Vikram Solar Global IPO Overview

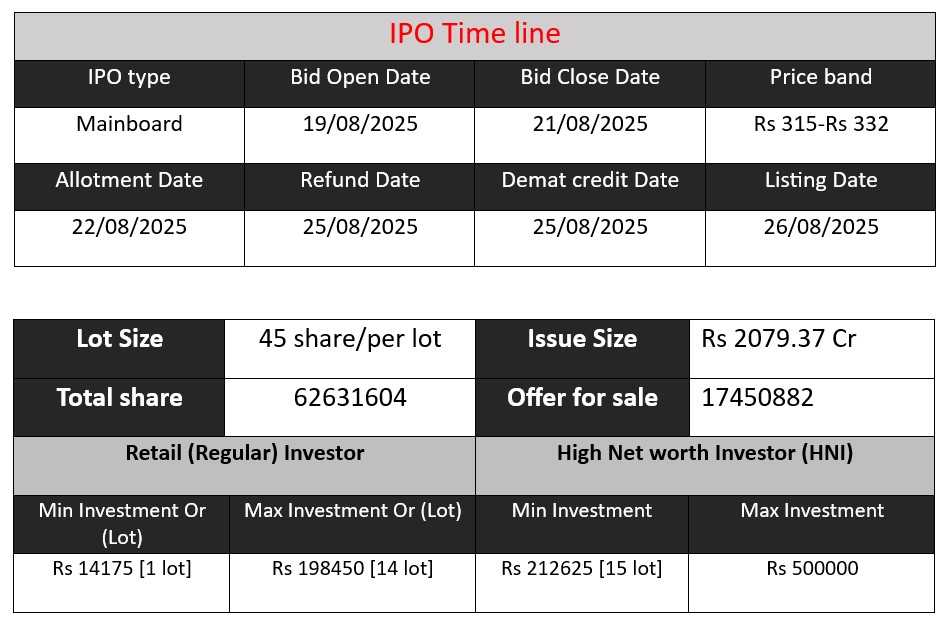

Vikram Solar Limited’s IPO opens on August 19, 2025 and closes on August 21, 2025, with a price band of ₹315–₹332 per share. The issue size is ₹2,079.37 crore, comprising a fresh issue of ₹1,500 crore and an offer for sale of ₹579.37 crore. The IPO aims to partially fund its Phase-I and Phase-II capital expenditures, with the balance for general corporate purposes.

Vikram Solar Global Subscription and GMP Status

| Subscription Rate Source: NSE/BSE | |||

| Category | Shares Offered | Shares Bid For | Subscription (x) |

| QIBs | 1,26,67,954 | 1,80,88,16,760 | 142.79 |

| NIIs | 97,12,871 | 49,43,81,250 | 50.90 |

| Retails | 2,26,63,365 | 17,34,22,845 | 7.65 |

| Employees | 3,17,460 | 15,37,110 | 4.84 |

| Shareholders | |||

| Total | 4,53,61,650 | 2,47,81,57,965 | 54.63 |

| Last Updated: 21 Aug 2025- 7 PM | |||

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 39 | 315-332 |

| Last Updated: 21 Aug 2025- 7 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Core Business & Overview

- Founded & Headquarters

Established in 2005, Vikram Solar Limited is headquartered in Kolkata, West Bengal, India. - Core Activities

It is one of India’s leading solar energy companies, primarily engaged in manufacturing high-efficiency photovoltaic (PV) modules. Additionally, the company provides engineering, procurement & construction (EPC) services, and operations & maintenance (O&M) for solar power projects.

Strengths

- Vertically Integrated Business Model

Vikram Solar’s combined presence across manufacturing, EPC, and O&M forms a robust three-tier revenue engine. This integration boosts operational efficiency, margin optimization, and customer retention. - Strong Growth Trajectory & Capacity Expansion

The company has rapidly scaled from 12 MW in 2009 to 4.5 GW in 2025, aiming for 20.5 GW by FY27. It’s also building a 3 GW solar cell manufacturing plant in Tamil Nadu and an upcoming facility in the U.S.. - Market Recognition & Product Quality

Recognized as a Tier-1 manufacturer by BloombergNEF and consistently ranked as a “Top Performer” by Kiwa PVEL for module reliability. Recently, the high-performance “SURYAVA” bifacial module using heterojunction (HJT) technology was launched, achieving efficiencies over 23%. - Favorable Industry Tailwinds & Policy Support

Strong government encouragement—such as ALMM, PLI schemes, and renewable energy targets—supports domestic manufacturing. Additionally, anti-dumping duties and import restrictions benefit Indian manufacturers like Vikram Solar. - Strong Global Presence & Export Focus

Vikram Solar serves worldwide markets, especially the U.S., having offices abroad and supplying to 32–39 countries. However, exports dropped sharply to just ~1% in FY25 due to regulatory uncertainty, leading to reliance on domestic markets (99% of revenue).

Potential Risks

- Customer Concentration Risk

The top 5 customers account for around 76%–77.5% of revenue, and the top 10 for 88–89%—meaning loss of any major client could significantly impact revenue. - Raw Material & Working Capital Pressures

The PV module business is capital-intensive and sensitive to fluctuations in raw material prices (wafers, cells). Long receivable cycles and extended debtors highlight working capital stress. - Execution Risks from Aggressive Expansion

Scaling capacity from 4.5 GW to over 15 GW within a couple of years involves significant capex and execution complexity. Odisha cell plant and US facility add further layers of complexity. - Policy & Regulatory Uncertainty

Export volume has plunged due to changing trade policies and regulatory uncertainty, particularly in the U.S. Any rollback of domestic incentives (e.g., PLI, ALMM) could dampen demand.

Financial Performance Overview (₹ in Crore)

| Particular | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 2,073.23 | 2,510.99 | 3,426.45 |

| Profit (PAT) | 14.49 | 79.72 | 139.83 |

| Total Assets | 2,476.29 | 2,585.50 | 2,832.15 |

Revenue

- FY 2023: ₹2,073.23 Cr

- FY 2024: ₹2,510.99 Cr (↑ 21.1% growth)

- FY 2025: ₹3,426.45 Cr (↑ 36.5% growth)

Strong and consistent revenue growth shows rising demand for its solar modules and EPC projects.

Profit

- FY 2023: ₹14.49 Cr (very low margin)

- FY 2024: ₹79.72 Cr (↑ 450% jump)

- FY 2025: ₹139.83 Cr (↑ 75% growth)

Profitability has improved significantly. From thin margins in FY23, it is now showing strong earnings, thanks to better operational efficiency and higher margins.

Total Assets

- FY 2023: ₹2,476.29 Cr

- FY 2024: ₹2,585.50 Cr (slight ↑)

- FY 2025: ₹2,832.15 Cr (steady ↑)

Assets have grown steadily, indicating expansion in manufacturing capacity and investment in infrastructure.

✅ Pros

- Strong revenue and profit growth in recent years

- Expanding solar module capacity with global ambitions

- Government policy support (PLI, ALMM, renewable targets)

- Recognized Tier-1 solar module manufacturer (BloombergNEF)

- Diversified business model (Modules + EPC + O&M)

❌ Cons

- High IPO valuation compared to peers

- Heavy dependence on top few customers

- Raw material price volatility impacts margins

- Execution risk in aggressive expansion plans

- Policy/regulatory uncertainty in exports

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.