Sellowrap Industries IPO Overview

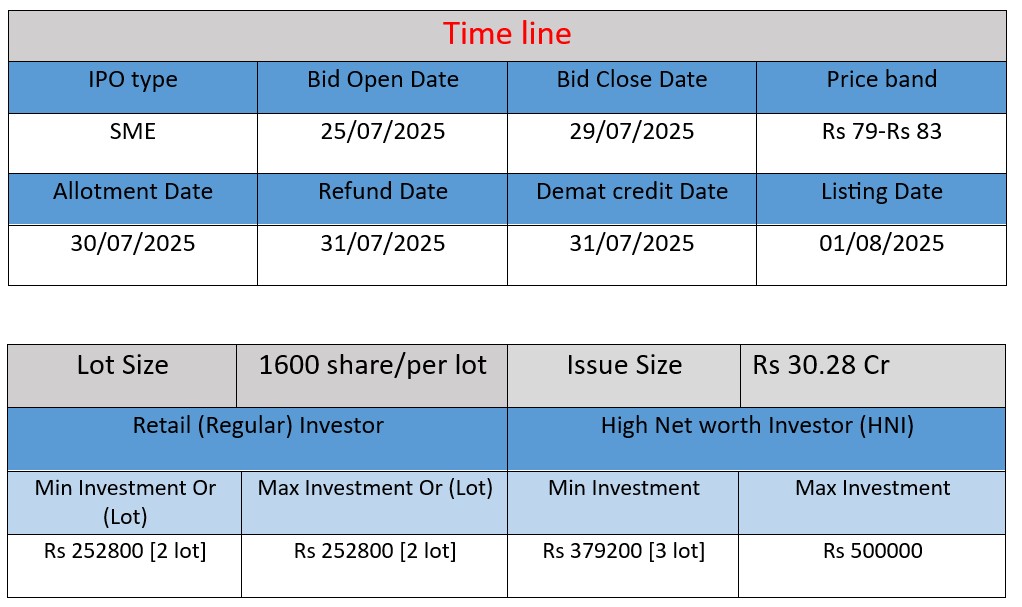

Sellowrap Industries IPO opens on July 25 and closes on July 29, 2025. The issue size is ₹30.28 crore, entirely a fresh issue of 36.47 lakh shares. Price band is ₹79–83 per share. Minimum lot size is 1600 shares. The funds will be used for machinery purchase, infrastructure expansion, working capital, and general corporate purposes. Listing is planned on NSE SME on August 1, 2025.

Sellowrap Industries IPO Subscription Status

| Category | Subscription (x) |

| QIBs | 18.69 |

| NIIs | 111.30 |

| Retails | 62.99 |

| Total | 56.34 |

| Last Updated: 29 July 2025 Time: 5 PM (Note: This data is updated every 2 hours) Source: NSE/BSE | |

| GMP (₹) | IPO Price (₹) |

| 14 | 83 |

| Last Updated: 29 July 2025 Time: 5 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded & Location: Originally launched as a proprietorship in 1983; incorporated as Sellowrap Industries Private Limited in 2004; converted to Public Limited company effective October 15, 2024.

- Specialisation: Manufactures customized engineered components—primarily plastic injection‑moulded parts, PU foam mouldings, foam NVH (noise, vibration, harshness) parts, screen sealing parts, labels and stickers, and EPP‑moulded structures—for the automotive, white goods, and non‑automotive sectors.

- Operations: B2B supplier to marquee OEMs in India and exports to markets like Brazil, Germany, and the UK; operates four manufacturing facilities across Gurugram (Haryana), Ranipet and Kancheepuram (Tamil Nadu), and Pune (Maharashtra), spread over ~5 acres, equipped with centralized R&D and warehousing.

Strengths

- Quality & Certifications: Maintains a zero‑defect quality track record with awards from Suzuki Motor Gujarat and ACMA Safety Excellence; certified under IATF 16949:2016 (automotive quality), ISO 45001:2018 (health & safety), ISO 14001:2015 (environment), and ISO 27001:2013 (information security).

- Trusted OEM Partnerships: Long-term relationships with leading domestic and international OEMs that support consistent demand and collaborative product innovation.

- Integrated Manufacturing & R&D: In‑house R&D team of engineers (~11) supports innovation and advanced materials development; facilities strategically located near key OEM hubs to reduce lead times and improve efficiency.

Potential Risks

- Sector Concentration: Reliance on the automotive sector’s health; any slowdown in vehicle production or demand could significantly impact revenues.

- Customer Concentration Risk: High dependency on top 10 customers, which could affect revenue stability if any major client cuts business or delays orders.

- Operational Disruptions: Risk of manufacturing downtime or machinery breakdowns affecting delivery schedules and production continuity.

- Sustainability of Profit Margins: Recent sharp increases in PAT margins may be difficult to maintain over time, especially under cost pressures or competitive pricing.

- Leverage & Compliance Exposure: Relatively high debt-equity ratio and legal exposure on labour compliance in India could increase financial risk.

Financial Performance Table

| Financial Year | Revenue (₹ Cr) | Profit (₹ Cr) | Total Assets (₹ Cr) |

| FY 2023 | 131.76 | 2.86 | 92.82 |

| FY 2024 | 138.02 | 5.94 | 99.79 |

| FY 2025 | 162.45 | 9.97 | 143.02 |

Revenue

- In FY 2023, revenue stood at ₹131.76 crore.

- It rose to ₹138.02 crore in FY 2024 — a growth of 4.8%.

- In FY 2025, revenue further jumped to ₹162.45 crore — a growth of 17.7% over the previous year.

Consistent revenue growth indicates increasing demand for the company’s products and its strong position in the automotive and white goods segments.

Profit

- Profit was ₹2.86 crore in FY 2023.

- It more than doubled to ₹5.94 crore in FY 2024 — over 107% growth.

- By FY 2025, profit rose further to ₹9.97 crore — 68% growth over FY 2024.

The sharp rise in profit reflects improved cost efficiency, operational performance, and better margins.

Total Assets

- FY 2023: ₹92.82 crore

- FY 2024: ₹99.79 crore (7.5% increase)

- FY 2025: ₹143.02 crore (43.3% increase)

The significant asset growth in FY 2025 may be due to investment in infrastructure, machinery, and funds raised through the IPO.

| ✅ Pros of Sellowrap Industries IPO |

| Strong OEM Client Base – Long-term B2B relationships with trusted brands Consistent Financial Growth – Steady rise in revenue, profit, and assets Global Exports – Serving international markets like Brazil, Germany, UK Certified & Award-Winning – IATF and ISO certified; recognized by Suzuki Growth-Driven IPO Use – Funds to be used for machinery and expansion Strategic Factory Locations – Plants near major automotive hubs |

| ⚠️ Cons of Sellowrap Industries IPO |

| High Customer Dependence – Revenue largely depends on top 10 clients Automotive Sector Risk – Vulnerable to slowdowns in the auto industry ME Platform Listing – Lower liquidity and investor activity Competitive Market – Operates in a high-competition industry Debt & Compliance Exposure – Moderate debt and regulatory risks Uncertain Margin Sustainability – Recent profit jump may not last |

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.