Vigor Plast IPO Overview

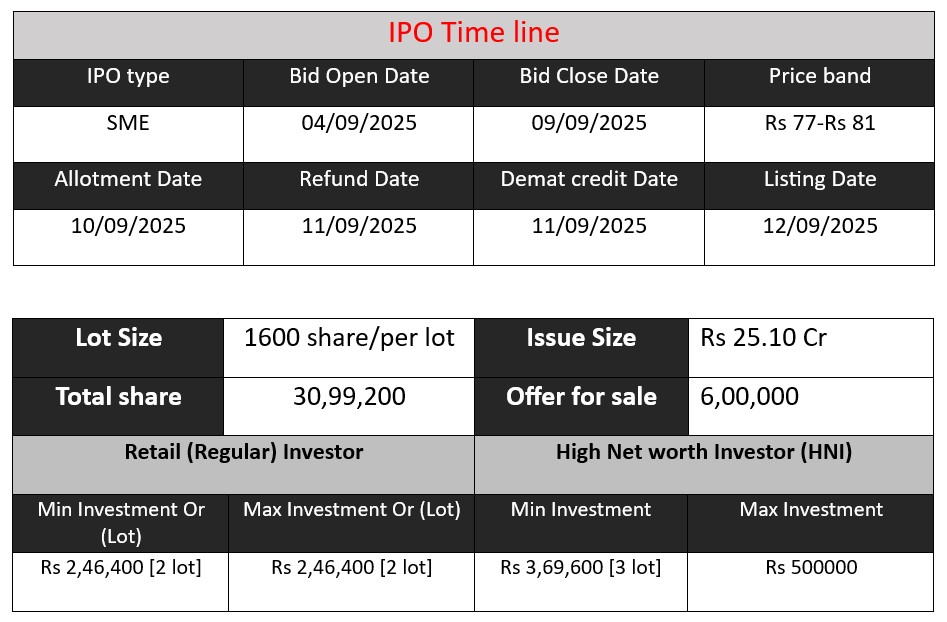

Vigor Plast India Ltd’s SME IPO opens on 4 September 2025 and closes on 9 September 2025. The offer includes a fresh issue of 24.99 lakh equity shares and an offer-for-sale (OFS) of 6 lakh shares, totaling 30.99 lakh shares and aiming to raise about ₹25.10 crore. Net proceeds will be used for repaying borrowings , building a new warehouse in Ahmedabad and general corporate purposes.

Vigor Plast Subscription and GMP Status

| Category | Subscription (x) |

| QIBs | 0.51 |

| NIIs | 2.24 |

| Retails | 0.84 |

| Total | 0.70 |

| Last Updated: 08 Sep 2025- 6 PM Source: NSE/BSE | |

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 77-81 |

| Last Updated: 08 Sep 2025- 6 PM | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Date

Vigor Plast Core Business & Overview

Established in 2014, Vigor Plast started as a trader of PVC pipes and fittings and later expanded into manufacturing around 2020.

Product Range

The company manufactures a diverse line of plastic piping and fittings, including PVC, uPVC (unplasticized), cPVC (chlorinated PVC) pipes and related fittings. These serve sectors like plumbing, irrigation, sewage (SWR), residential, commercial, agricultural, and industrial uses.

Infrastructure & Distribution

- Manufacturing facility located in Dared, Gujarat, equipped with fully automated machinery and an in-house quality laboratory.

- Warehouses strategically placed in Rajkot, Jamnagar, Surat, Ahmedabad, and one more planned in Dholka

- Distribution network includes around 440 distributors across 25 Indian states and UTs, supported by a mobile app (“Vigor India Plast”) and focused logistics.

- Also exports to Nepal, adding a modest international footprint.

Strengths

- Wide and diversified product portfolio

Offers comprehensive piping and fitting solutions across multiple sectors—plumbing, sewage, agriculture, industrial, residential, and commercial. - Advanced manufacturing and quality control

The automated facility and in-house lab ensure consistent, high-quality production, backed by certifications like ISO 9001 (2015) and BIS for CPVC, SWR, and PVC. - Strong distribution footprint

Multiple warehouses in Gujarat, a wide distributor network, and technological support through an app help maintain strong reach and efficiency.

Risks

- Customer concentration

Top 10 customers accounted for around 27% of total sales (FY25)—down from 40% in previous years—indicating vulnerability if key clients are lost. - Supplier dependency

A few suppliers dominate raw-material sourcing: top 10 suppliers account for ~66% of purchases in FY25, and the top supplier alone 26%—posing supply chain risk. - Geographic concentration

A large portion of revenue still comes from Gujarat (41.5% in FY25), making the business susceptible to regional disruptions. - Cash flow pressures & investment outflows

Negative cash flows from investing (e.g., ₹11.5 Cr in FY24) and financing, along with modest operating cash inflows, may create constraints if the trend continues. - Borrowing obligations

The company had borrowings of ₹16.5–16.5 Cr as of mid-2025; servicing these while managing expansion could strain finances. - Execution risk for expansion plans

Cost estimates for the new warehouse and growth initiatives are internally determined and may not materialize as planned, possibly impacting projections. - Regional and sector exposure

Revenue is heavily weighted toward industrial and residential sectors, both sensitive to economic and regulatory fluctuations.

Financial Performance Overview (₹ in Crore)

| Year | Revenue | Profit | Assets |

| FY 2023 | 37.28 | 0.30 | 20.09 |

| FY 2024 | 42.48 | 2.93 | 35.88 |

| FY 2025 | 45.58 | 5.15 | 40.50 |

Revenue

- FY 2023: ₹37.28 Cr

- FY 2024: ₹42.48 Cr

- FY 2025: ₹45.58 Cr

Revenue grew steadily — 14% YoY in FY24 and 7% YoY in FY25. Growth is positive but slowing, showing stability rather than rapid expansion.

Profit

- FY 2023: ₹0.30 Cr

- FY 2024: ₹2.93 Cr

- FY 2025: ₹5.15 Cr

Profitability improved sharply — more than 9x jump in FY24 and 76% growth in FY25. Indicates better cost control, margin expansion, and operating efficiency.

Total Assets

- FY 2023: ₹20.09 Cr

- FY 2024: ₹35.88 Cr

- FY 2025: ₹40.50 Cr

Assets nearly doubled from FY23 to FY24 and continued to rise in FY25. Suggests heavy investments in infrastructure, manufacturing, or expansion.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.