Shringar House of Mangalsutra IPO Overview

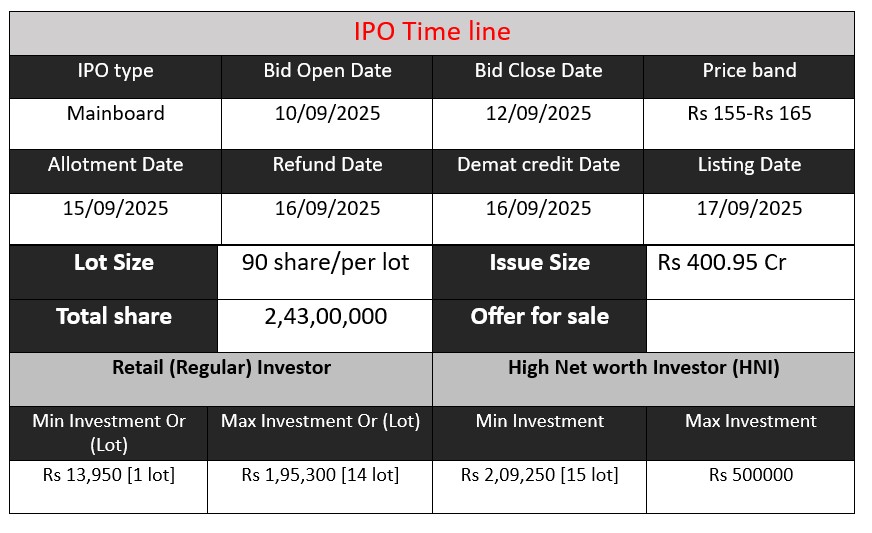

Shringar House of Mangalsutra Limited is launching a ₹400.95 crore fresh-issue IPO, offering 2.43 crore equity shares at a price band of ₹155–165 per share. The public subscription opens on September 10, 2025 and closes on September 12, 2025. Proceeds will be used to meet working capital needs (₹280 crore) and for general corporate purposes. The offer is entirely fresh equity with no offer-for-sale component.

Shringar House of Mangalsutra Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.86 |

| NIIs | 14.81 |

| Retails | 9.62 |

| Employees | 24.06 |

| Total | 8.24 |

| Last Updated: 11 Sep 2025 | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 31 | 155-165 |

| Last Updated: 14 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Shringar house of mangalsutra Core Business & Overview

Shringar House of Mangalsutra Ltd, incorporated in 2009, is a specialized jewelry company focused solely on the design, manufacturing, and marketing of premium mangalsutras. These are typically set in 18K and 22K gold and embellished with materials such as American diamonds, cubic zirconia, pearls, mother-of-pearl, and semi-precious stones—primarily catering to business-to-business (B2B) clients, including corporate buyers, wholesalers, and retailers across India and select international markets.

The company claims approximately 6% share of India’s organized mangalsutra market (CY23) and operates across 24 states and 4 union territories domestically, in addition to exports to the UK, USA, UAE, New Zealand, and Fiji.

Strengths

- Focused Market Niche with Design Expertise

Being a specialist in mangalsutras enables the company to build deep expertise and brand recognition in a high-value, culturally significant jewelry segment. - Strong B2B Client Portfolio & Distribution Network

It serves prominent clients such as Malabar Gold, Titan, GRT, Reliance Retail, Joyalukkas, Damas (UAE), and PN Gadgil—with nearly 34 corporate clients, over 1,000 wholesalers, and 81 retailers as of March 31, 2025. - Robust Financial Growth & Profitability Metrics

For FY25, revenue surged nearly 30% YoY to ₹1,430 cr, while PAT doubled to about ₹61 cr. Additionally, return ratios are impressive—ROCE = 32%, ROE = 36%, with EBITDA margin 6.5% and PAT margin 4.3%.

Risks

- Product & Geographic Concentration

The company is narrowly focused on mangalsutras—a segment tied to specific cultural and ritualistic demand—and heavily reliant on Maharashtra (which contributes around half of its ₹1,400 cr topline). This raises concerns over demand shifts or regional saturation. - Volume De-Growth Despite Revenue Growth

FY25’s revenue increase was driven by higher realizations (i.e., gold price inflation), while actual volume sold declined by 1%, potentially signaling weakening underlying demand. - Operational Efficiency & Inventory Metrics

The inventory turnover ratio fell to 6.3x in FY25 from 7.6x in FY24, lagging behind peers (e.g., Shanti Gold, Utssav CZ at 7.5x, Sky Gold at 9x), indicating slower stock movement and possible working capital constraints

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 950.22 | 23.36 | 211.55 |

| FY 2024 | 1101.52 | 31.10 | 265.00 |

| FY 2025 | 1429.81 | 61.11 | 375.75 |

Revenue

- FY 2023: ₹950.22 Cr

- FY 2024: ₹1101.52 Cr

- FY 2025: ₹1429.81 Cr

Revenue has shown consistent growth, increasing by ~16% in FY24 and 30% in FY25. This sharp acceleration in FY25 highlights strong demand and expansion in operations.

Profit

- FY 2023: ₹23.36 Cr

- FY 2024: ₹31.10 Cr

- FY 2025: ₹61.11 Cr

Profit has more than doubled from FY23 to FY25. The margin improvement shows better cost management and scaling benefits. FY25 marks a significant jump, reflecting strong operational efficiency.

Total Assets

- FY 2023: ₹211.55 Cr

- FY 2024: ₹265.00 Cr

- FY 2025: ₹375.75 Cr

Assets have been steadily growing, with a 77% rise from FY23 to FY25. This indicates ongoing investment in infrastructure, inventory, and expansion to support future growth.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.