Tata Capital IPO Overview

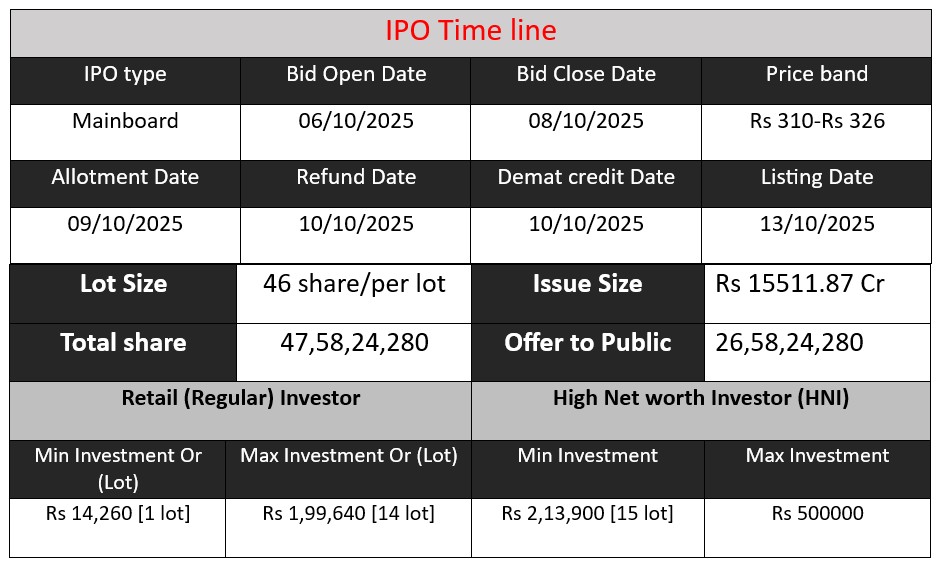

Tata Capital IPO aims to raise ₹15,511 crore through the issue of equity shares. The IPO opens on October 6, 2025, and closes on October 8, 2025. Proceeds will be used for debt repayment, general corporate purposes, and business expansion. Investors can subscribe to this largest-ever NBFC IPO in India, offering an opportunity to participate in Tata Capital’s growth story.

Tata Capital GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 6.5 | 310-326 |

| Last Updated: 10 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Basic Detail

Tata Capital Core Business & Overview

Tata Capital Limited is a diversified financial services company and a subsidiary of Tata Sons Private Limited, the holding company of the Tata Group. Established in 1991 as Primal Investments and Finance Limited and renamed in 2007, Tata Capital operates as a Non-Banking Financial Company (NBFC) under the Reserve Bank of India’s regulations.

Headquartered in Mumbai, Tata Capital offers a comprehensive suite of financial services, including:

- Commercial Finance: Providing funding solutions for businesses across various sectors.

- Consumer Loans: Offering personal loans, home loans, and other retail financing products.

- Wealth Services: Delivering investment advisory and wealth management services to individuals and institutions.

- Tata Cards: Involved in the distribution and marketing of credit cards under the Tata brand.

With a presence across India, Tata Capital serves a diverse clientele, including retail, corporate, and institutional customers, through both physical branches and digital platforms

Strengths

- Brand Equity: As part of the Tata Group, Tata Capital benefits from strong brand recognition and trust, which enhances its market position.

- Diversified Portfolio: The company offers over 25 financial products, including home loans, personal loans, business loans, and wealth management services, catering to a wide range of customer needs.

- Robust Risk Management: Tata Capital has implemented a strong risk management framework covering credit, operational, market, information security, fraud, and reputational risks.

- Digital Transformation: The company has embraced digital technologies to enhance customer experience and operational efficiency, including the automation of audit processes and the use of data analytics tools.

Risks

- Credit Risk: Exposure to credit risk, particularly from unsecured loans and the merged Tata Motors Finance Limited (TMFL) book, could impact asset quality.

- Interest Rate Fluctuations: Changes in interest rates may affect the company’s lending margins and overall profitability.

- Regulatory Mandates: The Reserve Bank of India requires upper-layer NBFCs to list by December 31, 2025, which could pose challenges in terms of compliance and market conditions

Financial Performance Overview (₹ in Crore)

| F Y. | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 10,173.03 | 13,292.63 | 21,897.39 |

| Profit | 2,321.10 | 2,492.45 | 2,594.28 |

| Assets | 17,358.52 | 17,709.31 | 24,787.03 |

Revenue

- FY 2024 revenue increased by ₹3,119.60 Cr (30.7%) compared to FY 2023.

- FY 2025 revenue surged to ₹21,897.39 Cr, an increase of ₹8,604.76 Cr (64.7%) over FY 2024.

Observation: The company shows strong top-line growth, especially in FY 2025, indicating either higher sales, expanded operations, or acquisition-driven revenue.

Profit

- Profit increased steadily from ₹2,321.1 Cr in FY 2023 to ₹2,594.28 Cr in FY 2025.

- However, the profit growth is modest relative to revenue growth:

- FY 2024: +7.4%

- FY 2025: +4.1%

Observation: While revenue is growing rapidly, profit margins are under pressure, possibly due to higher operating costs, interest expenses, or increased provisioning.

Asset

- Total assets increased from ₹17,358.52 Cr (FY 2023) to ₹24,787.03 Cr (FY 2025), a growth of 42.8% over two years.

Observation: This indicates aggressive expansion or higher lending/investment exposure, which can support future revenue growth but may also increase risk.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.