Sunsky Logistics IPO Overview

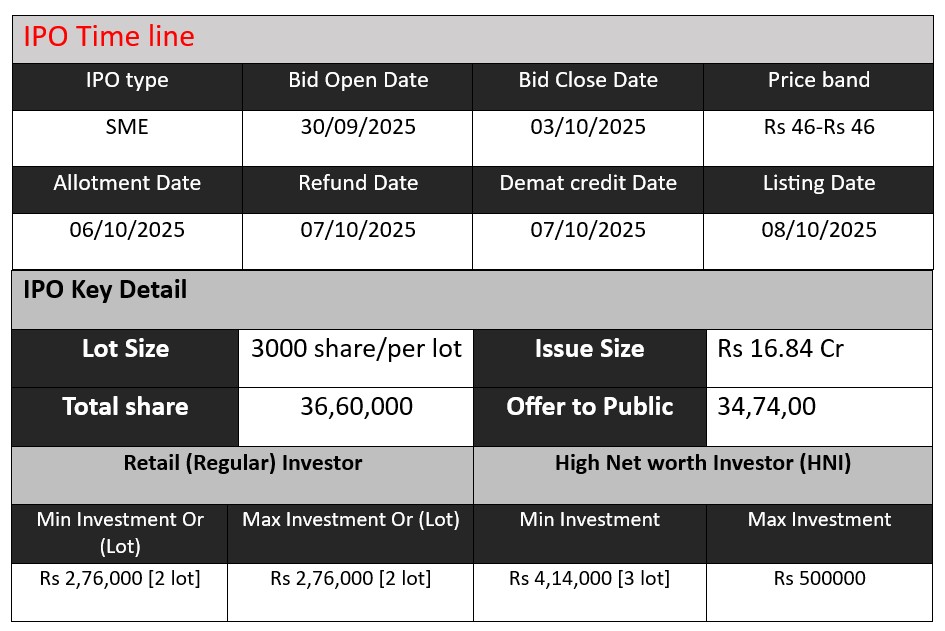

Sunsky Logistics Ltd is launching an SME IPO to raise ₹16.84 crore by issuing 36.6 lakh equity shares at a fixed price of ₹46 each. The IPO opens on September 30, 2025, and closes on October 3, 2025. The lot size is 3,000 shares, with a minimum investment of ₹2,76,000. Proceeds will fund flatbed trailer purchases, repay borrowings, meet working capital needs, and cover general corporate expenses. Listing is scheduled for October 8, 2025, on the BSE SME platform.

Sunsky Logistics GMP Status

| GMP (₹) (grey market premium) | IPO Price (₹) |

| 0 | 46 |

| Last Updated: 6 Oct 2025 | |

| 📌 Note: The above GMP data is unofficial and has been collected from multiple sources including grey market dealers and market observers. It is provided purely for informational and educational purposes. Please consult your financial advisor before making any investment decisions. | |

Sunsky Logistics Core Business & Overview

Sunsky Logistics Limited is an integrated logistics solutions provider based in Ahmedabad, Gujarat, India. Established on July 5, 2020, the company offers a comprehensive range of third-party logistics (3PL) services, including freight forwarding, customs clearance, inland transportation, warehousing, packaging, fumigation, marine insurance, and project cargo handling. With over 10 years of experience in the international logistics market, Sunsky Logistics aims to be a landmark service provider for exporters and importers worldwide.

Core Services

- Multimodal Transport: Sunsky holds a Multimodal Transport Operator (MTO) license, enabling operations across rail, road, air, and sea. The company is also a member of the World Shipping Alliance (WSA) and obtained an Ocean Transportation Intermediary (OTI) certificate in 2022.

- Global Network: The company has established a strong network of agents across countries like the USA, UAE, Australia, and the UK, facilitating smooth logistics and customs operations in major export markets.

- Comprehensive Solutions: Sunsky provides end-to-end logistics solutions, including freight forwarding, customs clearance, inland transportation, warehousing, packaging, fumigation, and marine insurance, catering to both domestic and international shipping needs.

Strengths

- Experienced Leadership: Promoter and Managing Director, Akash A Shah, brings over 10 years of hands-on experience in the shipping, logistics, and transportation industry, contributing significantly to the company’s growth.

- Comprehensive Service Portfolio: Operating as a multimodal transport provider, the company offers end-to-end logistics solutions, including ocean and air freight forwarding, customs clearance, and project cargo handling.

- International Network: Sunsky Logistics has built a strong network of agents across countries like the USA, UAE, Australia, and the UK, enabling smooth logistics and customs operations in major export markets.

Risks

- Client Concentration: The top 10 customers contributed 85.72% of revenue in FY25, making the company vulnerable to the loss of any major client.

- Geographic Concentration: Most revenue comes from Gujarat, exposing the company to potential regional economic or regulatory risks.

- Negative Cash Flows: The company has recorded negative cash flows from operating, investing, and financing activities in the past, including ₹(70.71) lakhs from operating activities as of July 31, 2025.

- Dependence on Third Parties: Operations rely heavily on third-party service providers for transportation and customs clearance, as the company does not hold its own Customs House Agent license

Financial Performance Overview (₹ in Crore)

| Financials | FY 2023 | FY 2024 | FY 2025 |

| Revenue | 19.34 | 14.77 | 22.04 |

| Profit | 0.31 | 1.25 | 2.59 |

| Assets | 2.75 | 5.16 | 8.22 |

Revenue:

- FY 2024 saw a decline in revenue to ₹14.77 Cr from ₹19.34 Cr in FY 2023, a drop of approximately 23.6%, likely due to market fluctuations or temporary operational challenges.

- In FY 2025, revenue jumped to ₹22.04 Cr, showing a strong recovery and growth of 49.3% over FY 2024, indicating thecompany’s ability to scale operations and capture market opportunities.

Profit:

- Despite the revenue dip in FY 2024, profit increased significantly to ₹1.25 Cr from ₹0.31 Cr in FY 2023, suggesting improved cost efficiency or better margins.

- FY 2025 continued this positive trend with profit rising to ₹2.59 Cr, more than doubling compared to FY 2024. This indicates strong operational leverage and profitable growth.

Assets:

- Total assets have steadily increased from ₹2.75 Cr in FY 2023 to ₹8.22 Cr in FY 2025. This shows the company is expanding its resource base, potentially to support higher business volumes and diversify operations.

Disclaimer:

The above IPO analysis and financial data are based on information provided by the company in its official documents. For complete details, please refer to the Red Herring Prospectus (RHP) linked above. Investors are strongly advised to consult their financial advisor before making any investment decisions.