Systematic Industries IPO Overview

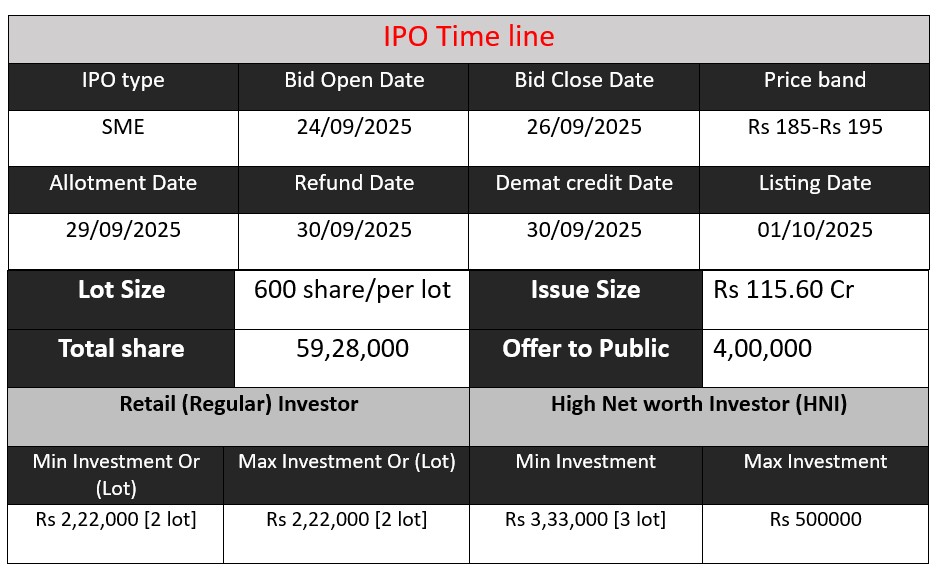

Systematic Industries Ltd is launching an ₹115.60 crore IPO, offering 59.28 lakh equity shares (fresh + OFS). The public issue opens on 24 September 2025 and closes on 26 September 2025. Proceeds will be used for repayment/pre-payment of debt and general corporate purposes. The IPO is priced in the ₹185–195 per share band and will list on the BSE SME platform.

Systematic Industries GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 10 | 185-195 |

| Last Updated: 26 Sep 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

IPO Key Detail

Systematic Industries Core Business & Overview

Systematic Industries Limited was incorporated in March 2000, in Mumbai, Maharashtra.

It operates in the steel wire and cable sector: manufacturing and supplying a variety of steel wires and cable products. Its clients span power transmission, infrastructure, telecom, agriculture, and allied industries.

Product line includes carbon steel wires, high carbon wires, mild steel wires, GI (galvanised iron) wires, cable armour wires, aluminium clad steel wires (ACS), ACSR core wires, optical ground wires (OPGW), optical fibre cables (OFC), and related wire & cable products.

It has multiple manufacturing units: three in the Union Territory of Dadra & Nagar Haveli and Daman & Diu; one in Valsad, Gujarat. Combined installed capacity is 100,000 metric tonnes per annum (MTPA).

The company is certified under ISO 9001:2015 (quality management), ISO 14001:2015 (environmental management), ISO 45001:2018 (occupational health & safety) standards.

Strengths

Based on IPO prospectus disclosures and analyst summaries, here are notable strengths:

- Diverse & Broad Product Portfolio

They serve multiple segments (power transmission, telecom, infrastructure, agriculture) with a wide range of steel & cable products. This reduces dependence on a single product or sector. - Production Capacity & In-house Capabilities

Strong manufacturing infra: four units, capacity 100,000 metric tonnes/year, with facilities for wire drawing, galvanising, ACS cladding etc. Also laboratories & testing capability. - Quality & Compliance Certifications

ISO certifications for quality, environment, safety help in gaining customer trust, meeting regulatory and export requirements. - Geographical Reach & Customer Base

Significant domestic presence (25 states/UTs in India) plus exports to over 30 countries. - Growth Trend

Consistent growth in revenue and profit margins, indicating improving operational leverage and possibly better cost control.

Risks

No company is without risks. Here are some of the potential risk factors for Systematic Industries, drawn from prospectuses, expert commentary, and market-analysts:

- Dependence on Steel Wire Market & Cyclical Demand

A large portion of revenue comes from steel wires. Demand in power transmission, infrastructure, telecom etc., can fluctuate with macro-economic cycles, government spending, raw material prices, etc. A downturn or policy change can hurt demand. - Raw Material/Supplier Concentration & Price Volatility

Heavy reliance on certain suppliers (top 3 suppliers account for high proportion of purchases). Raw materials like steel wire rods, aluminium, zinc etc., are subject to price swings. Any disruption or price hike can squeeze margins. - Operational Risks at Factories

Manufacturing plants are susceptible to breakdowns, maintenance issues, natural disasters, supply chain disruptions (power, logistics), labour issues, etc. If production stops, costs rise, order fulfilments delayed. - Foreign Exchange Risk

Since the company exports some portion of its products (around 7-9% of revenue recent years) and likely imports some raw materials, fluctuations in foreign exchange rates can affect cost of imports and competitiveness of exports. - Concentration Risks: Customers & Geography

Though it sells widely, a few top customers contribute significant part of revenues; losing one or more could materially affect results. Also, heavy sales from certain Indian states (for purchases or inputs) could expose it to local/regional disruptions. - Capital & Debt Burden

IPO proceeds are partly earmarked for repaying borrowings (₹95 crore). This suggests the company has non-trivial debt; servicing debt and interest cost can weigh on profitability. Also, expansions or upgrades require capital which might add to debt or dilute equity.

Financial Performance Overview (₹ in Crore)

| Year (FY) | Revenue | Profit | Total Assets |

| 2023 | 320.48 | 6.31 | 130.34 |

| 2024 | 370.31 | 12.40 | 161.55 |

| 2025 | 446.51 | 18.46 | 205.71 |

Revenue

- Growth Trend:

FY23 → FY24: +15.5%

FY24 → FY25: +20.6%

Revenue has shown steady and accelerating growth, driven by demand from power transmission, telecom, and infrastructure sectors. This indicates that the company is successfully expanding its customer base and handling larger volumes.

Profit

- Growth Trend:

FY23 → FY24: +96%

FY24 → FY25: +48.8%

Profit has grown faster than revenue, suggesting better cost control, improved operational efficiency, and possibly higher-margin product sales. The sharp rise between FY23–FY24 shows strong turnaround momentum, while FY25 maintained healthy growth.

Total Assets

Growth Trend:

FY23 → FY24: +23.9%

FY24 → FY25: +27.3%

Increasing asset base shows continued investment in capacity, technology, and infrastructure. This is positive for future scalability, though it may also involve higher capital expenditure and potential debt usage.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.