VMS TMT IPO Overview

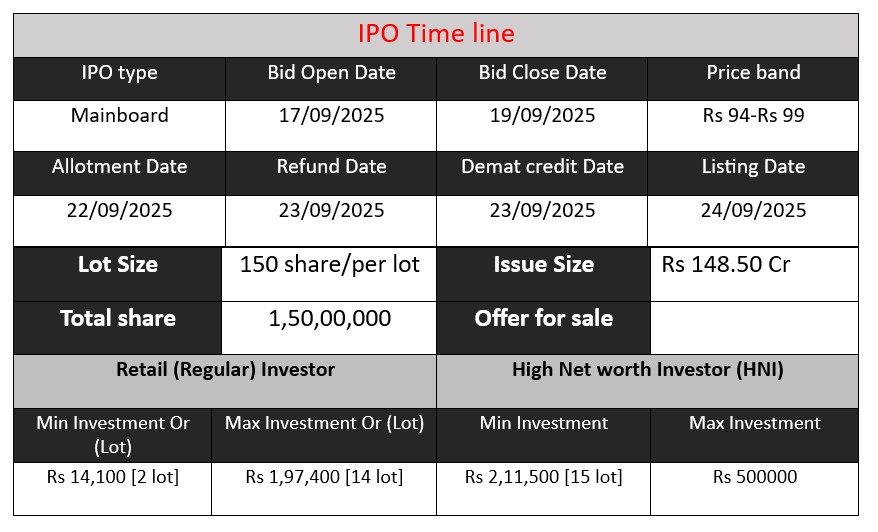

VMS TMT Limited IPO opens for subscription 17-19 September 2025, offering 1.50 crore fresh equity shares at a price band of ₹94-99 per share. The company aims to raise approximately ₹148.50 crore, with proceeds largely earmarked for repayment/prepayment of its borrowings and the balance for general corporate purposes. Shares to list on BSE & NSE on 24 September 2025.

VMS TMT GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 15 | 94-99 |

| Last Updated: 19 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

VMS TMT Core Business & Overview

VMS TMT is a steel manufacturer focused on producing TMT bars (Thermo-Mechanically Treated bars), which are used in reinforced concrete in construction due to their strength, ductility and resistance.

Facilities & Capacity: The company has a manufacturing facility at Bhayla Village, Ahmedabad, Gujarat. Its installed capacity is about 200,000 tonnes per annum (TPA) of TMT bars. It uses a mixture of scrap, billets, plus a continuous-casting machine (CCM) and rolling mill, etc.

Geographical focus / Customers: Predominantly Gujarat. A significant portion of its revenues comes from within the State of Gujarat (excluding Saurashtra and Kutch districts). It sells through a distribution network (dealers, distributors) under a retail licence agreement with Kamdhenu Limited, marketing its TMT bars under the “Kamdhenu” brand.

Strengths

From reviewing the company’s RHP, IPO documents and market reports, here are strengths:

- Experienced Promoters & Management

The promoters have experience in the steel / TMT business, and management is regarded as relatively strong. This helps in industry navigation and execution. - Distribution Network & Brand Leverage

Having a licence to use Kamdhenu brand in Gujarat gives them recognition; plus, existing network of distributors & dealers aids market access. - Capacity & Backward Integration Efforts

Use of CCM, rolling mills, etc., and efforts to integrate backwards in raw materials (scrap / billets) help to control production costs. Also, setting up infrastructure of manufacturing in Gujarat (which is a steel demand-heavy region) helps reduce logistics costs. - Improving Profitability

Despite revenue decline, profit growth (PAT) in FY24 and FY25 shows improving margin, indicating perhaps better cost management or operational efficiencies.

Risks

At least three important risk factors for VMS TMT are:

- Dependence on Retail Licence Agreement with Kamdhenu

The retail licence for the use of “Kamdhenu” brand is non-exclusive, and a large portion of revenues (nearly all TMT bar sales) are under that brand arrangement. If this agreement is terminated or altered adversely, the company could face difficulty in maintaining its distribution / dealer network and brand recognition. - Raw Material Price Volatility / Dependency

The business is heavily dependent on external suppliers for raw materials (scrap, billets). Raw material costs form a large percentage of total expenses (in many periods over 70-90%). Any disruption in supply, or sudden price increases, hurts margins. Also currency / import costs (if any) could add risk. - Revenue Decline / Market Conditions

Recent years show a revenue decline (FY25 vs FY23) due to reduction in TMT bar sales volume, lower realisations (selling prices), and shutting down or discontinuation of underperforming facilities (e.g. MS pipes facility in Bhavnagar) in some periods.

Also, demand in construction / steel could be cyclical; external macro factors (steel cycles, raw material supply chain, interest rates, demand in construction) matter. - Financial Leverage / Borrowing & Working Capital Pressures

Borrowings have increased materially; managing debt (interest, repayments) will be important. Working capital cycle can become stretched (inventory build-ups etc.). If revenues fall or costs rise, this could stress cash flows. - Regulatory / Environment / Brand / Licensing Risks

There are risk exposures to environmental regulations, licensing requirements, compliance. As steel / construction is a regulated sector, any adverse regulation (pollution, safety, raw material sourcing, import/export duties, etc.) may impact operations. Also, brand licensing agreements carry performance obligations (e.g. minimum sales quotas, branding standards) which if not met may lead to penalties or termination.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 882.01 | 4.19 | 227.28 |

| FY 2024 | 872.96 | 13.47 | 284.23 |

| FY 2025 | 770.19 | 14.74 | 412.06 |

Revenue

- FY 2023: ₹882.01 Cr.

- FY 2024: ₹872.96 Cr.

- FY 2025: ₹770.19 Cr.

Revenue shows a declining trend, falling nearly 12.7% from FY23 to FY25. This decline reflects weaker sales volumes or lower realization in TMT bars, signaling pressure in demand or pricing environment.

Profit

- FY 2023: ₹4.19 Cr.

- FY 2024: ₹13.47 Cr.

- FY 2025: ₹14.74 Cr.

Despite revenue decline, profit improved significantly, more than tripling from FY23 to FY25. This suggests better cost control, operational efficiencies, or improved margins, which is a positive sign.

Total Assets

- FY 2023: ₹227.28 Cr.

- FY 2024: ₹284.23 Cr.

- FY 2025: ₹412.06 Cr.

Assets almost doubled in 3 years, reflecting capacity expansion, investments, or working capital growth. The asset growth combined with profitability improvement shows the company is strengthening its base, although the revenue drop is a concern.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.