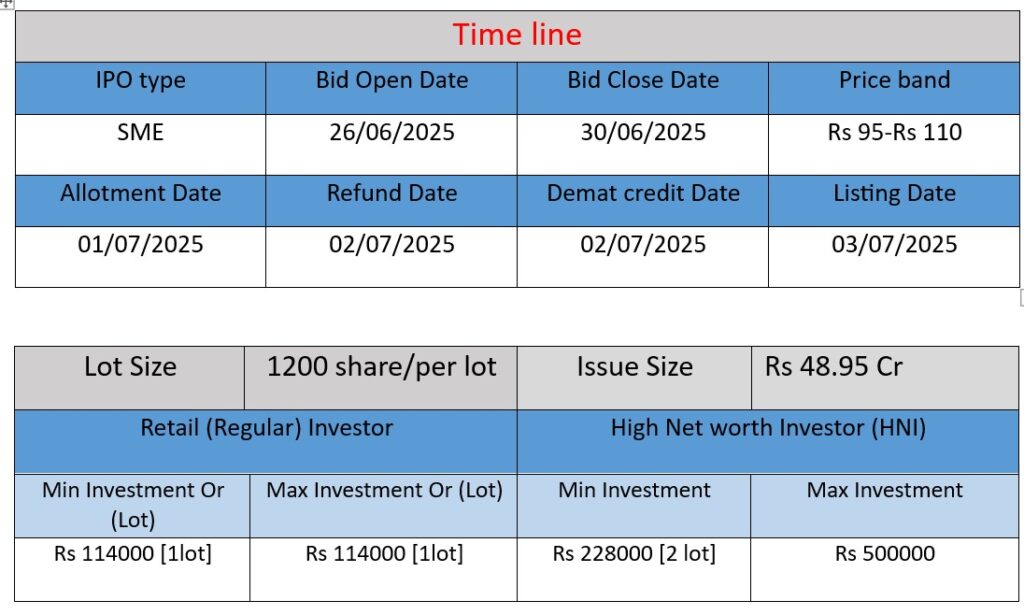

Valencia India Ltd’s ₹48.95 Cr IPO opens June 26–30, 2025, with a price of ₹87/share. The issue includes a fresh issue of 40 lakh shares and an OFS of 4.5 lakh. Funds will be used to develop 15 villas and a clubhouse, meet ₹33.5 Cr in working capital needs, and for general corporate purposes worth ₹11.5 Cr.

Company Profile

- Incorporation & Evolution

Established on March 8, 2017 as Valencia Country Club Private Limited, the firm shifted to Valencia India Private Limited in July 2020 and became a public limited company on June 20, 2024. - Headquarters & Leadership

Based in Ahmedabad, Gujarat, with directors including Keyur Patel (Managing Director), Prakash Mahida (Chairman), and Dhavalkumar Chokshi (CFO). - Business Operations

Operates primarily in travel, hospitality, real estate development, and trading of FMCG, agro, and dairy commodities, with global export-import presence

Core Activities

- Hospitality & Real Estate

Currently runs a country club with amenities (lodging, spa, banquet, pool, villas), and organizes events like weddings, corporate gatherings, picnics . - FMCG & Commodities Trading

Engages in import/export and distribution of food and non-food products, especially in the Middle East.

Strengths

- Rapid Financial Growth

FY 2023 saw total revenue jump 82.2%, profit up 44.1%, and net worth expand by 59.4% compared to FY 2022. - Diversified Business Lines

Portfolio spans hospitality, real estate, and trading, mitigating risk from sectoral downturns. - Experienced Leadership

Key personnel bring decades of expertise in construction, hospitality management, and finance .

Risks & Challenges

- Capital-Intensive Model

Development of villas and clubhouses (as per IPO objectives) requires significant investment and financing. - Sector Vulnerability

Tourism and hospitality are highly sensitive to economic cycles, travel trends, and health crises. - Regulatory Compliance & Financial Discipline

Prior “open charges” totaling ₹3.3M and obligations toward Micro & Small Enterprises suggest potential cash flow or compliance risks.

Conclusion

Valencia India Limited is a newly public, multi‑faceted platform blending hospitality, real estate, and commodity trading. Backed by swift revenue and profit growth, its diversified model and seasoned leadership offer solid foundations. However, the high capital needs, cyclical sector exposure, and emerging financial obligations require vigilance. The planned IPO funding aimed at developing additional villas and clubhouse infrastructure could accelerate growth if matched with stable demand and prudent financial management.

Here is a brief financial performance analysis across FY2022 to FY2024:

Revenue

- FY2024: ₹7.11 crore

- FY2023: ₹5.23 crore

- FY2022: ₹4.19 crore

Analysis:

Revenue has shown consistent growth over the past three years:

- Up 36% in FY24 over FY23

- Up 25% in FY23 over FY22

This reflects expanding business activities and rising demand, especially in hospitality and trading.

Profit (Net)

- FY2024: ₹1.94 crore

- FY2023: ₹0.56 crore

- FY2022: ₹0.25 crore

Analysis:

Net profit grew 246% in FY24 and 124% in FY23. This sharp rise indicates better cost efficiency, increased scale, and higher-margin segments becoming profitable.

Total Assets

- FY2024: ₹12.07 crore

- FY2023: ₹6.26 crore

- FY2022: ₹4.85 crore

Analysis:

Assets nearly doubled in FY24, suggesting major investments in real estate projects (villas/clubhouse) or infrastructure. Asset growth supports long-term expansion plans but also implies higher capital exposure.

📌 Summary

- Strong top-line and bottom-line growth over 3 years.

- Profitability grew faster than revenue, showing operational efficiency.

- Asset base has significantly expanded, likely in line with IPO objectives to scale infrastructure.

- The company is in a growth phase, with improving margins and long-term investment in core sectors.