Essex Marine IPO Overview

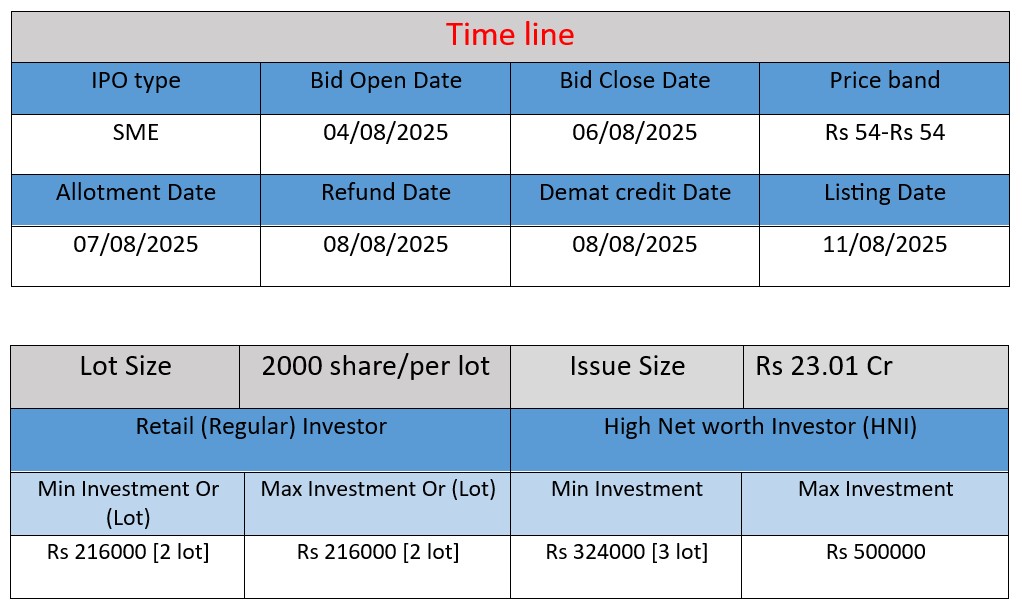

Essex Marine Ltd’s SME IPO opens 4 August 2025 and closes 6 August 2025, issuing 42.62 lakh equity shares (face value ₹10) at ₹54/share to raise ₹23.01 crore. Of these, 2.14 lakh shares are reserved for market makers, and 40.48 lakh shares are offered to the public. Proceeds will fund peeling capacity expansion, a ready‑to‑cook section, working capital, loan repayment/pre‑payment, and general corporate purposes

Essex Marine Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.00 |

| NIIs | 0.48 |

| Retails | 2.79 |

| Total | 1.56 |

| Last Updated: 6 Aug 2025 Time: 11 AM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 54 | |

| Last Updated: 6 Aug 2025 Time: 11 AM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Incorporated in 2009, Essex Marine Limited is a Kolkata‑based seafood processing and export firm operating under its brand “Essex”.

- Its facility in Shankarpur, Purba Medinipur, West Bengal—near a major landing centre—handles procurement, processing, cold storage, and export of marine fish, vannamei shrimp, squid, eel, mackerel, etc. It serves international markets including China, Europe, Israel, and job‑work clients.

- The company operates an 1,800 MT cold storage in Kolkata (Tangra), and its plant holds international quality certifications such as HACCP, FSSC V5.1, BRC, GMP, SSOP, FSSAI.

Strengths

- Strategic location of the processing unit near major landing centres ensures access to high-quality raw seafood at low cost.

- Global export footprint with repeat orders from markets in China, Europe, and Israel, indicating reliable demand and long-term relationships.

- Quality and compliance credentials: certifications (FSSC, BRC, HACCP) align with international standards and support export credibility.

- Management expertise: experienced promoters and leadership team with substantial industry background in seafood processing and exports.

Potential Risks

- Biosecurity and environmental exposure: seafood operations are vulnerable to disease outbreaks at shrimp farms, hatcheries, landing sites, processing facilities, and during transport—a material financial risk.

- Product concentration risk: heavy reliance on only a few products (e.g., shrimp and certain fish), meaning adverse changes in demand or pricing could impact revenue significantly.

- Customer and geographic concentration: a substantial portion of revenue stems from repeat orders and large clients in a limited number of export destinations. Loss of any major client or political/economic disruptions abroad could affect operations.

- Operational dependencies and financial structure:

- Majority of operations in West Bengal region—a regional supply risk.

- Dependence on uninterrupted power supply for processing/cold storage.

- Unsecured borrowings from promoters repayable on demand, which may affect liquidity

Financial Performance Overview (₹ in Crore)

| Financial Year | Revenue | Profit | Total Assets |

| FY 2022 | 59.80 | 1.73 | 43.89 |

| FY 2023 | 21.90 | 2.03 | 40.99 |

| FY 2024 | 19.15 | 1.82 | 34.25 |

Revenue

- FY 2022: ₹59.80 crore — Strong sales year.

- FY 2023: ₹21.90 crore — Sharp drop of ~63% from FY 2022.

- FY 2024: ₹19.15 crore — Further decline (~13%) from FY 2023.

The consistent drop in revenue may be due to reduced export volumes, market fluctuations, or operational challenges. This is a red flag for top-line growth.

Profit

- FY 2022: ₹1.73 crore

- FY 2023: ₹2.03 crore — Grew despite lower revenue.

- FY 2024: ₹1.82 crore — Slight decline from FY 2023 but better than FY 2022.

The company has managed to sustain profitability through cost control or better margins, even with falling revenue.

Total Assets

- FY 2022: ₹43.89 crore

- FY 2023: ₹40.99 crore

- FY 2024: ₹34.25 crore

Gradual asset decline may indicate repayment of loans, depreciation, or lower capital expenditure. This shows the company is becoming asset-light but could also reflect shrinking scale.

✅ Pros

- Strategic location near fish landing centers boosts raw material access.

- Export-focused business with international certifications (FSSC, BRC, HACCP).

- Consistent profitability despite revenue decline.

- Expansion plans into value-added products like ready-to-cook seafood.

❌ Cons

- Significant revenue decline over the past 2 years.

- Business concentrated in specific products and geographies.

- Vulnerable to disease outbreaks and environmental risks.

- SME IPO—lower liquidity and higher investor risk.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.