states/union territories. This reduces dependency on any one region or client. - Quality Systems & Process Control

ISO 9001:2015 certification, in-house testing labs (for raw material and finished goods), and the use of the Properzi process help maintain quality and process efficiency. - Consistent Profitability Improvement (Recent Years)

Though revenue has seen fluctuations, PAT has increased from FY23 to FY25 (₹1.42 crore → ₹6.93 crore). Also, improvements in EBITDA margins. - Use of Recycled Material & Zero Waste Practices

The company recycles aluminium scrap and uses it as raw material, and aims for zero waste manufacturing. This helps in sustainability, cost control. - Capacity Expansion Plan

Building a new facility (in Mehsana) implies room for scaling operations and meeting increased demand.

Risks

Here are significant risks and challenges the company faces, as per the sources:

- Raw Material Cost & Margin Pressure

Aluminium ingots / scrap are a large part of cost (majority of input cost). Any increase in raw material price, or inability to pass on cost to customers, could squeeze margins. - Working Capital Strain

Inventory levels and receivables are relatively high and growing, causing cash flow challenges. - Revenue Volatility / Demand Fluctuations

Revenue dropped from FY24 to FY25 (₹148.92 crore → ₹133.00 crore). Demand fluctuations or economic slowdown in end-user markets (construction, power, industrial) could adversely affect business. - Dependency on Key Suppliers & Customer Locations

While the customer base is diversified, large proportion of revenue comes from a few states (e.g. Gujarat, Maharashtra). Also, the top few suppliers account for a significant share of material purchase; any disruption in supply can hurt operations. - Capacity Utilization & Execution Risk

The existing facility may be operating below optimal capacity (some sources suggest 63-% utilization for older facility). The new facility must be built and commissioned in time and without cost overruns to deliver benefits. - Competition & Pricing Pressure

There is both organised and unorganised competition in aluminium long products. Also, it being a commodity business, price competition is intense.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 129.22 | 1.42 | 37.20 |

| FY 2024 | 147.01 | 6.58 | 51.56 |

| FY 2025 | 132.72 | 6.93 | 70.03 |

Revenue

- FY 2023: ₹129.22 crore

- FY 2024: ₹147.01 crore

- FY 2025: ₹132.72 crore

Revenue rose from FY23 to FY24 but declined in FY25, indicating demand fluctuations or pricing pressure despite expansion efforts.

Profit

- FY 2023: ₹1.42 crore

- FY 2024: ₹6.58 crore

- FY 2025: ₹6.93 crore

Profit has shown consistent growth, even when revenue fell in FY25. This suggests better cost management, higher margins, or efficiency improvements.

Total Assets

- FY 2023: ₹37.20 crore

- FY 2024: ₹51.56 crore

- FY 2025: ₹70.03 crore

Assets have steadily increased year-on-year, reflecting investment in capacity expansion and strengthening of the balance sheet.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.