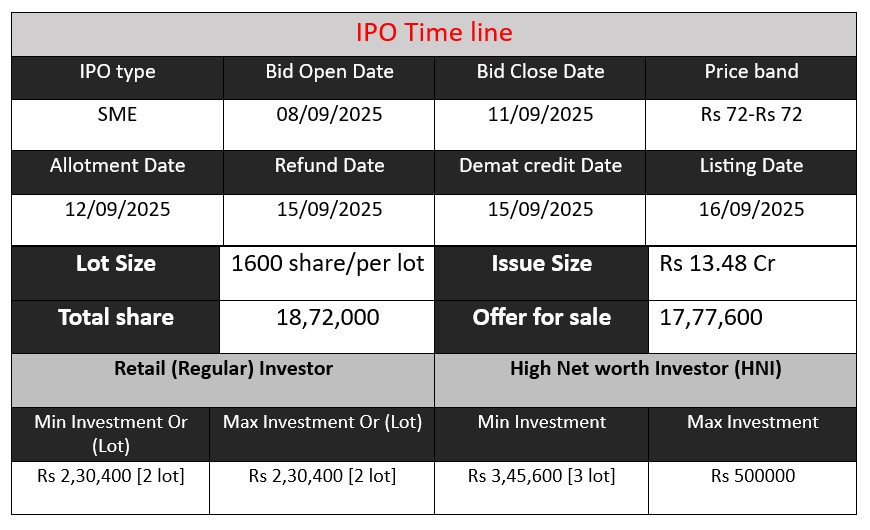

Krupalu Metals Ltd’s SME IPO is a fixed-price fresh issue of 1,872,000 equity shares at ₹72 each (face value ₹10), raising approximately ₹13.48 crore. The offer opens on 8 September 2025 and closes on 10 September 2025. Proceeds are earmarked for capital expenditure (new plant & machinery), working capital, and general corporate purposes. Listing is scheduled on BSE-SME.

Krupalu Metals GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 72 |

| Last Updated: 11 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Krupalu Metals Core Business & Overview

Krupalu Metals Ltd. originated in 2009 as Krupalu Engineering Services and evolved to its current form, headquartered in Jamnagar, Gujarat—a prominent center for brass and copper industries in India.

Primary Activities

The company specializes in manufacturing and supplying a wide range of brass and copper products, including sheets, strips, and custom components such as inserts, pipe fittings, terminals, bus bars, and electrical parts. They also offer job-work services and trading of raw materials.

Manufacturing Capabilities

Situated at a modern manufacturing facility (Plot No. 4345, GIDC Phase-III, Jamnagar), Krupalu Metals has automated and semi-automated production lines with a monthly capacity of approximately 150 tonnes.

Quality Standards

The company holds ISO 9001:2015 certification, showcasing its commitment to maintaining rigorous quality management systems.

Strengths

- Experienced Promoters & Leadership

Led by promoters like Mr. Jagdish Parsottambhai Katariya (Managing Director) and Mr. Navinbhai Katariya (Executive Director), with over 17 years of industry experience each. - Diversified Product Portfolio & Industry Reach

The wide range of brass and copper products serve multiple sectors—automotive, construction, electrical, oil & gas, agriculture, and water treatment—providing resilience through diversified end-markets. - Strategic Location & Production Base

Operating from Jamnagar, known as the “Brass City of India”, Krupalu benefits from proximity to raw materials and industry networks. Additionally, they maintain a renewable 99-year lease through GIDC, enhancing operational stability. - Customer Retention & Quality Focus

The firm cultivates strong client relationships, repeat business, and adheres strictly to customized quality specifications, bolstered by a focused QA team and adherence to certification norms.

Risks

- Customer & Supplier Concentration

A significant portion of revenue comes from a small set of key clients. Losing any of them could materially impact business performance. Similarly, reliance on limited suppliers increases vulnerability to supply chain disruptions. - Geographical Concentration

With all manufacturing operations in Gujarat and over 86% of its revenue derived from the same region, the company is susceptible to regional economic, regulatory, or logistical issues. - Cash Flow Constraints

The company reported negative operational, investing, and financing cash flows in recent years. Persistent cash outflows could pose liquidity challenges down the line. - Legal & Reputational Concerns

Krupalu Metals, its directors, and associated entities are involved in certain legal proceedings (including criminal or tax-related cases). Any adverse outcomes could negatively affect their reputation, operations, and financials. - Material & Competition Risks

Fluctuations in raw material prices, limited diversification beyond brass products, rising labor costs, and pressure from competitive or alternative materials (like aluminum or plastics) could erode margins and margin reliability.

Financial Performance Overview (₹ in Crore)

| Particulars | FY 2023 | FY 2024 | FY 2025 |

| Revenue (₹ Cr.) | 33.57 | 37.11 | 48.39 |

| Profit (₹ Cr.) | 0.42 | 1.55 | 2.15 |

| Total Assets (₹ Cr.) | 15.25 | 19.46 | 20.03 |

Revenue

- FY 2023: ₹33.57 crore

- FY 2024: ₹37.11 crore

- FY 2025: ₹48.39 crore

Revenue grew steadily with a 44% rise from FY 2023 to FY 2025, showing strong demand for the company’s products and improved market reach.

Profit

- FY 2023: ₹0.42 crore

- FY 2024: ₹1.55 crore

- FY 2025: ₹2.15 crore

Profit increased over 5 times from FY 2023 to FY 2025. This reflects better cost control, higher margins, and efficient operations, though the absolute profit base is still relatively small.

Total Assets

- FY 2023: ₹15.25 crore

- FY 2024: ₹19.46 crore

- FY 2025: ₹20.03 crore

Assets expanded by 31% between FY 2023 and FY 2025, suggesting consistent reinvestment in infrastructure and capacity. Growth in FY 2025 slowed compared to FY 2024, indicating stabilization after expansion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.