Abril Paper Tech IPO Overview

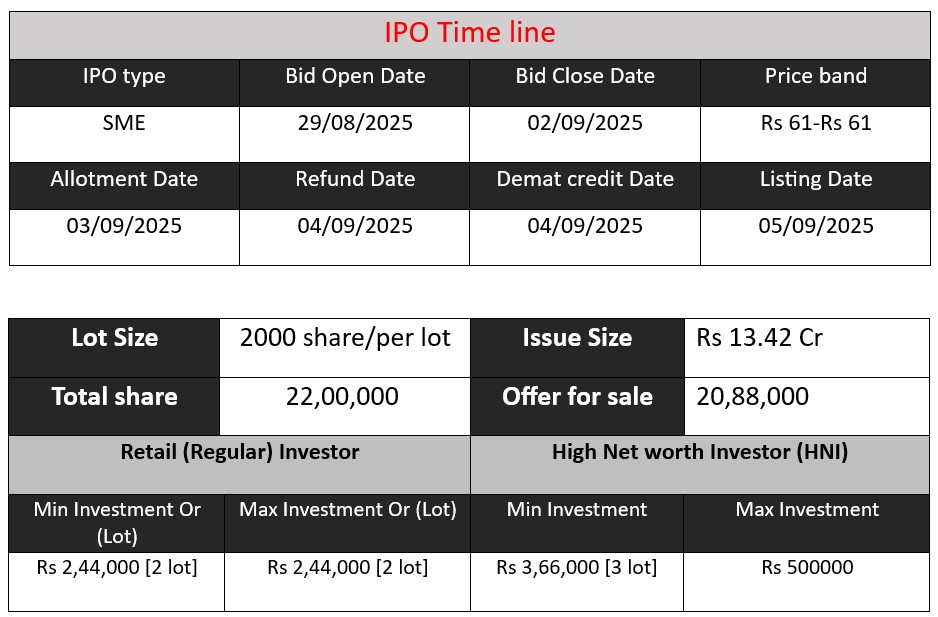

Abril Paper Tech Ltd’s IPO opens on August 29, 2025, and closes on September 2, 2025, offering 22 lakh fresh equity shares (₹10 face value) at a fixed price of ₹61 per share, raising ₹13.42 crore. The proceeds will fund two fully automatic coating and slitting machines (₹5.40 cr), working capital (₹5 cr), general corporate purposes (₹2.01 cr), and IPO expenses (₹1.01 cr). Listing is scheduled on the BSE-SME platform.

Abril Paper Tech Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 2.03 |

| NIIs | 5.34 |

| Retails | 1.90 |

| Total | 2.78 |

| Last Updated: 02 Sep 2025 5 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 3 | 61 |

| Last Updated: 02 Sep 2025 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

Abril Paper Tech Limited specializes in the manufacture and supply of sublimation heat transfer paper across GSM specifications (30, 65, 75, and 90). These papers are widely used in digital printing applications such as garments, textiles, hosiery, curtains, furniture, home furnishings, and other decorative items.

Incorporated in November 2023, the company emerged from Abril International. It operates its manufacturing and warehousing facility in Surat, Gujarat, leveraging the region’s strengths in textiles and printing industries.

Strengths

- Quality and Product Diversification

Abril offers high-quality sublimation paper in various GSM grades (30–90) and sizes (24–72 inches), catering to a broad spectrum of printing needs in fashion, home décor, and industrial segments. - Pan-India Reach & Distribution Network

The company maintains an extensive B2B network across 17 Indian states through distributors, with plans to strengthen its B2C footprint via online and dealer networks—targeting new high-margin markets like FMCG packaging and readymade garments.

Risks

- High Dependence on Raw Material Supply

Raw material costs dominate manufacturing expenses (89%), and Abril relies on a limited number of base-paper and chemical suppliers. Any price volatility or supply disruptions could materially affect margins. - Client Concentration Risks

The company’s revenues may disproportionately rely on a handful of clients, posing a risk if any major customer reduces orders or shifts allegiance. - Geographic and Operational Concentration

Abril operates from a single facility in Surat. This concentration exposes operations to local disruptions, regulatory changes, or logistical issues. - High Working Capital Needs

The business model is capital-intensive, requiring constant working capital. Any disruptions in liquidity or tight credit conditions could strain operations. - Regulatory & Environmental Compliance Risks

Manufacturing chemicals are involved in coating processes. Any changes in environmental or manufacturing regulations may lead to compliance costs or operational challenges.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 25.26 | 0.39 | 7.30 |

| FY 2024 | 25.12 | 0.96 | 14.59 |

| FY 2025 | 60.91 | 1.41 | 12.96 |

Revenue:

Revenue remained flat in FY 2023–24 (₹25 Cr.) but jumped sharply in FY 2025 to ₹60.91 Cr., indicating strong business growth.

Profit:

Profitability improved from ₹0.39 Cr. in FY 2023 to ₹0.96 Cr. in FY 2024, and further to ₹1.41 Cr. in FY 2025. However, profit growth is slower compared to revenue, suggesting higher costs or thin margins.

Assets:

Assets increased significantly in FY 2024 (₹14.59 Cr.) but declined slightly in FY 2025 to ₹12.96 Cr., showing possible restructuring, repayment, or asset revaluation

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.