हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

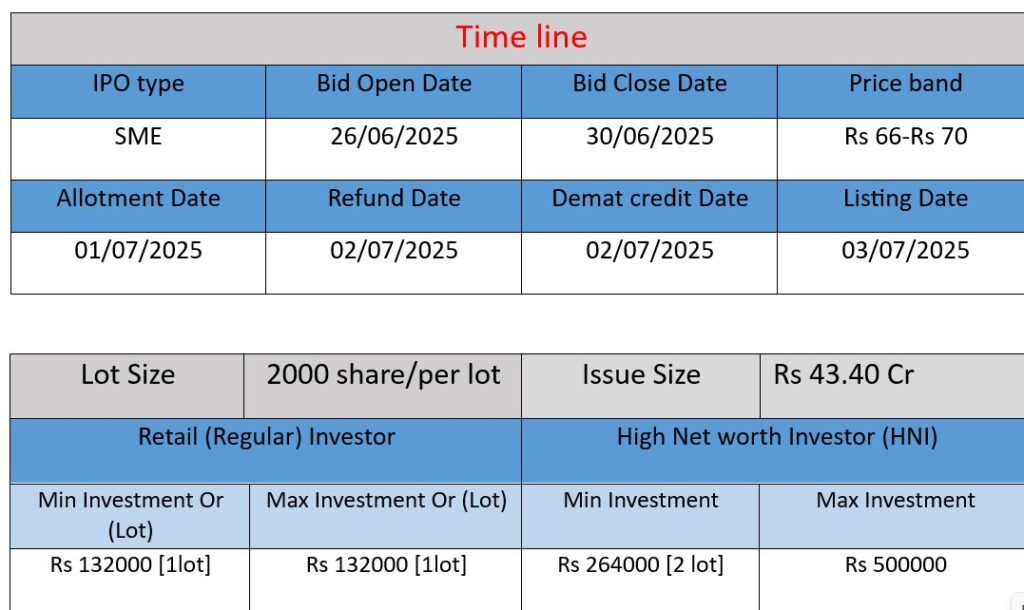

Moving Media Entertainment Ltd’s SME IPO (₹10 face value) opens June 26–30, 2025, aiming to raise ₹43.40 crore via a fresh issue of 62 lakh shares at ₹66–70 each. Proceeds will fund ₹25 cr for advanced camera and AV gear, ₹9 cr for debt repayment, and the balance for general corporate purposes. Listing is expected on NSE SME around July 3.

Core Business

- Rental specialist for camera & audio-visual gear: Incorporated in May 2022 (CIN U92419MH2022PLC382959), Moving Media offers rental of high-end cameras, lenses, lighting, sound equipment, and accessories—catering to film producers, ad agencies, broadcasters, events, and content creators—with nationwide reach.

- Comprehensive support services: Alongside equipment rental, the company provides delivery, setup, on-site technical assistance, user training, and post-installation maintenance through trained engineers.

- Key clients: Their clientele includes major names like Star India, Sunshine Pictures, SOL Production, Celebframe, and others.

Strengths

- Rapid revenue growth & strong margins: FY25 revenue rose ~59% to ₹37.06 cr, with high operating leverage (EBITDA margin ≈77%) and healthy PAT margin (~28%), demonstrating efficient business scaling.

- Niche positioning with specialized service: Operating in a niche domain with technical value-add (gear + expertise + support), setting itself apart from general rental players.

Risk Factors

- High dependency on media production cycles: Demand is tied to film/TV/digital shoot schedules—any slowdown in production (e.g., pandemic resurgence or budget cuts) could severely impact utilisation rates.

- Technology obsolescence: Camera and lighting tech evolves rapidly. The company must continually refresh its inventory to stay current—CAPEX-intensive.

- Financial leverage: They plan to use proceeds partly to repay debt. Still, sudden market disruptions could affect cash flow and ability to service any residual debt.

Moving Media has established itself quickly in a specialized, high-margin niche within India’s M&E sector. Its growth track, robust margins, and strategic use of IPO capital (for equipment upgrades and debt easing) position it well. However, its success is closely tied to the cyclicality of media production and its need to keep pace with evolving technology. The lukewarm initial IPO response suggests cautious market sentiment.

➡️ If production activity keeps up and they successfully refresh gear, the company could continue its momentum. However, potential investors should keep an eye on booking trends, tech cycles, and future financial health before subscribing.

Here is a brief financial performance analysis across FY2023 to FY2025:

Revenue

- FY2025: ₹37.06 crore

- FY2024: ₹23.38 crore

- FY2023: ₹7.67 crore

Analysis:

The company has shown explosive revenue growth, with a 58.5% increase in FY25 and a 204.7% increase in FY24. This consistent upward trend reflects strong demand for its specialized media equipment rental services and efficient business scaling.

Profit

- FY2025: ₹10.40 crore

- FY2024: ₹10.09 crore

- FY2023: ₹1.50 crore

Analysis:

Net profit more than tripled in FY24, with slight growth in FY25 despite higher revenue, indicating high fixed costs or initial reinvestments. Still, maintaining profitability above ₹10 crore is a strong sign of financial stability and operational efficiency.

Total Assets

- FY2025: ₹94.77 crore

- FY2024: ₹32.56 crore

- FY2023: ₹8.34 crore

Analysis:

Assets jumped by 191% in FY25, likely due to new equipment purchased ahead of the IPO. This increase shows aggressive expansion and capital investment, but it also implies the company must maintain high asset utilization to stay efficient.

Summary

- Revenue and asset growth show a rapidly scaling business.

- Profit has remained strong despite heavy capital spending.

- Company is asset-intensive but maintains strong margins.

- With IPO proceeds focused on upgrading equipment and reducing debt, the financial position is expected to further improve.