Wework India IPO Overview

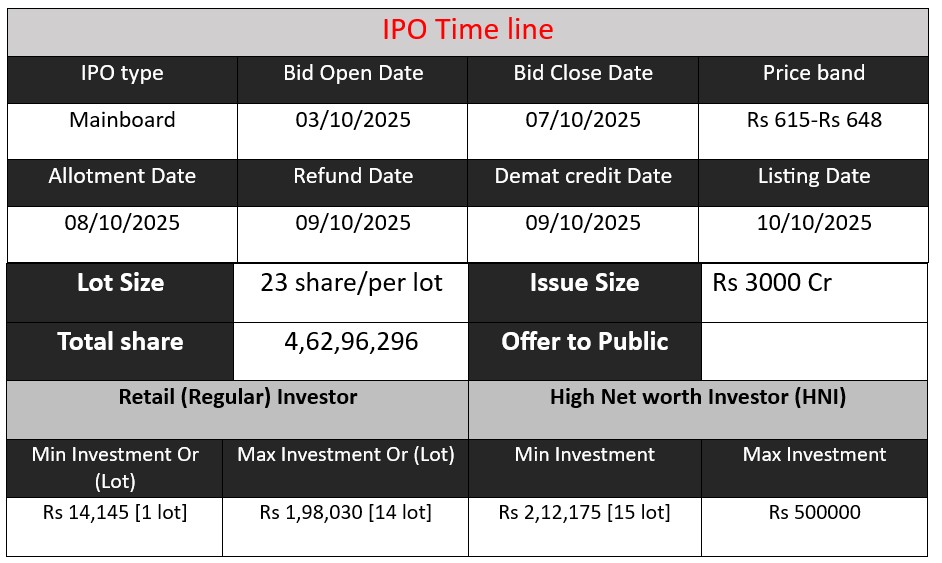

WeWork India Management Ltd. is launching its Initial Public Offering (IPO) from October 3 to October 7, 2025. The price band is set between ₹615 and ₹648 per share, aiming to raise up to ₹3,000 crore through an Offer for Sale (OFS) of 46.3 million shares. The IPO is scheduled to list on the NSE and BSE on October 10, 2025. Proceeds will go to selling shareholders, Embassy Buildcon LLP and 1 Ariel Way Tenant Ltd.

Wework India GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 615-648 |

| Last Updated: 8 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Wework India Core Business & Overview

WeWork India Management Limited is a leading provider of premium flexible workspaces in India, offering a range of office solutions including private offices, co-working spaces, and customized managed offices. Established in 2017 and backed by the Embassy Group, WeWork India has grown to become one of the largest operators in the sector, with a strong presence in major cities such as Bengaluru, Mumbai, Delhi, and Pune.

Wework Core Operations

WeWork India specializes in transforming leased properties into fully managed, tech-enabled office spaces. As of June 2025, the company operates 68 centers across 8 cities, providing over 114,000 desks in approximately 7.67 million square feet of leasable area. The company’s offerings cater to a diverse clientele, including large enterprises, startups, and individual professionals.

Strengths

- Market Leadership: WeWork India has been the largest flexible workspace operator in India by total revenue for the past three fiscal years, as reported by CBRE.

- Strong Brand Recognition: The company enjoys high brand visibility and a loyal customer base, bolstered by its association with the global WeWork brand and local expertise through the Embassy Group.

- Diverse Offerings: WeWork India provides a comprehensive range of workspace solutions, including private offices, co-working spaces, and hybrid digital solutions, catering to various business needs.

Risks

- Concentration Risk: A significant portion of WeWork India’s revenue is derived from a few key landlords and cities. For instance, over 70% of its revenue comes from Bengaluru and Mumbai, and the top 10 landlords account for 34.3% of its lease agreements.

- Economic Sensitivity: The demand for flexible workspaces is closely tied to economic cycles. Economic downturns or shifts in business sentiment could impact occupancy rates and rental income.

- Regulatory and Operational Risks: Operating in multiple cities requires compliance with various local regulations and obtaining necessary approvals. Any lapses in compliance or operational challenges could affect business continuity

Financial Performance Overview (₹ in Crore)

| Financial Metric | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 1314.52 | 1665.14 | 1949.21 |

| Profit | -146.81 | -135.77 | 128.18 |

| Assets | 4414.02 | 4482 | 5391.67 |

Revenue

- FY 2023 → FY 2024: Revenue increased from ₹1,314.52 Cr to ₹1,665.14 Cr, showing a growth of 26.6%. This indicates strong business expansion, likely due to more office spaces and clients in major cities like Bengaluru, Mumbai, and Delhi.

- FY 2024 → FY 2025: Revenue further increased to ₹1,949.21 Cr, a growth of 17%, reflecting continued demand for flexible office solutions and effective utilization of assets.

Profit

- FY 2023 → FY 2024: Losses decreased slightly from -₹146.81 Cr to -₹135.77 Cr, indicating some operational improvements and better cost management.

- FY 2024 → FY 2025: The company turned profitable with ₹128.18 Cr profit, marking a positive turnaround. This shows that revenue growth, combined with controlled expenses, has started generating net profits.

Assets

- FY 2023 → FY 2024: Assets increased slightly from ₹4,414.02 Cr to ₹4,482 Cr, suggesting moderate investments in office spaces and infrastructure.

- FY 2024 → FY 2025: Assets grew significantly to ₹5,391.67 Cr, a 20.3% increase, reflecting expansion into new centers and strategic investments to support the growing revenue base.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.