Dev Accelerator IPO Overview

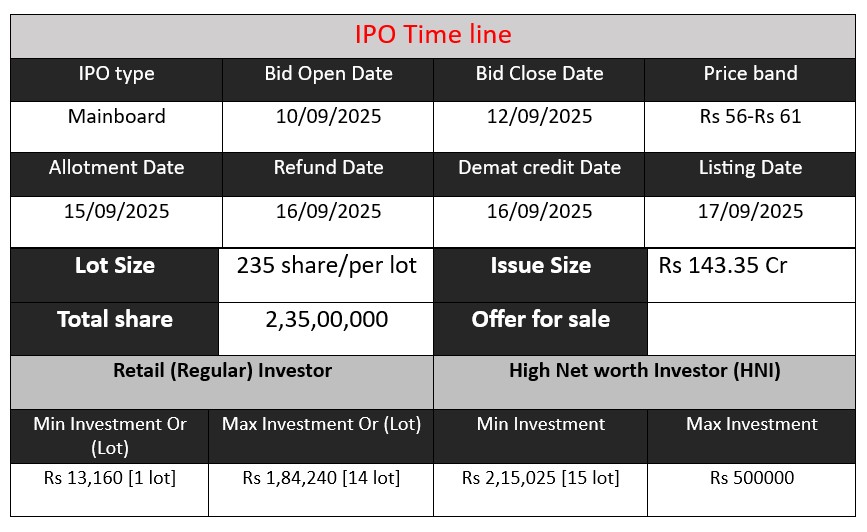

Dev Accelerator Ltd (DevX) launches its book-built IPO from 10 to 12 September 2025, issuing 2.35 crore fresh equity shares valued up to ₹143.35 crore. Proceeds will fund fit-outs of new centers, debt repayment and general corporate needs. The public issue comprises entirely new shares, with allotment expected by mid-September.

Dev Accelerator Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 2.40 |

| NIIs | 15.36 |

| Retails | 59.31 |

| Employees | 6.16 |

| Shareholders | 13.39 |

| Total | 16.08 |

| Last Updated:11 Sep 2025 | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 8 | 56-61 |

| Last Updated: 14 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Dev Accelerator Core Business & Overview

Dev Accelerator operates as a provider of flexible co-working and managed office spaces under the brand DevX. It delivers customizable workspace solutions—ranging from single desks to fully tailored office suites—without upfront capital costs and with fast fit-outs (90–120 days). This includes in-house design, delivery, and facility management services designed for modern enterprises, startups, and corporates.

Geographic Presence & Scale

As of May 2025, DevX operates 28 centers across 11 Indian cities, covering approximately 860,522 sq ft, and serving over 250 clients with a seating capacity of 14,144.

The company has a footprint in both Tier-1 and Tier-2 markets—including Delhi-NCR, Mumbai, Hyderabad, Pune, Ahmedabad, Indore, Jaipur, Udaipur, Rajkot, and Vadodara—and is expanding further, with new centers planned (Surat and its first international center in Sydney) under letters of intent.

Strengths

- High Occupancy & Growth Metrics

Dev Accelerator maintains above 80% occupancy, driven by strategic locations in Tier-2 cities and strong customer alignment.

Financially, it has shown robust growth: from FY2023 to FY2025, operational centers grew at a CAGR of 23.67%, seating at 16.34%, and built-up area at 15.24%. Revenue surged at a CAGR of 50.75%, reaching ₹158.87 crore in FY25. - Customer-Centric Offerings & Efficient Turnaround

Its no-upfront-cost model, customizable design, and rapid delivery (within 90–120 days) make it highly attractive to businesses seeking flexibility and speed. - Experienced Leadership

Promoters collectively hold over 21 years of experience in the flexible workspace sector, and the senior team brings over 57 years of combined industry experience—lending operational and strategic strength.

Risks

- Market Volatility & IPO Uncertainty

As this is Dev Accelerator’s first public offering, there’s no prior market for its shares. Post-listing liquidity and sustained trading levels are not assured. - Investment Risk

Like all equity investments, there’s risk of partial or total loss, particularly with a new issuer. The RHP advises that investors should rely on independent evaluation and be wary of market volatility. - Grey Market Sentiment

Although DevX has not seen a Grey Market Premium (GMP) in the unlisted market so far—indicating subdued initial buzz—this could reflect investor uncertainty about valuation or future performance. - Performance Risk for New Centers

Expansion into new territories—especially entering overseas markets—carries execution risk. New centers may underperform or take time to reach expected occupancy levels.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Total Assets |

| FY 2023 | 69.91 | -12.83 | 282.42 |

| FY 2024 | 108.09 | 0.44 | 411.09 |

| FY 2025 | 158.87 | 1.77 | 540.38 |

Revenue

- FY 2023: ₹69.91 crore

- FY 2024: ₹108.09 crore

- FY 2025: ₹158.87 crore

Revenue shows strong growth with a CAGR of 53% over three years. The company is rapidly scaling its operations and customer base.

Profit

- FY 2023: Loss of ₹12.83 crore

- FY 2024: Small profit of ₹0.44 crore

- FY 2025: Improved profit of ₹1.77 crore

The shift from losses in FY23 to consistent profitability in FY24 and FY25 highlights operational efficiency, cost control, and improved occupancy. However, margins are still modest compared to revenue growth, suggesting room for further efficiency gains.

Total Assets

- FY 2023: ₹282.42 crore

- FY 2024: ₹411.09 crore

- FY 2025: ₹540.38 crore

Assets grew steadily, reflecting expansion of centers and investments in infrastructure. Rising assets align with the company’s strategy to scale its presence across multiple cities and internationally.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.