हिंदी में पढ़ने के लिए मेनू बार से हिंदी भाषा चयन करें।

What’s Happening?

Tesla’s electric vehicle (EV) sales in the European Union have dropped by over 40.5% year-over-year, signaling a serious concern for the global EV leader. Once hailed as the benchmark for innovation and performance, Tesla’s Model Y, its flagship model in Europe, is now losing appeal in a rapidly evolving market.

Reasons Behind the Decline

| Factor | Details |

| Aging Models | Tesla hasn’t significantly updated its mainstream models, especially the Model Y and Model 3, in years. Competitors are releasing fresh, feature-rich alternatives. |

| Rising Competition | Chinese EV giants like BYD are entering Europe with aggressively priced and well-equipped electric vehicles. |

| Local EV Surge | European brands such as Volkswagen, Renault, and Stellantis are capturing market share with homegrown models that benefit from subsidies and local production. |

| Charging Advantage Shrinking | Tesla’s charging network used to be a major edge, but open-access policies and expanding third-party infrastructure have narrowed that gap. |

| Regulatory Pressures | Some European nations are imposing additional taxes on luxury or heavier EVs, hurting Tesla’s price competitiveness. |

Europe’s Changing EV Landscape

- BYD’s Expansion: BYD has quickly gained traction in Germany, Norway, and the Netherlands with budget-friendly EVs that appeal to mass-market consumers.

- Volkswagen’s Resurgence: With models like the ID.3 and ID.7, VW is reclaiming domestic loyalty and offering better after-sales support.

Incentive Shift: Many EU nations are modifying EV subsidies to favor local manufacturing or lower-priced vehicles

Tesla’s Market Share in Decline

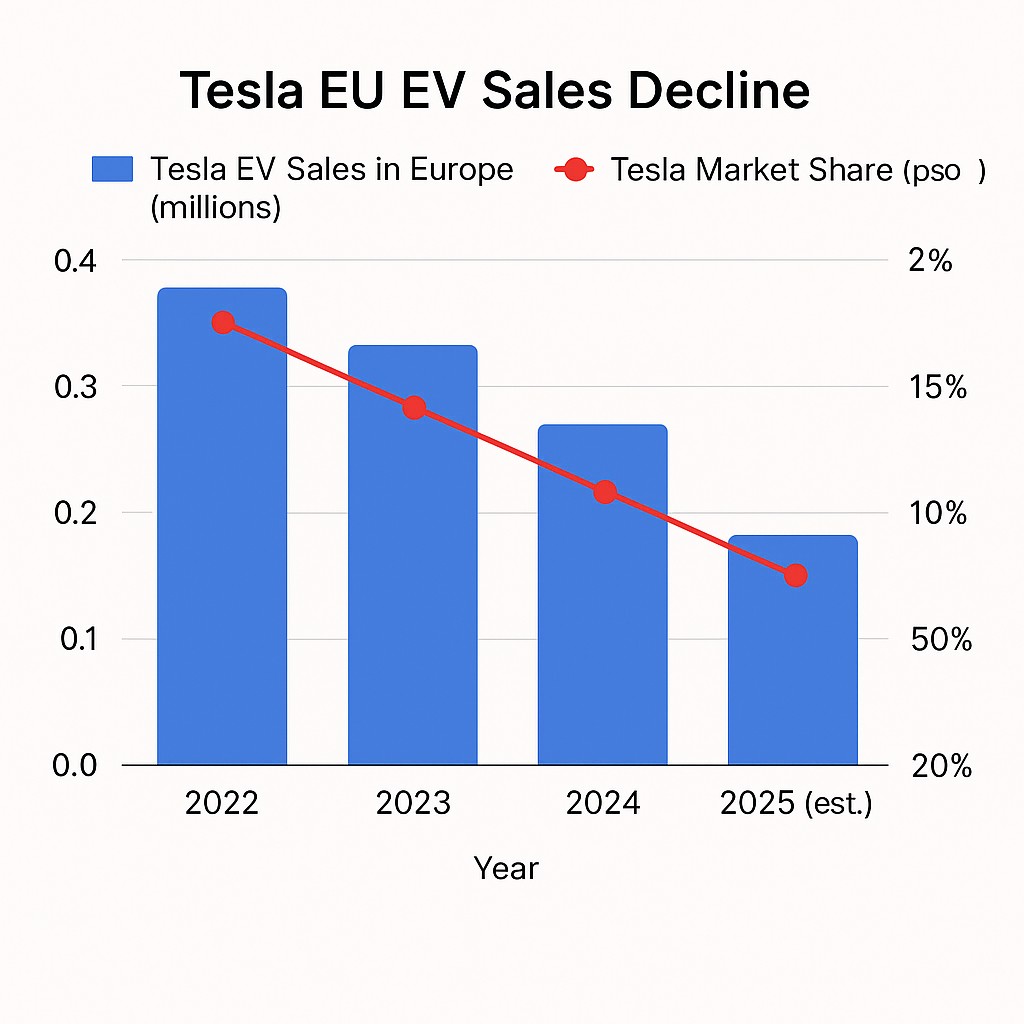

The chart below illustrates Tesla’s declining EV sales in the EU and its shrinking market share from 2022 to an estimated low in 2025:

| Year | Tesla EU Sales (Millions) | Market Share (%) |

| 2022 | 0.35 | 20% |

| 2023 | 0.31 | 17% |

| 2024 | 0.25 | 14% |

| 2025* | 0.15 (Est.) | 12.5% (Est.) |

What Tesla Must Do

To regain traction in Europe, Tesla needs to:

- Launch New Models: Introducing long-awaited models like the Cybertruck or a budget-friendly compact EV would re-energize its lineup.

- Strengthen Local Operations: Expanding Gigafactory Berlin’s output and sourcing locally will reduce costs and improve margins.

- Revamp Pricing: With rising competition, Tesla must revisit its pricing strategy—especially for entry-level variants.

- Boost Localization: Tailoring features and designs to European tastes (compact cars, city-range EVs) is essential.

Tesla’s declining sales in Europe are not just numbers—they’re a reflection of a broader market shift. Consumers are prioritizing value, variety, and local relevance, and Tesla’s current lineup seems increasingly out of sync. To stay ahead, the company must rethink, retool, and relaunch its strategy before its dominance in one of the world’s most mature EV markets slips further.